4 ways to work smarter with your money

In a world motivated by the desire to live a luxurious life, many of us fall into the trap of spending our money on all sorts of things – some of which are not even necessary.

Although we are entitled to buy the things that our heart desires, spending money left right and centre is simply not the way to go. Instead, the lack of self-control when it comes to how we manage our finances has the potential to drift us even further away from the visions we have for ourselves. This could lead to you being lost and might not be able to track where your money has gone.

This is why financial education is extremely important in helping you to use your finances wisely.

Here is how you can be fully in control of your money:

Budget

There comes a time when we have to go back to the basic principles of life – one of these things is budgeting.

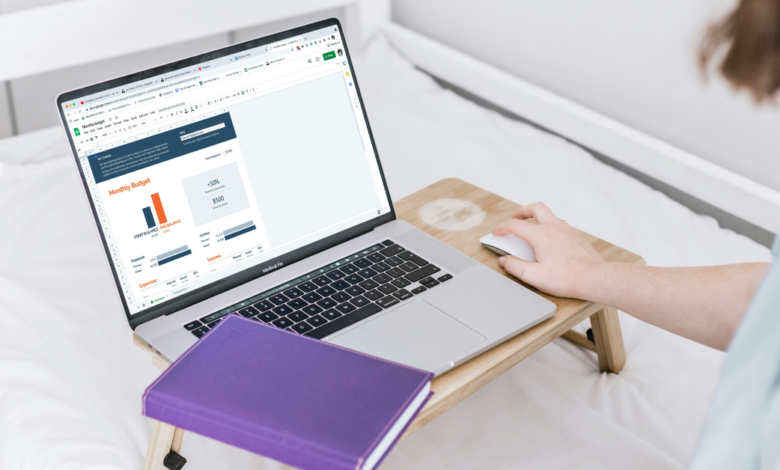

Whether it is through creating an online spreadsheet or simply writing it down in a book, the best way of budgeting is by writing down your total income and later subtracting all of the expenses to see how much you have left over.

“It helps you see where your money is going, makes it easier to pay bills on time, save money for the things you want, prepare for emergencies and plan for the future,” explains lifestyle publication We Are Citizens Advice.

Set money aside

Another way of becoming money-wise is by setting money aside in case of an emergency. This is usually referred to as being an emergency fund.

According to We Are Citizens Advice, there are several ways to achieve this, one is by creating a piggy bank. You can use this to put your loose change in. In addition, the above-mentioned source adds that it would be wise to set a rule e.g. tell yourself that you will not spend anything that is R10 and below and put that into your savings jar.

Don’t spend unexpected cash

The unexpected tax is the money that we receive without real labour involved. This can be anything from a tax return, inheritance money or an insurance pay-out.

While it may be tempting to treat yourself, it would be much wiser to spend it on unsettled debt in order to bring you a bit of financial relief. This is particularly beneficial in the future explains reputable financial investment company Spaceship.

Learn

The abovementioned source further explains that it is important to equip one’s self with the skill of learning financial skills. Whether it is by means of a book, podcast, or blog. Allowing your brain to absorb financial information will over time assist you in understanding important concepts like investing,

Also see: The ultimate guide to journaling

The post 4 Ways to work smarter with your money appeared first on Bona Magazine.