Current numbers range from R3 billion to R12 billion phased in over three years.

The recapitalisation of the national carrier is very much a work in progress following the news that Standard Chartered Bank had decided not to extend its working capital facility of R2.2 billion over the weekend.

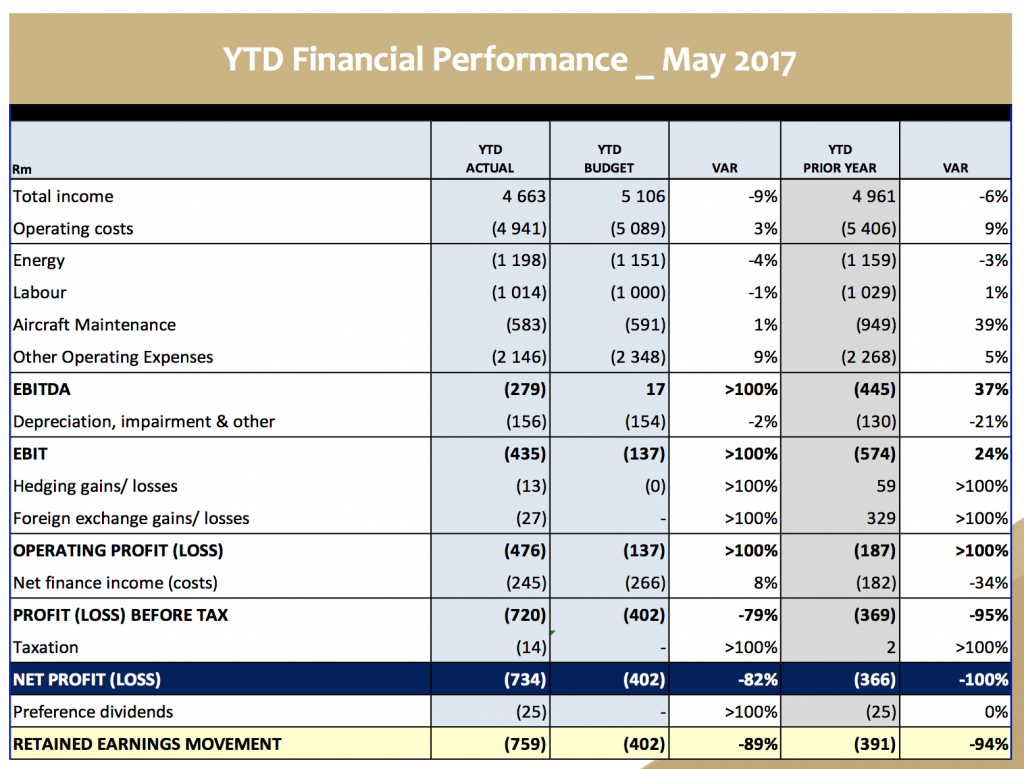

Why SAA needs a recapitalisation: Year-to-date performance for April and May 2017

Source: Parliament – Standing Committee on Finance

Moneyweb went undercover to speak to a range of sources familiar with what is happening behind the scenes to get a sense of how the recapitalisation is going to happen.

- A full or partial sale of SAA is not an option.

- The Public Investment Corporation is not going to recapitalise the ailing airline with equity. This means that there is no risk members of the Government Employees Pension Fund will indirectly become a shareholder of SAA. What the PIC may elect to do, based on its own risk parameters and on the same terms as commercial lenders (i.e. with a government-backed guarantee in place) is extend debt funding to SAA if it deems worthwhile.

- The redemption of the R2.2 billion Standard Chartered facility, together with uncommitted guarantees of R490 million means SAA has available guarantees of approximately R2.7 billion. Because a guarantee is just a promise to honour any loan “guaranteed” by our national government if, and when, they may be called on to do so (as demonstrated in the Standard Chartered issue), SAA can now approach its existing lenders or new ones to borrow a further R2.9 billion. We understand discussions are underway. In the interim, the airline seems to have enough cash to remain operational. Suppliers we spoke to on Tuesday indicated they had been paid in full for the services rendered in May, as per 30-day contractual debtor terms.

- Senior executives from National Treasury are meeting with the airlines’ lenders on a weekly basis.

- The equity injection being considered by the asset and liability management of National Treasury is, according to current thinking, going to be in the order of R3 billion – R12 billion which will be phased in over the next three financial years. SAA’s financial year end is March, so this would apply to the 2018, 2019, and 2020, financial years.

- There are a couple of reasons why it is being spread over this timeframe. The first is because the recapitalisation is conditional. “The lenders and Treasury want to see things happening,” was the way it was put to us. On this note – there have been some positive developments – The airline is close to appointing a CEO and a chief commercial officer (COO), with the requisite experience to drive the turnaround strategy.

- The second reason is that the injection has to be fiscal neutral. This means the government does not want to borrow any additional money to fund the recapitalisation. We understand most of the delay in announcing the plan is because Treasury is trying to figure out how to do this. Proceeds from non-core asset sales is one option being considered, while finding money from budget savings or tax over-collections is another.

The basis of providing any additional money to SAA is that it does, at some point, stand on its own two feet. The recapitalisation will provide the airline with the time to implement the turnaround strategy that will reposition it as a regional carrier, and in financial terms, increase revenue by approximately R13.6 billion over the five-year period of the plan, while at the same time realising cost-savings of R10.1 billion. The airline needs to mitigate the key risks it has identified in its presentation to parliament last week, which include:

Key risks to turnaround plan

Brought to you by Moneyweb

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.