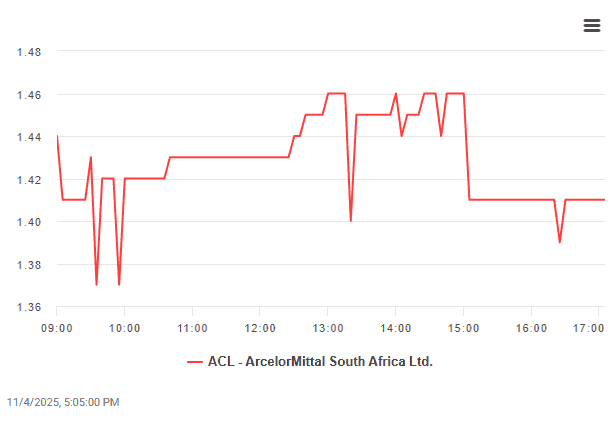

Has spent the R1.683bn facility provided by the IDC intended to delay its closure.

ArcelorMittal SA (Amsa) says it has ceased long steel production at its Newcastle plant and placed most of its facilities under care and maintenance, having drawn down the full R1.683 billion facility given it by the Industrial Development Corporation (IDC), which was intended to delay the wind-down.

In a cautionary Sens announcement, the company says it will continue to trade its remaining stock.

This comes at a time when the company is engaged with the IDC over a potential rescue.

“Engagements to explore alternative solutions continue. Further announcements will be made in relation to these matters as and when appropriate,” says the Sens announcement.

Amsa first announced plans to close long steel production at its Newcastle and Vereeniging plants in January 2025 due to unsustainable energy and logistics costs, cheap imports from China, and inadequate policy support.

The planned shutdown was delayed several times, with the IDC offering the R1.683 repayable loan in April, supplemented with about R400 million from the Unemployment Insurance Fund to cover wages.

The IDC loan facility was fully drawn down by July, though the company continues to seek ways to rescue its long steel production facilities over the longer term.

Amsa’s annual reports show a steady decline in demand for steel in SA, which has fallen roughly 20% over the last seven years.

ALSO READ: ArcelorMittal warns it might close without urgent solution to challenges

One mill closes, another opens

Meanwhile, it was announced that a R2.5 billion Chinese steel mill, backed by Chung Fung Metal, is under development in Nigel, Gauteng, and will produce 600 000 tonnes of long steel products when operational. It will employ 1 200 workers when at full production.

The need for the new Chinese plant remains puzzling given falling domestic demand for steel, though its location alongside key transport corridors to the port of Durban suggests exports will play a key part in its business plan.

Investment into the broader steel value chain remains capped by lack of stable energy, regulatory uncertainty and ongoing dumping – mainly from China.

Speaking to Moneyweb’s Jimmy Moyaha, SA Iron and Steel Institute secretary-general Charles Dednam says SA expects total consumption this year of 4.4 million tonnes, of which about 2.8 million tonnes will come from local steel mills, the rest from imports. The installed capacity for steel is about 10 million tonnes, leaving huge unused local capacity.

“So opening up a new steel capacity in the country does not really make any sense with regard to the overall capacity that exists already in the country,” says Dednam.

“I think [there] should rather be some optimisation and rationalisation of current capacities. That could be a much cheaper and more effective way to go [rather than] a new mill coming on stream again.”

ALSO READ: Newcastle to lose 37% of its jobs: Devastating consequences of ArcelorMittal closing

Job losses

The National Unions of Metalworkers of South Africa challenged the Section 189 process (of the Labour Relations Act) concluded in March 2025, with the Labour Court ordering the company to halt dismissals while further consultations take place.

The closure of the long steel mills threatens roughly 3 500 jobs.

The Labour Court ordered that no further dismissals should take place until the consultation process is completed and that dismissed employees should be reinstated. Amsa has applied for leave to appeal the decision.

This article was republished from Moneyweb. Read the original here.