Overall, it will pay less after this swap from a lease to a commercial mortgage.

Discovery has announced it will purchase its iconic head office on the corner of Katherine Street and Rivonia Road in Sandton from landlords Growthpoint and Zenprop for R4.05 billion.

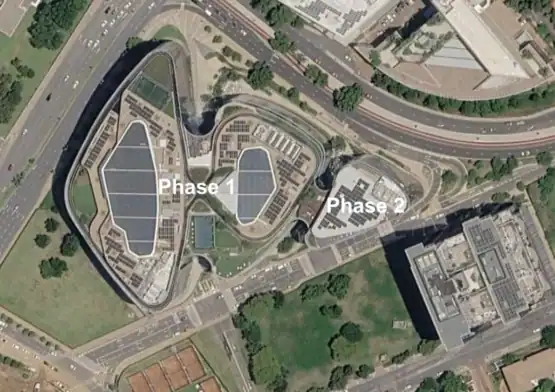

It says “with seven years until expiry of the lease, the group evaluated its long-term lease and determined it would likely stay beyond the current lease period”. In addition, it has “optimised” its space requirements, meaning that it does not see the need for the (effective) ‘option’ on Phase two of the building (known as The Ridge).

Read the Discovery and Growthpoint Sens.

It consolidated its various divisions from buildings around its former 155 West Street head office into a single new head office in 2018, when it signed a 15-year lease on the building. The development, designed by Boogertman + Partners and built by WBHO and Tiber, cost R3 billion to construct. According to a Netwerk24 report in 2019, the group was paying R280 million in rent annually at the time, with this reportedly set to increase to R600 million (or R50 million a month) by 2028.

Discovery will acquire Phase 1 of 1 Discovery Place (the Grove and Park buildings) which together comprise 91 756m2 and, along with this, also cancel the lease for Phase 2 (The Ridge) which comprises 19 369m2. It occupies no space in Phase 2, and this has been separately let to other tenants, including, amongst others, consulting engineers Knight Piésold, financial planners and brokers Growthhouse and NBA Africa, for some time now.

ALSO READ: Discovery to cough up after major medication claims mistake

Discovery will fully fund the acquisition of its head office with debt.

The financial services group says the purchase will have “strong financial and economic benefits” as “economic dynamics have moved in favour of a purchase, with both prevailing interest rates and property prices in Johannesburg having reduced significantly”. Overall, it will pay less for the space after this swap from a long-term lease to a commercial mortgage loan.

In addition to owning the building, it says it is “locked into an immediate and expanding net annual cash-flow saving, delivering approximately R800 million in net present value over the remaining lease period”.

Growthpoint, which owns 55% of the building, contends that as part of its efforts to optimise its portfolio balance, “Discovery Phase 1 was identified for disposal, notwithstanding its P-grade quality, allowing Growthpoint to responsibly manage exposure while maintaining overall portfolio quality”.

ALSO READ: ‘All we need is 4 UJ students’: Discovery moves to discipline employee over leaked WhatsApps

At the end of June 2025, its share of Phase 1 was valued at R2.23 billion. It will receive R2.3 billion from Discovery for its 55% stake. In addition, Growthpoint will purchase 45% of Phase 2/The Ridge, which it does not currently own, from Zenprop for R323 million. It says this was fully let at the end of its last financial year (June).

Growthpoint says the disposal aligns with its stated strategy of reducing office exposure in Gauteng and Sandton and also “contributes to a reduction in single tenant asset concentration within this node”. The Reit has been refocusing its South African portfolio “toward sectors and regions that are expected to deliver more stable and resilient income profiles over the longer term, including retail, logistics and increased Western Cape exposure”.

Acquiring the remainder of The Ridge enables Growthpoint to “retain an appropriate presence within the Sandton Summit precinct”. It notes, however, that its reported office vacancies will be higher in the periods ahead “as a large, fully let asset is removed from the portfolio”.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.