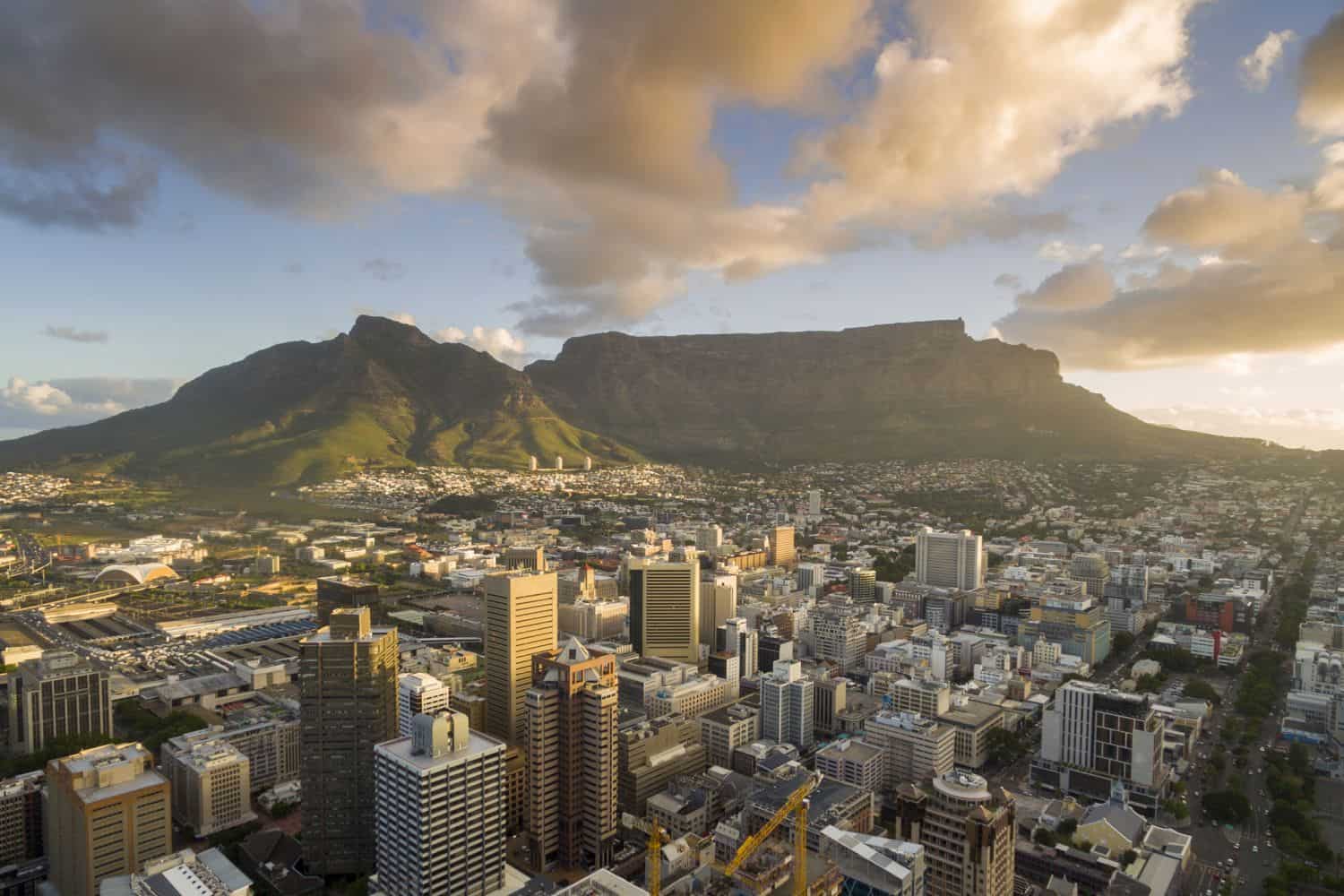

Cape Town leads, while Johannesburg lags

Cape Town appears to be the preferred destination for businesses looking to rent or buy commercial property, as brokers view the city as the strongest market.

The quarterly FNB Property Broker Survey, released on Tuesday, shows that the City of Cape Town continues to be perceived as the strongest market, showing the most significant “under-supply” across all three major commercial property sectors.

FNB Property Broker Survey asks real estate agents, also known as brokers, about the current state of the commercial property market in South Africa. The brokers must operate in the City of Johannesburg and Ekurhuleni (collectively Greater Johannesburg), Tshwane, eThekwini, the City of Cape Town, and Nelson Mandela Bay.

Cape Town leads, Joburg lags

The survey is measured using three sectors: office, industrial and retail property markets. Cape Town leads in all the sectors, while Greater Johannesburg remains the weakest, with perceived oversupply in all three sectors.

“Cape Town stands out as the strongest metro across all three commercial property markets, while Greater Johannesburg is perceived as the weakest by a significant margin,” says John Loos, FNB’s property strategist.

Included in the survey are questions on the perceived balance (or imbalance) between demand and supply for properties being transacted, broken down by metro. In this context, “market strength” refers to relatively high demand versus supply, and “market weakness” to the opposite.

ALSO READ: 8 tips for investing in South African commercial property

Why Cape Town?

Loos adds that Cape Town has experienced an influx of skilled professionals and affluent households. Additionally, there has been business migration and expansion in the city.

He notes that there is a limited land supply in Cape Town, but also a stronger local governance and infrastructure.

“These factors appear to support long-term investor confidence, reflected in both the commercial and residential market data.”

Retail property market

“Based on broker feedback on whether demand exceeds supply, supply exceeds demand, or the market is balanced, we compile a demand-supply perception index. This index ranges from +200 to -200, where:

• +200 means 100% of brokers perceive that demand far exceeds supply, and

• -200 means 100% perceive that supply far exceeds demand.

• A zero score implies a balanced market,” adds Loos.

Across all three sectors, the retail property market recorded the strongest sentiment with a score of +23, while the industrial property market recorded +22, and the office market remains under pressure, with a negative score of -30.

“In short, brokers perceive the Retail and Industrial Markets as moderately undersupplied, while the office market is oversupplied.”

Oversupply

He highlights that the national office market oversupply is largely driven by Gauteng metros. All metros recorded positive scores when it comes to the industrial property market, except Greater Johannesburg.

“This is surprising, given Johannesburg’s relatively low industrial vacancies and the fact that industrial property has been the best-performing sector nationally. The weakness may reflect long-term investor concerns about the region,” adds Loos.

NOW READ: Commercial property confidence increases, but still perceived as weak