While most economists said that the repo rate was too difficult to call, the MPC made the decision not to cut or increase.

The Monetary Policy Committee of the Reserve Bank decided at its meeting this week to keep the repo rate unchanged and warned about geopolitical risk to the local economy.

Four members of the committee voted to keep the repo rate unchanged at 6.75%, while two favoured a 25 basis points cut.

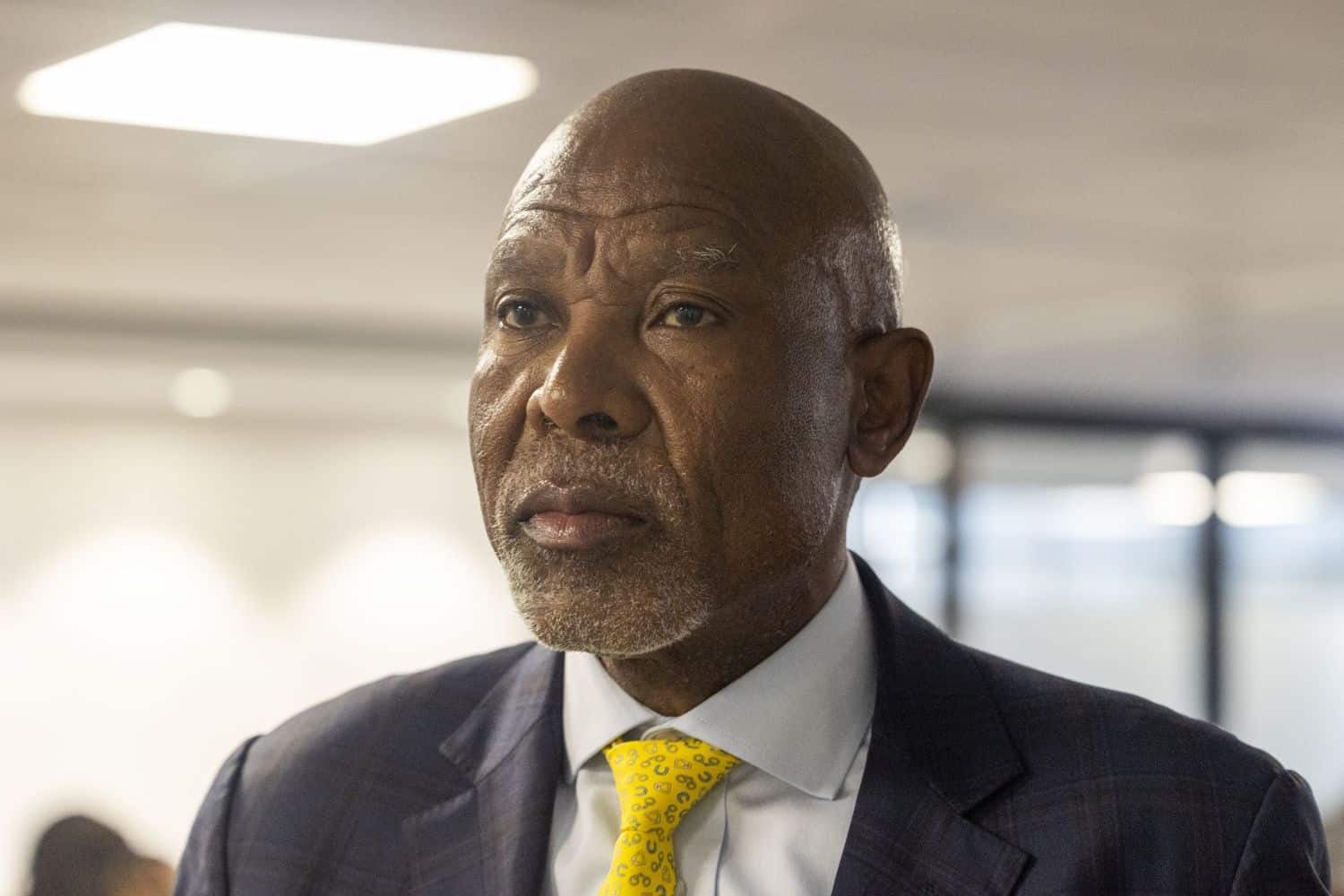

Lesetja Kganyago, governor of the South African Reserve Bank (Sarb), made the announcement on Thursday afternoon in Pretoria after the meeting of the Monetary Policy Committee (MPC). He pointed out what most of us already know; 2025 was a watershed year for the South African economy.

“Despite a volatile global backdrop, there was significant progress on domestic reforms, including a new inflation target. These efforts have been rewarded with lower borrowing costs, a rapid decline in inflation expectations and steadier growth. It is crucial to sustain this progress.

“For monetary policy, our main contribution is to deliver on the new target, which means stabilising inflation at 3% over the next few years. Further gains in economic performance would come from reaching a prudent public debt level, lowering administered price inflation and continuing structural reforms that raise potential growth.”

ALSO READ: Repo rate: will the Reserve Bank cut? Or not?

Global uncertainty: 2026 already started with shocks

He pointed out that last year was marked by extreme global uncertainty, while 2026 began with a new round of shocks.

“Geopolitical tensions remain elevated, reflecting what appears to be a rupture in the global political order. There are also new threats to central bank independence.

“Markets are jittery and precious metals like gold received safe-haven flows. There are also ongoing risks of an artificial intelligence (AI) bubble. Furthermore, global imbalances have become very large.

“For example, China’s trade surplus was over a trillion dollars last year, a new record. Meanwhile, government debt is still growing fast in key economies, with the US fiscal deficit, for example, approaching $2 trillion. These trends are not sustainable.”

Turning to South Africa, Kganyago said economic growth looks steadier. “The economy expanded for four consecutive quarters and the available data suggest it grew further in the most recent quarter. This would mark the longest unbroken growth phase since 2018.”

ALSO READ: Good time to review SA’s prime reference rate – economist

Household consumption main driver for growth, but investment remained weak

According to Kganyago, household consumption was the main growth driver, increasing by more than 3% last year, compared to an estimated 1.3% for the overall economy. “Unfortunately, investment has been weak, contracting during the first half of 2025.

“However, the third-quarter data showed a rebound. We hope this investment recovery will be sustained, allowing the economy to achieve structurally higher growth.

“Our forecasts continue to show growth moving somewhat higher, approaching 2% over the medium term, but we see some upside risks to these projections.”

Moving to prices, Kganyago pointed out that inflation was 3.2% last year, close to the Sarb’s 3% objective. “Inflation was a bit higher towards the end of the year, mainly due to temporary factors. The December print came in at 3.6% but we expect this was the peak and that inflation will slow from here.

“Indeed, our near-term inflation forecast has fallen, with the rand stronger and a lower oil price assumption. However, we are keeping an eye on food inflation, especially meat prices, which are affected by a serious outbreak of foot-and-mouth disease.

“We are also concerned about electricity prices, given that Nersa’s price correction may increase from R54 billion to R76 billion.”

ALSO READ: Inflation rate for November slightly down, another repo rate cut in January?

Inflation expectations decreased

The governor said all was not doom and gloom.

“Inflation expectations have fallen, with the latest survey showing longer-term expectations at record lows. We look forward to expectations declining further, as South Africans experience ongoing lower inflation and learn more about the new target.

“In turn, lower expectations will be important for getting inflation to settle at 3%. We are benefiting from low goods price inflation, supported by factors like the stronger rand. Goods inflation is at 3% and core goods is at 1.2%.

“By contrast, services inflation is still over 4%. It is desirable to have services inflation moving closer to 3%, as low inflation becomes the new normal for South Africa.”

Kganyago said the MPC assesses the risks to the inflation outlook as balanced. “Against this backdrop, the MPC decided to keep the policy rate unchanged at 6.75%.”

The Quarterly Projection Model continues to forecast gradual rate cuts as inflation subsides. The model interprets the policy stance as moderately restrictive currently, with rates reaching neutral levels during 2027.

As before, he said, this rate path remains a broad policy guide. “Our decisions will continue to be taken on a meeting-by-meeting basis, with careful attention to the outlook, data outcomes and the balance of risks to the forecast.”

ALSO READ: Property market welcomes repo rate cut: Here’s how 2026 will look

Adverse and positive scenarios for repo rate

The MPC also created an adverse and a positive scenario again. Kganyago said over the past year, there were large changes in the rand exchange rate as well as oil prices.

“Our baseline forecasts assume these prices will stay roughly where they ended 2025, but the outlook is uncertain.

“We therefore considered a pair of scenarios: a favourable one where the rand is stronger and the oil price keeps falling and a more challenging one where the rand weakens and oil goes up again.”

In the adverse scenario, inflation peaks at 4% and the convergence to the 3% target is slower. Interest rates are largely unchanged in the near term, with the shift down to neutral delayed by about a year.

In the positive scenario, inflation gets as low as 2.3% temporarily. In this context, expectations ease faster and inflation ultimately settles near 3% more quickly. This allows front-loading of interest rate cuts, with neutral reached during the current year.

Kganyago said these scenarios show that even quite large shocks, like those modelled, would not push inflation outside the Sarb’s tolerance range of 3% plus or minus one. “The scenarios also demonstrate how supply shocks interact with inflation expectations, affecting how fast we deliver on the 3% target.

“We are trying to anchor expectations at 3%. Positive shocks get us there sooner, while negative shocks delay the process, but do not block it. Overall, monetary policy appears well positioned to manage the range of shocks that might come our way.”