How one firm turned R10m into R26.5bn …

Australia is a veritable graveyard when it comes to the fortunes of South African entities – especially retailers – trying their luck Down Under. Pick n Pay tried with Franklins and eventually sold that unit in 2012 after burning through a boatload of cash.

The canonical example is the department store David Jones, which Woolworths bought for roughly R21 billion in 2014. It sold that business in 2022 for R1.6 billion, resulting in a loss of more than R27 billion (given exchange rate dynamics). Its Country Road Group continues to struggle, despite various attempts at reorganising that unit.

Mr Price, too, tried to launch its Mr Price Home and core Mr Price concepts in that market and elected to put that subsidiary into administration in 2019.

TFG acquired a number of (menswear) brands in that market – Connor, Johnny Bigg, Tarocash and yd – but in the most recent six months, revenue slipped 0.3% and operating profit was down 18.4%.

Of course, privately held fast food outfit Nando’s has been a success in Australia, with well over 100 locations, but is it a A$1 billion business? Perhaps.

ALSO READ: Goodbye Ozempic? Aspen plans to roll out weight-loss drug

The one that made it big …

Then there is the South African business that entered the Australian market about three decades ago and is now selling that subsidiary for R26.5 billion.

This is a remarkable return on the R10 million in ‘seed capital’ that Aspen Pharmacare invested in Australia all those years ago.

Speaking to investors and analysts last week, CEO Stephen Saad said that when he and Gus Attridge, one of the founding shareholders of Aspen along with himself, arrived in Australia, they were “in their 30s” and “had a R10 million cheque”.

We “bought some products” and “found two people” – one of whom, Trevor Ziman, regional CEO of Asia Pacific, is “still with us”.

“And we bought two laptops and we thought we were really smart and we’re going to do something big in Australia …

“Until we came back home and every analyst on the other side told us: ‘Every South African company fails’ [in Australia].”

Saad says Aspen was under such pressure it was extremely careful to not expand that business “beyond two laptops and two people”.

“We outsourced everything in case we had to leave in a hurry.”

ALSO READ: Over R22bn wiped off Aspen’s market cap amid US fallout

The very definition of ‘big’

In late December, Aspen received an unsolicited offer from private equity firm BGH Capital for its Asia Pacific assets (excluding those in China) which values that business at A$2.37 billion (R26.477 billion).

It has accepted this offer and will use the proceeds primarily to pay down debt.

“It’s quite a story to come here and tell you that actually that little R10 million has grown to nearly R26.5 billion,” says Saad.

He admits that it’s difficult to comprehend the scale of R26.5 billion.

To put it in perspective, he sketches a scenario with 26 500 people in Kings Park Rugby Stadium.

If each had to be awarded R1 million and if each was announced as a winner, which took one minute, it would take a total of 18 days and 18 nights to get through the list.

“That was a little suitcase and a very small relative amount of money. It was an unbelievable achievement from what was an incredibly asset-light start because on day two we lost both our laptops. They were stolen and that really made us think twice about why we’re there but I’m glad, I’m glad we stayed the distance.”

Saad stresses that “Australia is a tough market, but our team there has proved tougher”.

Over time, Aspen became the largest generics company in that market.

“One in five of every medicine dispensed in Australia was an Aspen product,” says Saad.

“Think about that, you see five people in the chemist, one is getting an Aspen medicine.”

“We found that regulations tightened very … that it tightened up quite a bit in Australia and it became quite a tricky market from a pricing perspective,” says Saad. “Our team adapted … they divested products … they changed course.”

“And the last five years have been particularly tough as the team try to pivot towards OTCs [over-the-counter medicines], but they’re a determined team and they built, they built a business that was a top five OTC company.”

Saad says candidly that Aspen has “never ever asked a shareholder for one cent”.

“We’ve never done a rights offer, nothing. Please understand how we built Australia, how we built the whole of Aspen. We’ve never issued a share to a shareholder and said ‘Please, we need financing here’.”

“With all that said, we’ve never been shy of corporate activity over the years, including numerous divestments.”

He says Aspen has never sold the “family silver” and that he “cannot think of one [where] we didn’t do it at a double-digit Ebitda [earnings before interest, tax, depreciation and amortisation] multiple”.

ALSO READ: Aspen to stop local vaccine production in Gqeberha as orders dry up

Lightbulb moment

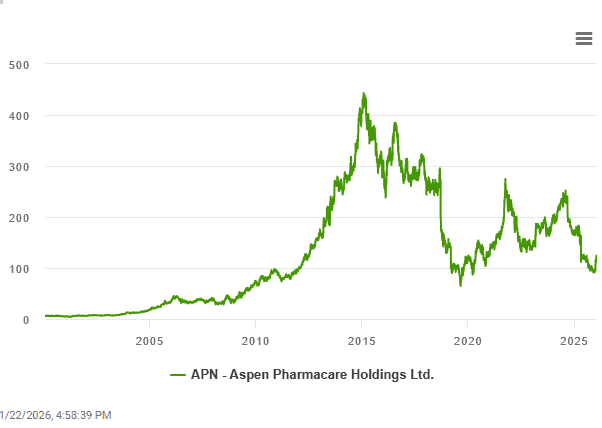

Until last year, over the last two decades, he has not commented on the “mismatch” between the share price and the sum of the parts of the underlying business.

“I’ve left that to others to do because, you know, it’s not my job.”

Once he vocalised his thoughts in 2025, he “bought a lot of shares afterwards”.

Saad has an ingrained belief in the group’s assets and its track record in commercial pharmaceuticals and in manufacturing.

“We told you we would consider a value unlock if we got fair value for some of the assets we considered, and this is a demonstration of that value and we have considered and we have accepted it.”

“I just want to add that even at the current price today, we’re still well short of what the balance of the sum of parts are. Have a look at our growth drivers. We will continue to look for ways to unlock this value.”

This article was republished from Moneyweb. Read the original here.