While economists do not expect manufacturing to pick up soon, they point out that pricing is at least positive.

The Absa PMI for December signals that manufacturing is still under pressure as weak factory activity at the end of 2025 points to a soft fourth quarter, amid subdued demand for manufacturing goods.

However, Jee-A van der Linde, senior economist at Oxford Economics Africa, says although they do not expect demand conditions to improve meaningfully in 2026, South Africa’s broader price environment remains favourable.

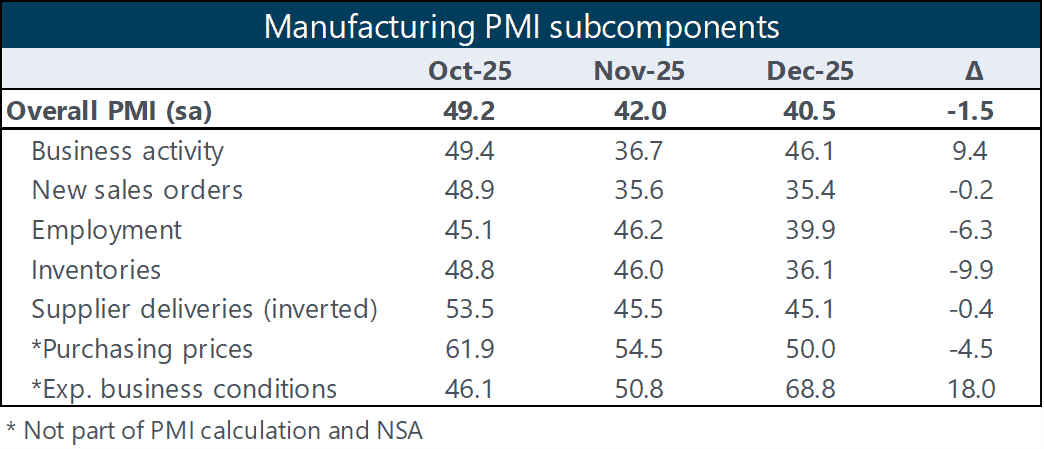

The seasonally adjusted Absa PMI declined by 1.5 percentage points to 40.5 in December, signalling that the manufacturing sector remains under pressure. Sharp drops in the inventories and employment indices were the main drivers of the weaker headline reading.

New sales orders changed little in December, with the subdued level reflecting ongoing weak demand, while the business activity index improved sharply during the month. However, the index remained in contractionary territory for 11 of the 12 months of 2025.

ALSO READ: Construction activity best in 11 years, but S&P PMI disappoints again

Positive sentiment for business conditions

Meanwhile, the index tracking expected business conditions in six months’ time increased notably in December to reach its highest level since the 70.8 recorded in September 2024. Van der Linde says this aligns with the improvement in business confidence surveys during the fourth quarter of 2025 and coincided with the stronger rand exchange rate at the end of last year, which likely helped alleviate input cost pressures.

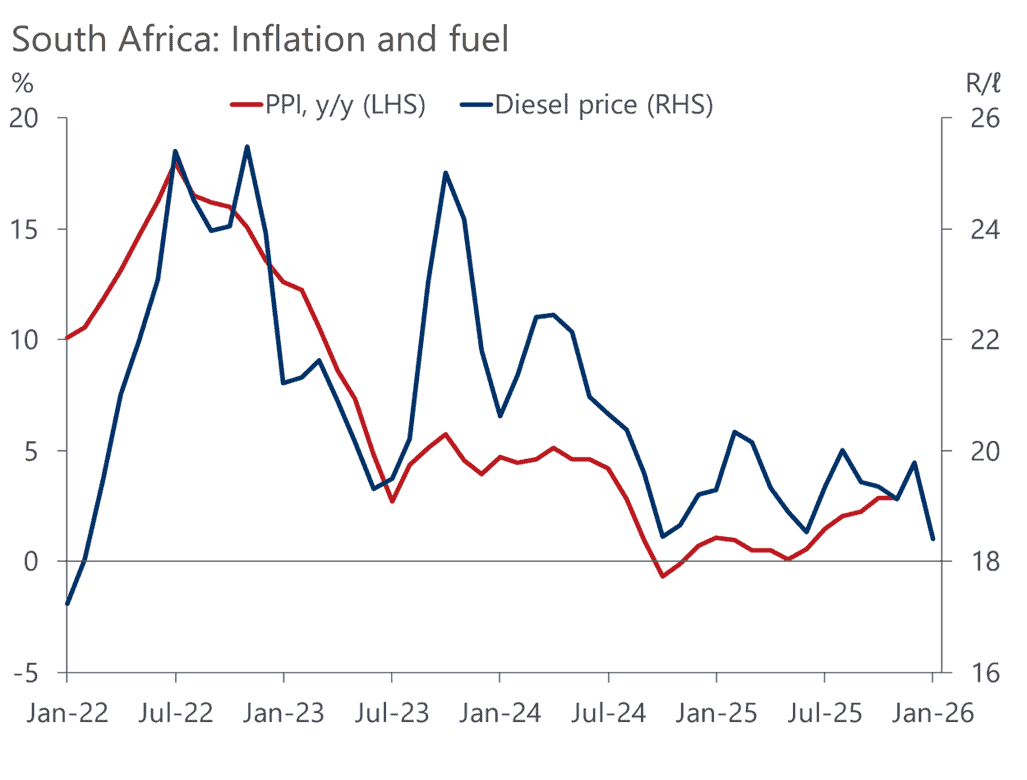

In addition, he points out that the sharp drop in diesel prices this month adds to South Africa’s benign price outlook. “We expect PPI inflation to rise marginally from 1.5% in 2025 to roughly 2.2% this year.”

This chart shows domestic diesel prices are down 4.5% from a year ago:

ALSO READ: Was 2025 a better year for economy and will 2026 bring new successes or challenges?

Sharp decline in Absa PMI in December lowest for 2025

Van der Linde says the fourth-quarter PMI average of 43.9 marks a sharp decline from the 49.9 recorded during the preceding quarter and the lowest for 2025.

“Seasonally adjusted manufacturing output has disappointed so far in the fourth quarter of 2025, as South Africa’s manufacturing sector continues to experience strain due to weak domestic demand and the impact of US import tariffs. We do not anticipate a meaningful improvement in the near term.”

South Africa’s manufacturing production volume also declined in November and Van der Linde says the country’s manufacturing sector continues to experience strain due to weak domestic demand and the impact of US import tariffs.

“Manufacturing is South Africa’s third-largest economic industry, representing 14% of gross value added. Sectoral growth slowed to just 0.3% in the third quarter of 2025, from 1.5% in the second quarter, when manufacturing was among the main contributors to overall gross doemstic product (GDP).

“In addition, the latest industry numbers point to a subdued performance in the fourth quarter. As long as the 30% import tariffs on South African products remain in place, domestic manufacturing activity is likely to stay sluggish, with current economic fundamentals insufficient to provide a meaningful lift.”

This table shows that factories face contraction despite slight business activity gains:

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.