Through unlocking massive investment by 2030.

Recommendations by more than 1 000 business leaders as part of the B20 worldwide will, if implemented, achieve a near doubling in African foreign direct investment [FDI] to between $85 billion and $110 billion and increase intra-African trade from its current 17% to 20-30% by 2030.

Accomplishing this will require innovative financial instruments and harmonising regulations across the continent to breathe life into the African Continental Free Trade Area [AfCFTA], which aims to create a single market in Africa for goods and services.

These are among 30 recommendations, backed by detailed reports, which were handed over to Minister of International Relations and Cooperation Ronald Lamola at a presentation in Sandton on Thursday.

The B20 South Africa comprises business representatives from the G20 countries, selected invited countries and international organisations.

The recommendations are split into eight ‘task forces’ from energy to food and industrialisation.

The B20 Trade and Investment Task Force has set a bold target of increasing Africa’s share of global manufactured value addition from 2% in 2023 to between 5% and 10% by 2030. This will require mobilising capital and achieving rapid integration of African markets by harmonising regulations among participating countries.

“There is a need to challenge narrow, extractive, and self-interest driven economics. We should all strive for inclusive growth,” said Ramola.

The Food and Agriculture Task Force recommends boosting food production in regions with competitive advantages, in a way that is sustainable, while strengthening local and regional sourcing as a bulwark against price volatility and external shocks.

This could be achieved through incentives in the form of incentives such as tax credits and exemptions, preferential procurement, and concessional loans.

ALSO READ: Opportunities for SA to shape debate at B20 and G20

African industrialisation

Andrew Kirby, CEO of Toyota SA and chair of the B20 SA Industrial Transformation and Innovation Task Force, noted the role of industrialisation as a key driver of economic growth.

There are “practical approaches to advance up the value chain – from raw material production to value-added goods – and ultimately leveraging advanced technologies to transform production itself, delivering greater benefits for producers, manufacturers and consumers.”

Emerging and developing economies face added challenges, such as high interest rates, rising debt, shrinking fiscal space, and limited access to affordable capital.

Solving this will require fresh approaches, such as private sector participation in the design of national industrial strategies, backed by ‘national foresight systems’ to future-proof industrial strategies, expanded trade facilitation, and a sharper focus on the skills needed for an industrial economy. A critical step in achieving these goals is better access to capital, through matching grants, concessional loans, tax credits for research and development, and early-stage support for commercial ventures.

The Digital Transformation Task Force has a target of reducing the number of people without internet to zero by 2030, down from the current 2.6 billion. It aims to make fixed broadband available to most of the world’s population within the next five years and increase smartphone ownership from the current 71% to 100%.

This will require a substantial expansion of high-speed internet services to underserved areas.

ALSO READ: Wondering why the G20 matters? Moneyweb launches podcast to break it down

Just energy transition

The Energy and Just Energy Transition (Jet) Task Force recommendations set a target of increasing Jet financing seven-fold by 2040, alongside a five-fold increase in global value unlocked through industrialisation across sustainable energy value chains.

It wants to see a doubling in global annual investments in grid infrastructure to $780 billion in the next 15 years, with 80 million kilometres of grid infrastructure being upgraded over this period.

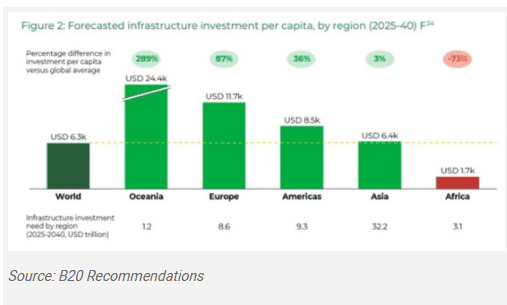

Speaking prior to the B20 presentation, Lungisa Fuzile, Standard Bank’s chief executive for the Africa regions and offshore, and co-chair of the B20 Finance and Infrastructure Task Force, said the world faces an infrastructure gap of $500 billion, of which roughly a fifth is in Africa.

“Modern economies deliver quality goods and high-speed communications on the back of quality infrastructure. To achieve inclusive growth, we need to narrow that [infrastructure] gap,” said Fuzile.

Bridging the infrastructure gap will require vast amounts of capital, which in turn will need a review of prudential requirements such as those imposed on banks by the Basel III Accord, with similar requirements for insurers.

The B20 recommends unlocking domestic pension and asset manager funds for infrastructure, alongside an expansion of the role for private credit. Sovereign fund money could also be tapped in parallel with blended finance options.

Another theme addressed by the B20 was integrity and compliance, with recommendations to adopt international frameworks for the responsible use of technology in countering corruption, backed by digital whistleblowing platforms and the use of digital identity integrity tools. It also wants to see a global climate finance transparency registry that tracks funding flows, outcomes, and integrity standards.

The handover of these recommendations comes ahead of South Africa’s hosting of the G20 Summit of world leaders this November in Johannesburg.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.