But admits there is no expectation that the economic outlook will change substantially for the better in the year ahead.

JSE-listed Caxton & CTP Publishers, Printers and Distributors delivered solid operating results combined with strong cash generation in a difficult and highly competitive operating environment in the year to end-June 2025.

Caxton MD Tim Holden said the operating environment was characterised by little to no growth and subdued consumer spending.

Read the Sens here.

He added that the group’s financial results for the year are testament to its resilience, focus on its customers, cost consciousness, and the benefits of timely and well-judged capital investments.

However, Holden said there is no expectation that the economic outlook will change substantially for the better, and it is hoped that the economy will not experience any further decline.

“With this in mind, we continue to manage all aspects of our operations closely and take appropriate actions where needed,” he said.

ALSO READ: Caxton continues to look for ‘the right acquisition opportunities’

Revenues showed signs of recovery in the year’s second half but still reflected the tough economic environment and increased marginally by 0.9% to R6.7 billion from R6.6 billion.

The group’s financial results in the previous financial year were bolstered by the finalisation of an insurance claim related to the Durban floods and the receipt of R173.2 million from this non-recurring claim, which helped to offset a decline in operating profits largely.

Profit from operating activities before depreciation and amortisation decreased 10.7% to R828 million in the year to end-June 2025 from R927.2 million in the prior year, while profit from operating activities after depreciation and amortisation declined by 13.7% to R567.7 million from R657.9 million in the same period.

However, on a normalised basis, excluding the prior year’s insurance receipt, operating profit before depreciation and amortisation increased by 9.8% after depreciation and amortisation by 17.1%.

Normalised headline earnings per share, excluding the insurance claim proceeds, increased 12.0% to 178.9 cents from R159.4 cents, but inclusive of the insurance proceeds decreased by 8.8% to 178.9 cents from 196.1 cents.

ALSO READ: Caxton and Capital Newspapers take Media24/Novus battle to ConCourt

Caxton’s solid operating result, combined with strong cash generation, with cash and cash equivalents increasing by R519.1 million to R3.0 billion at end-June 2025, resulted in the net asset value per share rising 6.7% to R23.06.

A gross ordinary share dividend per share of 70.0 cents was declared, 16.6% higher than the 60.0 cents dividend declared in the previous year.

A net investment in property, plant, and equipment of R289.4 million for the year included the completion of the solar investment project. The group installed 13MW at a total investment cost of R180.9 million.

Holden said it also included continued investment in its packaging operations to upgrade machinery or enter new markets.

Commenting on the newspaper and printing division, Holden said national advertising revenues continued to decline and ended the year 3% below the prior year.

Holden said grocery retailers continue to dominate the customer profile and delivered strong growth over the prior year, but declines in the home improvement, electronics, and furniture markets offset this.

“Most of our publications are published weekly, and we have seen the most dramatic drop off in the third week of the month as retailers focus on mid-month and month-end campaigns.

“We will continue to monitor this trend, but we remain positive that with closer collaboration within the group, we will unlock some growth opportunities,” he said.

ALSO READ: Durban floods insurance claim gives Caxton a boost

Holden stressed that Caxton’s newspaper business remains key to the group, and the challenge of developing new revenue streams and managing costs as tightly as possible remains.

He said the performance would be monitored closely, and appropriate action should be taken should conditions persist.

Holden said the group’s daily newspaper, The Citizen, posted a much-improved performance driven by restructuring initiatives and stable advertising revenues in a challenging market.

He said the difficult trading environment in the book and magazine printing market continued into the second half of the financial year as the impact of the loss of the Media24 magazine volumes took effect, which necessitated a further restructuring that is now complete.

Holden hoped this would be compensated for by increased demand for education books from the proposed Foundation Phase curriculum rewrite. Still, the Department of Basic Education delayed this and is now expected to be in place for the start of the 2026 school year.

“This shift should help volume throughput in the first half of the new financial year,” he said.

ALSO READ: Caxton lays complaint against Google at Information Regulator

Holden said the group’s various packaging operations continue to deliver good results in challenging and competitive markets, which is a testament to the group’s capital investments, operational management, and employees.

He said the stationery division delivered a commendable performance, aided by the successful acquisition and integration of the Tidy Files assets effective 1 August 2024.

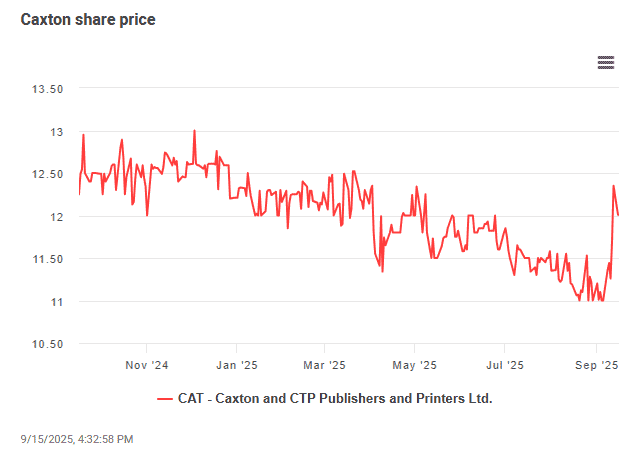

Shares in Caxton were trading 3.56% higher at R12.79 per share shortly after noon on Monday.

Disclosure: Caxton’s majority shareholders are also material shareholders in African Media Entertainment (AME), the owner of Moneyweb.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.