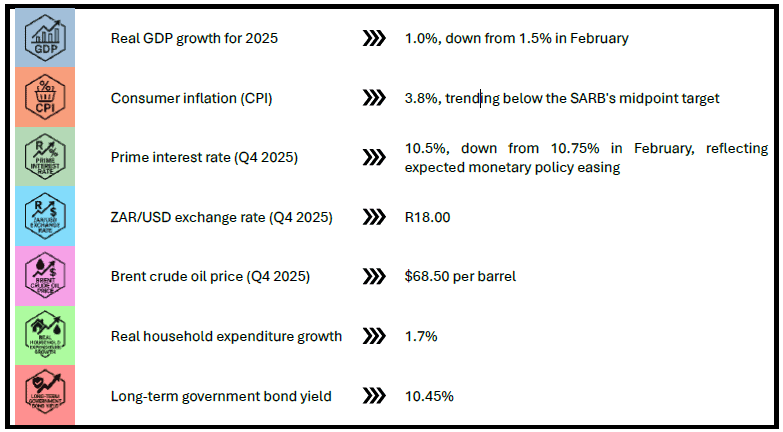

Economists have revised their expectations for GDP growth down to 1.0% in June, down from 1.5% in February.

South African economists taking part in the Economist of the Year competition have lowered their GDP growth forecasts as global and domestic risks, global policy uncertainty, structural imbalances, political volatility and geopolitical risks persist.

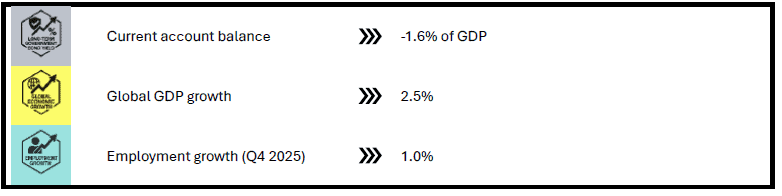

The Economist of the Year competition is hosted by the Bureau of Market Research (BMR), based on predictions submitted by 40 of the country’s top economists. Each month, participating economists provide predictions on eight key economic variables, with the June 2025 consensus reflecting the latest midpoint across all forecasts.

Reflecting on the deteriorating outlook, Professor Carel van Aardt, COO of the BMR, says these forecasts confirm that the South African economy remains stuck in a low-growth trap, compounded by global volatility and domestic structural deficiencies.

“Without meaningful reform and certainty in policy direction, growth will remain constrained and unemployment stubbornly high.”

ALSO READ: G20 finance officials say downside risks dominate global economic outlook – IMF

Re-imposition of US tariffs contributed to economists lowering their GDP growth expectations

Professor Deon Tustin, CEO of the BMR, says the competition serves as a vital barometer of informed sentiment in the economic community. “This consensus not only guides business and policy decision-making but also fosters transparent debate on South Africa’s economic prospects amid turbulent global conditions.”

Professor Corne van Walbeek, director of the research unit on the economics of excisable products at the University of Cape Town and member of the competition’s adjudication committee, says the outlook for the domestic as well as the global economies has worsened slightly since the start of the year.

“Predictions for both gross domestic product (GDP) indicators are down by about 0.5 percentage points since February. While it is difficult to attribute this to a single cause, the re-imposition of US tariffs and general uncertainty under the Trump administration are likely contributors.

“Interestingly, expectations for household expenditure growth remain largely unchanged, while inflation predictions have dropped. The current consensus inflation rate of 3.8% sits well below the midpoint of the inflation target band, which may explain why forecasters anticipate more aggressive interest rate cuts than they did earlier in the year.”

This chart shows the consensus forecast of the 40 economists: