The Wonderkop and Boshoek smelters will be placed on care and maintenance from 1 January unless a solution is found before then.

Glencore-Merafe says it will start issuing retrenchment notices immediately, after failing to secure competitive tariffs that would allow it to assess the feasibility of continuing operations following negotiations with Eskom over electricity tariffs.

This is the latest casualty of Eskom’s ballooning electricity tariffs, which have shut down more than half South Africa’s 59 chrome furnaces in recent years, according to Minister of Mineral and Petroleum Resources Gwede Mantashe.

An 800% increase in electricity tariffs since 2007 was cited by ArcelorMittal SA as one of the chief reasons for its decision to shutter its long steel production at Newcastle.

Trade union Solidarity reported in September that nearly half of Glencore’s 22 furnaces had been permanently or temporarily shut. A total of 2 425 direct jobs and more than 17 000 indirect jobs are at risk if the remaining furnaces are closed.

ALSO READ: State capture inquiry hears how Eskom treated Glencore differently to Tegeta

Eskom’s proposal ‘falls short’

In a statement on Monday, Glencore-Merafe says it received a proposal from Eskom regarding electricity tariffs on 28 November.

While the proposal is still subject to further approval processes, it will only allow for the continuation of the Lion smelter but does not provide a sustainable solution for the long-term viability of the Boshoek and Wonderkop smelters in Rustenburg.

The group says it started issuing formal retrenchment notices and voluntary severance packages on Monday, 1 December.

In the absence of a viable solution, the Boshoek and Wonderkop smelters will be placed on care and maintenance from 1 January 2026.

Merafe Resources owns 20.5% in the joint venture, with Glencore owning the rest. With an installed capacity of 2.3 million tonnes (Mt), the Glencore-Merafe Chrome Venture historically accounted for more than 30% of chrome exports from SA.

ALSO READ: Glencore awaits court verdict after paying millions for ‘favourable treatment’

Production has fallen from around 400 000 tonnes in 2022 to roughly half this volume. The company warned in September that it would start restructuring in terms of Section 189 of the Labour Relations Act.

In a Sens announcement at the time, JSE-listed Merafe said the consultation process was “as a result of the continuing economic pressures facing the South African ferrochrome industry and the lack of sustainable industry solutions that could alleviate the pressures in the near to medium term”.

Glencore-Merafe has a special tariff from Eskom, but that is insufficient to keep its smelters operating.

Despite promises by Minister of Electricity and Energy Kgosientsho Ramokgopa to provide improved tariffs for energy-intensive users and to restart idle smelters, the latest offer from Eskom appears to fall short of the mark.

ALSO READ: Nersa approves cheaper electricity for Amsa

The JV started shutting down furnaces from 2021 in response to rising electricity costs and market weakness, and earlier this year mothballed its Boshoek and Wonderkop smelters. Earlier this year, production was suspended at the Lion smelter, the only remaining ferrochrome operation within the JV, but has since restarted. Its long-term viability hinges on ferrochrome price recovery and energy cost relief.

The JV says it remains committed to engaging with all stakeholders through the retrenchment and restructuring process and is looking at options to safeguard jobs and maintain operational sustainability.

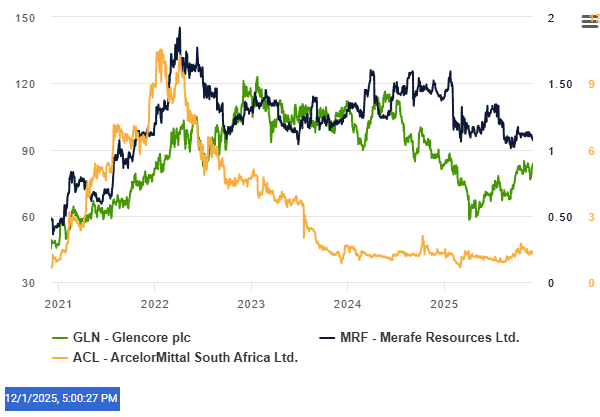

Glencore, Merafe Resources and ArcelorMittal SA share prices

This article was republished from Moneyweb. Read the original here.