The sharp increase in the gold price saw profit margins reach new records, strengthening balance sheets and promising high dividends … with some saying the case for gold ‘is still strong’.

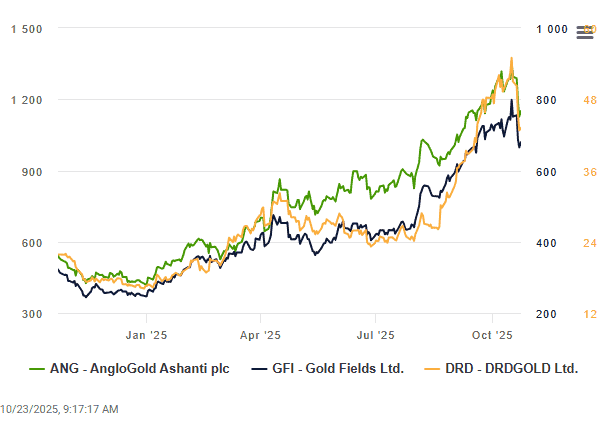

Gold shares have had a good run since January 2025, pushed by a 62% increase in the gold price. The share prices of the big SA gold producers, AngloGold Ashanti, Gold Fields, DRDGold and Sibanye-Stillwater, all increased by more than 200% in the last 10 months.

And then the gold price fell from its high of above $4 350 per ounce to barely above $4 000 over the past few days.

Gold shares immediately gave up a bit of their gains.

AngloGold Ashanti, Gold Fields and Harmony fell around 7% over the last week or so, and Sibanye-Stillwater by 11%.

Where does this leave investors?

Does this offer an opportunity, or is it time to get out and cash in the huge profits while it they’re still on the table?

Joseph Cavatoni, senior market strategist at the World Gold Council, says the bull market for gold is still strong.

“Gold has made 45 new records high this far in 2025,” he said in a radio broadcast aired the second week in October.

“I wake up every morning and the gold price is a couple of dollars higher. We cannot blame the Chinese, they are on holiday. It is Western investors buying,” he says, noting that exchange traded funds (ETFs) were net buyers of gold in September 2025 – to the tune of 240 tonnes.

Cavatoni says recent conversations with asset managers in the US and the UK revealed that fund managers are reducing exposure to government bonds in favour of gold.

“The 60/40 split between equities and bonds are being replaced by a 60/20/20 split by adding gold exposure.

“It makes sense. We have been arguing for years that the negative correlation between bonds and equities should not be taken for granted.”

While the strong rally in the gold price eased this week, it is still more than double what it was a year ago.

ALSO READ: Where will the rand go?

‘Quietly booming’

James Luke, fund manager at Schroders who looks after metal and mining portfolios, believes the run in gold shares is far from over.

“Gold equities have been quietly booming.

“We say ‘quietly’ because we don’t see much in the way of hype from either investors or from the producers themselves,” he says.

“Gold equities still look inexpensive,” he says, adding that shares are still cheap even if the gold price falls.

Luke argues that the performance of gold shares is dislocated from the reality of record cash flow margins that continue to expand. Historically, gold equities outperform bullion when margins are rising and lag when margins are falling.

“Since late 2023, producer cash flow margins have expanded to unprecedented levels as the gold bull market gathered pace,

“Average all-in sustaining cost margins are now around $2 000 per ounce, almost double than their previous peak during the middle of 2020.

“The reason is straightforward. While gold is increasingly priced as a pure monetary asset, cost inflation for miners – mainly energy, consumables and labour – has slowed sharply from the high levels of the period 2021 to 2023.”

He says room “for gold equities to outperform gold bullion remains substantial”.

“Relative to bullion prices, equities would need to outperform by a further 30% just to return to 2020 levels. Yet, margins today are double what they were then and gold producers’ balance sheets are much stronger.”

The combination of higher margins and leaner cost structures could translate into generous dividends and share buybacks. “If gold equities were to reflect current margins, they would rationally need to almost double compared to the current gold price,” says Luke.

ALSO READ: Gold is the new anchor for SA’s mining sector

Operations

The Schroders analysis of the gold industry’s operational reliability shows that operations have improved markedly.

“The 2020 to 2023 period was plagued by post-Covid supply chain bottlenecks, energy shocks and labour shortages,” says Luke.

“Producers are now delivering on a much more consistent basis. In the second quarter of 2025 alone, producers generated roughly 50% more free cash flow than analysts had forecast before the reporting season began.

“While margins are elevated, valuations remain reasonable,” he adds.

“On a long-run basis, price to net asset value [NAV] does not look stretched. Most gold miners still trade at discounts to NAV, effectively pricing in gold levels well below today’s prices.’

Despite the surge in profits, investors seem to remain cautious.

“We still don’t think [Western] investors are broad ‘believers’ in gold,” says Luke. “We are far from the blind-faith part of the cycle, and we see little sign of mania.”

The backdrop for gold seems strong. Prices are at record highs in both nominal and inflation-adjusted terms. Demand from central banks has been buoyant since the G7 froze Russian foreign reserves in 2022 – an event that escalated global concern over dollar dominance and currency security.

“Chinese households have turned increasingly to gold as a store of value amid a deepening real estate slump,” says Luke.

“On top of that, the White House’s renewed trade-war rhetoric and growing tension over Federal Reserve independence have driven investors toward monetary hedges.

“These are not isolated once-off events. They are symptoms of long-cycle fiscal and geopolitical trends that appear nowhere close to resolved.”

ALSO READ: JSE breaches 107 000 for first time as gold stocks shine

Room to run

Luke says governments’ fiscal fragility and the continued geopolitical concerns will continue to push gold higher.

“Fiscal fragility refers to unsustainable global debt and deficits driven by ageing populations and political paralysis. We are heading towards some form of fiscal dominance,” Luke says.

“Central banks will face pressure to finance deficits, tolerate higher inflation and accept weaker independence. This erodes faith in government bonds as risk-free assets.

“Meanwhile, the geopolitical shift reflects the end of the post-war unipolar world.

“We are moving from Pax Americana towards a multipolar reality centred on US-China competition. It’s a new Cold War,” says Luke.

The combination of exceptional profitability, lean cost bases and cautious investor sentiment suggests that gold shares may still have room to run.

“Strong cash flow, strong balance sheets and rising dividends all point to value that is still being overlooked,” says Luke. “We think the sector remains one of the most compelling opportunities in global equities.”

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.