As the gold price cracks $5 000/oz for the first time, Bank of America sees it going to $6 000/oz in the next few months.

The spectacular run in gold shares last year has continued into 2026, with the metal price cracking $5 000 an ounce (oz) for the first time, driving gold and precious metals shares to record highs.

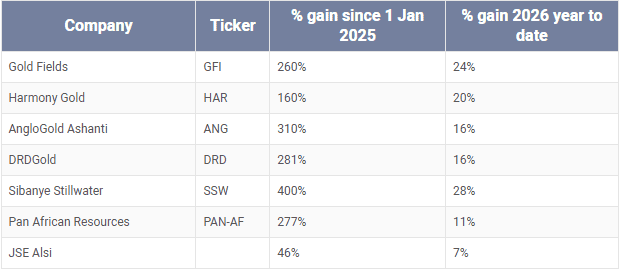

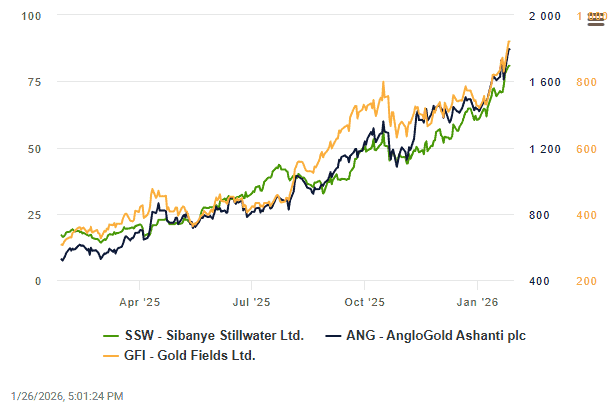

Sibanye Stillwater’s gain since 1 January 2025 surpassed 400%, with AngloGold Ashanti up 310% and DRDGold 281% over the same period.

This helped drive the JSE All Share Index (Alsi) above 124 500 on Monday, after it broke 100 000 in July 2025.

These outsized gains in precious metals stocks have pushed the JSE Alsi up 46% since the beginning of 2025, with the trend continuing into 2026.

The year-to-date performances are shown in the following table, with Sibanye Stillwater, Gold Fields and Harmony already snatching gains of 20% or more in the first three weeks of the new year.

The legendary patience of gold bugs has paid off in spades, ably assisted by some bizarre political turns from the White House, where President Donald Trump’s tariff policies appear to be dictated by whim, with war drums sounding in the Middle East as US carrier groups assemble off the coast of Iran.

ALSO READ: Gold shoots the lights out, crossing $5 000 for a first-time record high

Analysts at Morgan Stanley, HSBC and JPMorgan have provided mixed but predominantly bullish views on gold and the benefits of adding a touch of leverage through selective investment in gold stocks.

Some banks have started to sound caution over shares such as Sibanye Stillwater, though HSBC still sees potential for further gains as we head into the first quarter of 2026.

Morgan Stanley is taking a more cautious view on Sibanye Stillwater and Gold Fields after their magnificent runs in 2025.

Sibanye Stillwater’s diversified exposure to gold, platinum group metals (PGMs) and copper has ignited demand from investors who see some protection against a gold-only play.

The question remains whether this is the start of a gold supercycle or a gold peak.

JPMorgan expected gold to reach $5 000/oz in the first quarter of 2026, with strong demand coming from central banks and investors concerned about the falling value of the US dollar.

Michael Widmer, head of metals research at Bank of America, sees gold hitting $6 000/oz within the next few months, adding that bull rallies tend to peak when the drivers of the bull rally fade, and not just because prices rise.

“When you run the analysis since 2020, you can actually justify that retail investors should have a gold share of well above 20%,” he says in his annual review. “You can even justify 30% at the moment.”

Not only is gold a reliable hedge against financial uncertainty, it’s now also delivering market outperformance (alpha).

ALSO READ: Rand strengthens below R16/$ for the first time in 4 years

Central bank gold reserves have now surpassed that of US Treasuries, with gold now accounting for about 15% of total central bank reserves.

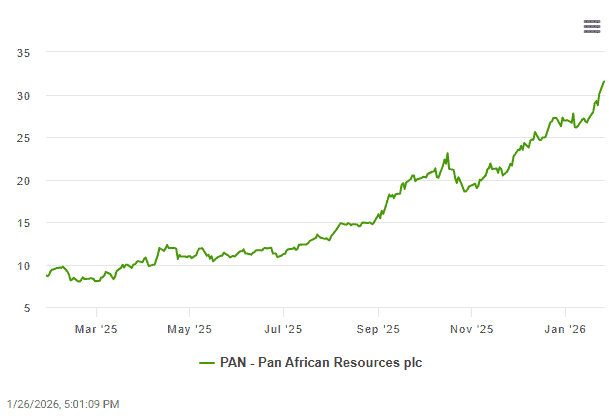

Pan African Resources rewarded the stoicism of investors who have waited nearly two decades for a payout by announcing an interim dividend of 12c a share this week.

This follows a 51% increase in gold production to 128 296 oz for the six months to December 2025, and a gold price that continues to surprise to the good.

Pan African was able to use this cash windfall to pay down more than 65% of its debt and expects to be debt-free a year from now.

This smart use of cash is reflected in a share price which has almost trebled over the past year.

ALSO READ: Is volatile geopolitics good for the gold price, rand and JSE?

Platinum stocks ride the wave

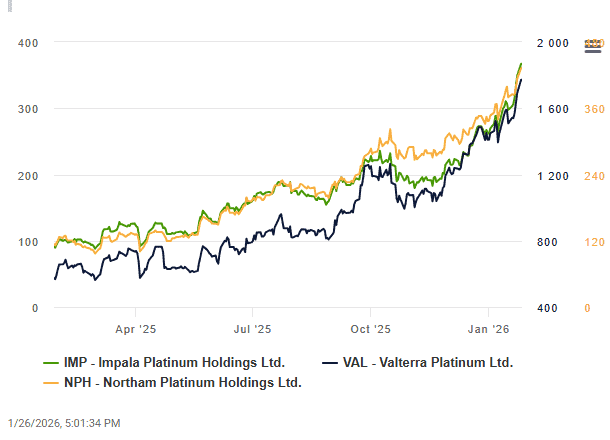

Tailwinds in the gold market bled over into PGMs, with Impala Platinum returning to an all-time high last seen in 2008. The shares are up 33% for the year to date, and more than 260% over the last year.

Nick Kunze from Sanlam Private Wealth told Moneyweb’s Simon Brown that a sell-American sentiment accounts, in part, for the surge in precious metals, including silver.

Central banks, particularly in Asia, have aggressively been accumulating gold, though it’s difficult to call a top to the market.

ALSO READ: Is a Hermès Birkin handbag a better investment than crypto and gold?

A Sens announcement from Valterra Platinum (formerly Anglo Platinum) says headline earnings per share are likely to increase 85-105% for the six months to December 2025, helped by a 26% stronger PGM dollar basket price of $1 852 per ounce. It’s share price is up 20% for the year to date.

Northam Platinum is up nearly 23% this year, capping off a more than 250% surge over the last year following a 3.7% increase in PGM production for the six months to December 2025.

The star performer here was its Eland operations with a 19.6% increase in concentrate, supported by a nearly 40% increase refined PGMs on behalf of third parties.

The start of 2026 has been one for the record books for precious metals and while it has all the outward appearances of a melt-up, few are willing to call the market top just yet.

This article was republished from Moneyweb. Read the original here.