Retailer Boxer is the standout non-resource stock.

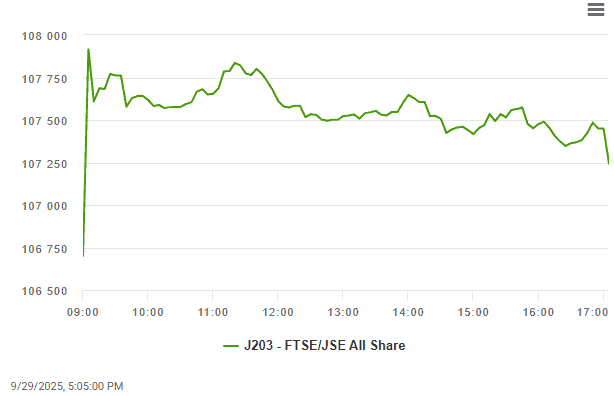

The JSE hit a new record on Monday morning, briefly trading at 107 914 points before moderating to 107 555 by mid-morning, lifted largely by a rally in gold shares.

Gold producers led the morning’s gains, with DRDGold climbing 4.93%, Sibanye up 4.73% and Harmony 4.48% higher.

Retailer Boxer was the standout non-resource stock, rising 3.97% after reporting a near 14% increase in turnover for the 26 weeks to the end of August.

Among the small caps, Purple Group – majority owner of trading platform EasyEquities – gained more than 13% by 11:30, hitting a 52-week high at R2.64.

Investor and trader Simon Brown, host of the MoneywebNOW podcast, says the momentum comes from resources, particularly gold shares. “This is a resource rally and mostly a gold rally. The Top 40 broke through 100 000 today for the first time ever,” he says.

Brown notes that gold has had a remarkable run. “It has had a spectacular year.”

Year to date, gold is up 43%, trading at $3 809.05 on Monday morning.

ALSO READ: Gold and platinum shares steal the show as JSE cracks new high

“The story for gold remains – central bankers are buying and there’s the [geopolitical] uncertainty. I don’t see it changing anytime soon. Maybe at some point gold can become too expensive for central bankers – but for now this is rocking.”

While the rally has lifted the overall market, Brown says many domestically focused companies – so-called SA Inc stocks – remain under pressure.

“Our retail stocks have had a tough year after a good 2024, so it hasn’t been great. Our banks are doing okay, but not knocking the lights out.”

He points out that bank shares were cheap at the beginning of the year, but are now moderately priced.

“And if you look at the small-cap space, most of them are not having a good year, except for a few – Purple Group is one of them.”

He stresses that the current strength is not tied to the local economy. “This is not a South African GDP story at all. It’s a gold story and, to a degree, valuations.”

ALSO READ: JSE All Share Index hit 100k points

Still, some retailers have benefited from better conditions. “Even from the consumer side – the two-pot money, lower inflation, lower rates – we’ve seen some decent retail figures coming through, but the likes of Mr Price and Foschini Group [TFG) – they had run ahead of themselves last year,” Brown says.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.