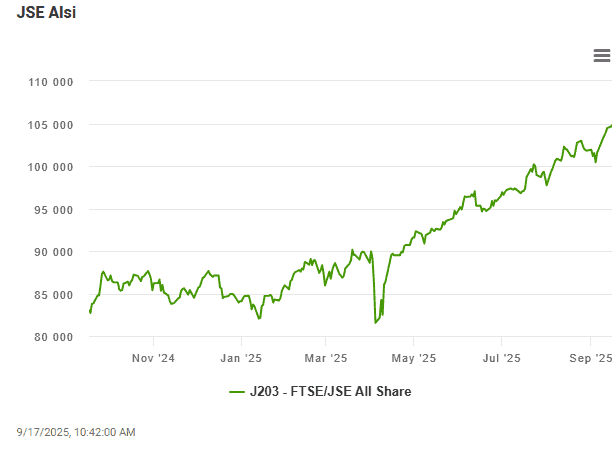

Before closing just shy of this new milestone.

The JSE All Share Index (Alsi) touched a fresh record above 105 000 points on Tuesday, remaining at those levels for most of the day before closing at 104 885.

At around 9am, the local bourse was trading at 105 486 points and stayed above the 105 000 mark until 4:15pm, when it dropped below the new milestone.

ASP Isotopes, which in July acquired all of SA onshore gas explorer Renergen’s issued shares, led the gains with a rise of more than 6%. Other strong performers included Pan African Resources, up 5.51%, MTN, which firmed 5.48%, Premier with a 4.44% advance, and Telkom, which added 3%.

Anchor Capital fund manager Peter Little again highlighted that the rally is being fuelled by a narrow group of shares.

“If you strip out gold and PGMs, as well as Naspers, Prosus and the telcos, which have had a pretty good year so far, it’s pretty tough,” he said.

ALSO READ: JSE All Share Index hit 100k points

Gold shares have surged 159% year-to-date, contributing 43% to the Alsi’s performance. Platinum shares are up 118% (14% contribution), while Naspers and Prosus have gained 43% (22% contribution), said Little.

Together, these groups account for 80% of the Alsi’s year-to-date performance, despite making up only 30% of the index weight.

Telcos, up 52% year-to-date, added another 7% to the Alsi’s performance.

By contrast, discretionary retailers have lost 23% year-to-date, and general retailers are down 5%. Banks (up 9% year-to-date) and insurers (up 10%) have held up relatively well in a difficult operating environment, Little noted.

ALSO READ: Investing in JSE shares: What you need to know

South Africa remains a “massive beneficiary of high commodity prices,” he said, which are boosting exports and supporting the economy, but he stressed that the average South African business is struggling.

“It’s anybody’s guess where the gold price is heading. It’s extremely elevated at the moment. Platinum is a different story, as there is industrial demand.”

Locally geared shares such as banks and retailers remain depressed. “They are also very cheap. If we get a boost in the economy and things improve economically, the prospects of those shares are pretty good,” Little said.

Market watcher and producer of the Braaibroodjie Index, Johann Biermann, said in a post on x that the JSE Alsi has surged more than 36% in US dollar terms this year, outstripping emerging markets overall, which are up around 24%.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.