Asisa started publishing the average pay-out rate of life insurers provide consumers with the peace of mind that valid claims are paid.

Life insurers settled 95.6% of all death claims in 2024 and paid out R39.5 billion in benefits to beneficiaries of life and funeral policies .

These life insurers are members of the Association for Savings and Investment South Africa (Asisa). The Asisa annual death claims payout statistics for 2024 show that life insurers processed 914 258 death claims against individual life, credit life, funeral and universal life policies.

The statistics also show that 873 825 of these claims were paid and 40 433 claims were declined due to reasons such as dishonesty, fraud, or contractual exclusions, including suicide within the first two years after taking out the policy.

Fully underwritten life policies are only issued if the individual policyholder has completed a full underwriting process, which involves a comprehensive assessment of the life insured’s health and medical history.

In 2021, Asisa started collating claims payout statistics for all types of life policies (fully underwritten and partially underwritten), as well as funeral policies.

ALSO READ: Think twice before switching your life insurance

Life insurance and funeral insurance payouts remained steady

Gareth Friedlander, a member of the Asisa Life and Risk board committee, says for the past four years (2021 to 2024), the average claims payout rate for life and funeral policies remained steady between 94% and 96%.

“Since life companies exist primarily to provide consumers with the option of insuring themselves and their loved ones against the financial impact of an event such as death, disability, or critical illness, policyholders and their beneficiaries should be able to trust that their policies will pay out when a life-changing event occurs.

“A life insurance company will only decline a claim if there is evidence of a crime, the benefit definition is not met or an exclusion applies, the policyholder died during the waiting period, or if fraud or intentional dishonesty was evident.”

This would, for example happen when a policyholder does not disclose important information about a medical condition or lifestyle when applying for the policy to secure cover and/or lower premiums.

The 2024 claims payout statistics show that more than 95% of claims were valid and therefore paid, with only 4.4% of claims declined, highlighting the importance of being honest with the life insurer when taking out a life or funeral policy, Friedlander says.

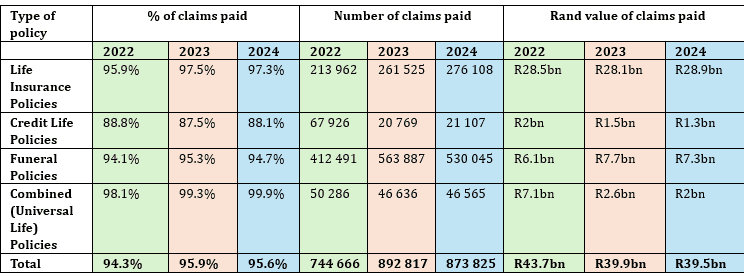

This table shows the Asisa claims payout statistics from 2022 to 2024:

ALSO READ: Consumers bounce back as insurance policies increase

Life insurance policies (including universal policies)

Friedlander points out that the highest average claims payout percentage is typically achieved for life insurance policies (including the old universal life policies), because they require some form of risk screening, such as health assessments and lifestyle questions, before the applicant’s life is insured.

Life insurance policies can offer life cover worth millions of rands and the underwriting process reduces the risk of fraud and non-disclosure at the application stage.

In 2024, 97.3% of claims against life policies were paid and 99.9% of universal life policies.

ALSO READ: Old Mutual reports paying an average of R59 million per working day in life insurance claims

Funeral insurance policies

Funeral insurance policies are designed to pay out quickly and without hassle when an insured family member dies and typically do not require blood tests and medical examinations. Funeral policies are also restricted in terms of the maximum cover they can provide.

Friedland says since there are no underwriting requirements for funeral insurance, it is often tempting for people to buy funeral cover only once they developed a serious illness and are expecting to die as a result. To prevent this, funeral cover usually imposes a waiting period of six months for deaths due to natural causes.

Therefore, the payout rate for funeral policies tends to be slightly lower than for life policies but still exceptionally high at 94.7% in 2024.

ALSO READ: Momentum Life pays out R6.6 billion in claims in 2024

Credit life policies

Credit life policies are designed to cover loans should the policyholder die before the debt, such as a home loan or car financing, has been settled. The payout by a credit life insurance policy decreases as the outstanding loan amount decreases and once the debt has been repaid, the cover ends.

Friedland says since premiums are worked into the monthly loan repayment, a default on the repayment also means that no premiums are paid to the life insurer and the cover therefore lapses.

He points out that claims against credit life policies are usually declined because the cover lapsed due to non-payment of premiums or the outstanding loan balance had been settled. The average claims payout rate for credit life policies was 88.1% in 2024.