While the SA Reserve Bank usually follows suit when the US Federal Reserve cuts rates, this time only the Fed moved.

As most economists expected, the South African Reserve Bank decided on Thursday to keep the repo rate unchanged, despite the outlook for inflation and the economy being stable as well as the inflation rate for August dipping by 0.2%.

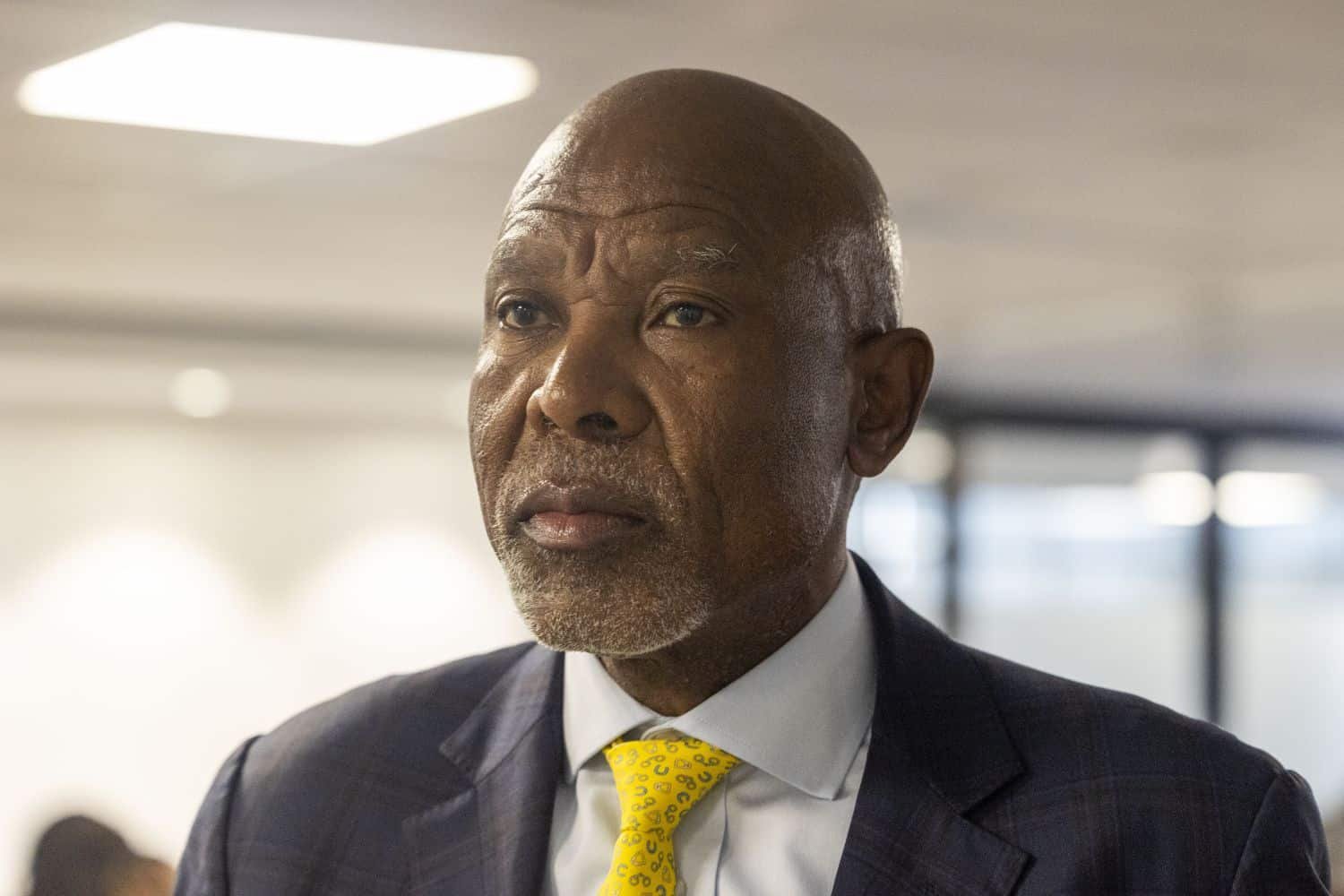

Making the announcement on behalf of the Monetary Policy Committee (MPC), South African Reserve Bank (Sarb) governor Lesetja Kganyago said the global economy appears resilient so far, with growth holding up and market volatility subsiding, despite the geopolitical environment remaining difficult and trade disruptions continuing.

“Since our last meeting, policy rates have been cut in the US and UK and the dollar weakened. Various commodity prices increased, although oil prices remain contained. These conditions support emerging markets like South Africa.

“However, while the cyclical factors mean global conditions are currently favourable, there are also more adverse structural developments, which are likely to prove challenging. Long-term interest rates have shifted higher in several major economies, reflecting a range of pressures, especially high and increasing debt levels, as well as inflation risks.”

ALSO READ: After surprise dip in inflation, will we see a surprise repo rate cut?

Positive numbers for growth, but no repo rate cut

Turning to South Africa, Kganyago said since its last meeting, the MPC noted positive indicators for second quarter output, but last week’s gross domestic product (GDP) release still surprised with the highest quarterly growth rate in two years.

“We therefore marked up our growth forecast for the year, from 0.9% to 1.2% despite a weaker export outlook, given higher US tariffs.

“Although the strong GDP report was welcome, we do not want to overstate the importance of one good quarter. We continue to see modest output gains over the next few years, helped by structural reforms.

“There are also some cyclical indicators, such as credit extension, which look positive. However, reaching a healthy growth rate will require much higher investment levels than we are achieving now.”

According to Kganyago, the risks to the growth forecast are assessed as balanced.

ALSO READ: Economists’ expectations for inflation and the repo rate this week

Pressure from food prices but inflation remains contained

Moving to prices, Kganyago said headline inflation picked up in recent months, broadly as expected. He pointed out that the pressure is coming mainly from meat and vegetables, but helped by fuel prices which have been declining.

Meanwhile, he points out, underlying inflation remains contained, with core around 3%. Inflation expectations also moderated further in the latest survey, which shows South Africans are getting used to lower inflation.

“We anticipate that headline inflation will increase over the next few months, peaking at around 4%. Our forecast now incorporates higher electricity price inflation, of nearly 8% rather than 6%, given the recent pricing correction by Nersa.

“This is a reminder of the serious dysfunction in administered prices, which undermines purchasing power and weakens growth. The solution to this crisis is not a higher level of inflation, but rather sector-specific reforms to improve efficiency.”

ALSO READ: This is why South Africa’s economic growth deteriorated since 2005

MPC keeping repo rate unchanged based on inflation projections

He said the MPC’s inflation projections also have upward adjustments for food and services prices, partly offset by a stronger exchange rate assumption. “Overall, we expect headline inflation to average 3.4% this year and 3.6% next year, before reverting to 3% during 2027.”

The MPC assesses the risks to the inflation outlook as balanced.

Against this backdrop, Kganyago said, the MPC decided to keep the repo rate unchanged, at 7%, with four members preferring to keep rates on hold, while two favoured a cut of 25 basis points.

Since September last year, the MPC reduced rates by 125 basis points and Kganyago said the MPC now want to see how this is affecting the economy, how expectations evolve and how inflation risks are resolved.

“The forecast has rates easing gradually as inflation returns to the bottom end of the 3-6% target range. The MPC emphasises that stabilising inflation at 3%, rather than 4.5%, implies a lower longer-term level for the policy rate.

“However, the rate path from the Quarterly Projection Model remains a broad policy guide. As usual, our decisions will be taken on a meeting-by-meeting basis, with careful attention to the outlook, data outcomes and the balance of risks to the forecast.”

ALSO READ: Moody’s: High borrowing costs in SA, while Fitch keeps rating stable

Sarb’s 3% preference for inflation

Kganyago emphasised that in their economic modelling, inflation expectations play an important role in shaping the transition to the Sarb’s 3% preference.

“Given uncertainty about the behaviour of expectations, for this meeting we considered scenarios where expectations adjust more slowly than they do in our baseline. These scenarios treat expectations as more backward looking, with less attention paid to the Sarb’s communication.”

He pointed out that the scenarios show a slower convergence to 3% inflation while the policy stance is somewhat tighter over the forecast period, with roughly one less cut and moderately lower growth.

Kganyago added that there are two important takeaways from the scenarios:

- Firstly, the disinflation process in the forecasts does not rely on optimistic assumptions about the behaviour of inflation expectations. It is robust to alternative assumptions, which generates similar inflation trends.

- Secondly, there are gains to be had from clear and credible communication. “In this regard, it is desirable to finalise target reform. Accordingly and in line with the recent joint statement from the Sarb and the National Treasury, we look forward to agreeing on a new target as soon as is practical, to better anchor inflation expectations.