Graphene Economics says even Mauritius is looking into intra-group transactions more closely.

Global crises – such as the 2008 financial crisis, the Covid-19 pandemic, and the recent international trade tensions created by US President Donald Trump – generally result in renewed focus on tax collection, particularly from multinational companies.

Tax authorities will take a closer look at companies’ transfer pricing policies and whether prices are being adjusted because of outside shocks, or whether the tariff increases are a convenient opportunity to shift profits to head office countries, warns Michael Hewson, director at Graphene Economics.

Transfer pricing is the price set when different parts of the same company, like its branches or subsidiaries, buy and sell things from each other – whether it is products, services, or ideas.

Transfer pricing policies influence how much tax a company pays in the countries where it operate.

ALSO READ: US tariffs: SA sends new proposal but no changes to laws

Reduced prices

Hewson says companies may react to the punitive tariffs introduced by the US by reducing the price of goods they export to the US in order to remain competitive. The risk is that they will lose market share if they do not make price adjustments to respond to the increased tariffs.

This, says Hewson, may attract the attention of revenue authorities.

“The South African Revenue Service [Sars] may challenge why prices to a related party in the US are now lower than prices to third parties in other countries,” he explains.

Hewson gives the example of a local manufacturer. If a global retailer, which manufacturers in China and other markets affected by high tariffs, sells more into SA, the demand for the local manufacturer’s products may reduce. Especially if the prices charged by the global retailer reduce.

This would impact the profitability of the local manufacturer. “These reduced profits may cause Sars to ask whether the lower profits are due to its transfer pricing policy, even though it’s actually impacted by external commercial factors.”

ALSO READ: US tariff an existential threat for a third of metals and engineering sector

Commercial rational

Companies need to carefully record their decisions for making pricing adjustments, along with the commercial rationale behind them. When a dispute arises, it may be years after the actual event, and it can be quite a challenge to find the right documentation – or even people who were involved in the decision-making at the time.

Hewson says Graphene Economics is increasingly receiving transfer pricing queries from countries it had not previously heard from. It has seen a notable increased focus on transfer pricing policies from East and West Africa.

“Governments are seeing transfer pricing as a big opportunity for revenue collections and the global shocks are proliferating the attention.”

The work done by institutions such as the African Tax Administration Forum (Ataf), the Organisation for Economic Cooperation and Development (OECD), the United Nations, and the World Bank have assisted with capacity building, training, and the introduction of transfer pricing legislation into Africa.

There has also been increased information sharing between Sars and revenue authorities in East Africa and West Africa. Mauritius, too, has recently been scrutinising intra-group transactions more closely and the number of audits has increased – something that has been unheard of in the recent past, notes Hewson.

ALSO READ: Transfer pricing: ‘Days of pleading ignorance are over’

Reducing risk and costs

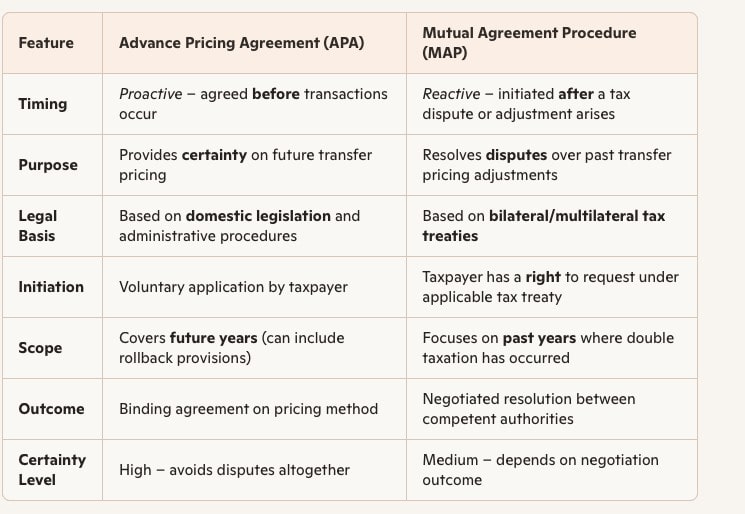

Important tools to mitigate disputes with tax authorities include advanced pricing agreements (APAs) and mutual agreement procedures (MAPs). Hewson says there are several companies in SA that are keen to enter into APAs with the tax authorities.

The main aim of an APA is to establish how prices will be set for future transactions, thereby reducing the risk of disputes following an audit, and the possibility of double taxation.

Draft legislation for a proposed APA Programme was introduced in 2023 and according to ENSafrica, the draft bill included a clause indicating that a chapter on the APA programme will be inserted into the Income Tax Act.

“The introduction of the APA programme is a positive and significant development in South Africa’s efforts to enhance its tax administration system. It provides taxpayers with an alternative, binding arrangement with Sars, and it will also offer upfront certainty on transfer pricing positions for a defined period,” the firm said at the time.

Hewson notes that companies generally do not care where their profits are taxed, but they want to avoid double taxation.

Several countries in Africa are using APAs. MAPs, on the other hand, offer a safety net when double taxation has already occurred due to tax authorities taking different positions.

The key differences between APAs and MAPs

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.