Analysts think the country is fundamentally in a ‘better’ position than two to four years ago.

President Cyril Ramaphosa famously lamented South Africa’s nine wasted years under Jacob Zuma in 2019. Since then, with the whammy from the Covid-19 pandemic and government’s severe lockdowns, those nine years have turned out more like a decade-and-a-half.

Only now are green shoots emerging, with our GDP set to grow by 1.4% according to various forecasts, with some upside surprises capable of boosting this to 1.5% (or even slightly higher).

As investors – and citizens – we tend to struggle to see the impact of incremental improvements over time.

In a recent quarterly webinar, Nolan Wapenaar, co-chief investment officer at Anchor Capital, said the asset manager believes, fundamentally, that “South Africa is in a better position than it was two, three, four, years ago,” and that the “trend of gradual improvement in South Africa is going to continue”.

This is not only a rand story, nor is it a commodity one.

Wapenaar, who is also head of fixed income at Anchor, points to a number of impactful trends that ought to provide healthy tailwinds to an already positive outlook.

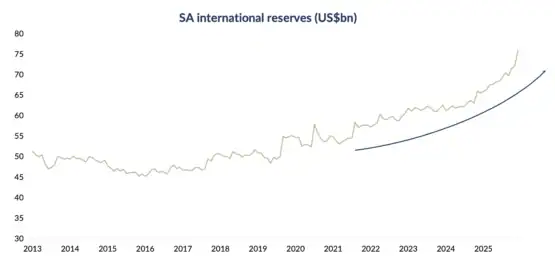

Foreign reserves

Firstly, Wapenaar highlights that our foreign reserves have “increased quite meaningfully” from the very predictable level of around $50 billion from the ‘Zuma years’ until the pandemic in 2020.

These are now 50% higher than they have been.

And “South Africa’s external balance sheet looks the strongest it’s ever been, and that is a small step in the right direction for South Africa”.

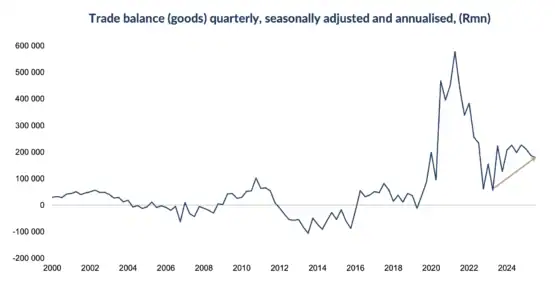

Trade balance

If one looks at the country’s external trade balance, due to higher commodity prices and lower oil prices, and because we export metals (primarily platinum and gold) and import oil, “we are actually ‘earning’ more dollars as a nation right now.

“We’re clearly not squandering it, but what it does do is make [our] economic positioning within the globe … actually quite favourable for South Africa.”

Most accept that the structural reforms underway at (primarily) Eskom and Transnet have begun removing these artificial and unnecessary constraints on growth.

ALSO READ: Illegal mining bleeds billions from economy, says Mantashe

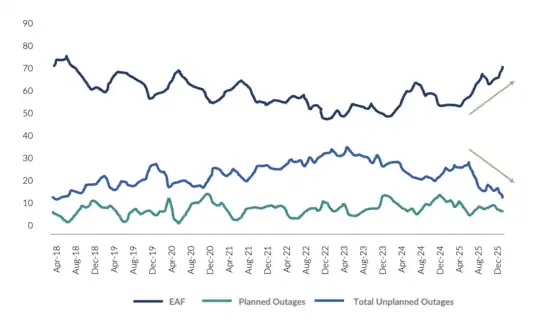

Power supply

We take Eskom’s turnaround and the near-complete absence of load shedding for granted, but when one looks over a longer period, the improvement at the power utility really is stark.

Its energy availability factor (EAF), or measure of available power, is back at levels last seen seven years ago. Wapenaar says that our plants were becoming less and less efficient, resulting in a clear negative trend between 2018 and 2023.

Operating these plants more efficiently plus catching up on the backlog of maintenance has resulted in a “very clear … improvement in our electricity supply, a small step in the right direction”.

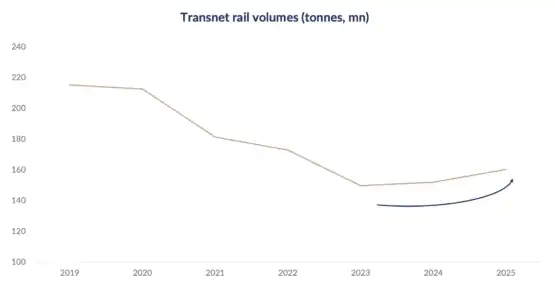

Rail

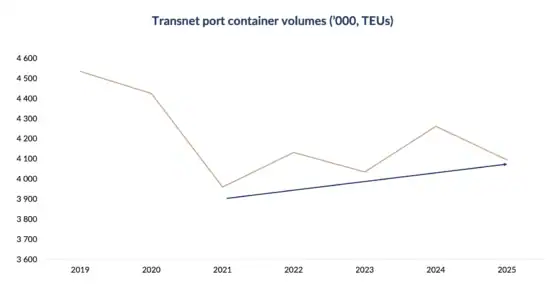

A similar trend was in place at Transnet, where rail and container volumes were both heading downward for years.

The improvement on the former since 2023 has been slight, but Wapenaar stresses that “we’ve stopped going backwards … the trend line is positive; it’s no longer negative”.

This is another “small step in the right direction”.

With the ports, too, we’ve “stopped going backwards, and since then we’ve seen infrastructure investment …”.

“We’ve seen private participation, and it’s very reasonable to expect that that sort of positive trend, if anything, is going to accelerate.”

Ports

These key metrics are “things that are actually happening on the ground in South Africa,” emphasises Wapenaar.

“These aren’t theoretical things. This isn’t like ‘Ramaphoria’, where there was a bit of positive sentiment, but it never manifested into any positive changes.”

These are “real goods on railway cars, real goods going through our ports, real electricity coming through the wires, and it ultimately is beginning to manifest in terms of the job market”.

ALSO READ: South Africa secures $8 billion from Afreximbank – here’s what it will be used for

Jobs

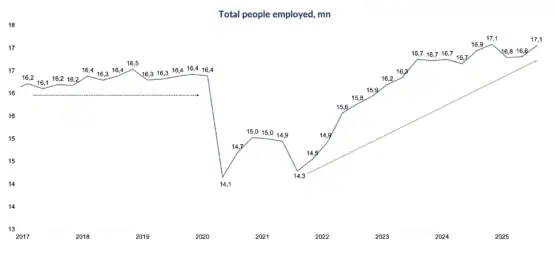

While it is easy to get caught up in quarterly unemployment statistics, Wapenaar underlines that up until Covid-19, employment in South Africa had “by and large stagnated” at little over 16 million people.

The recovery post-pandemic has been sound, and this “trend looks like it’s continuing”.

Importantly, we now have over 17 million people employed, which translates into “an extra one million people who are earning a living, an extra one million people who’ve got money in their pocket to go and spend at shops, an extra one million people who’ve broadened our tax base”.

“All of this again adds up to a slightly stronger South Africa, another step in the right direction.”

The primary balance

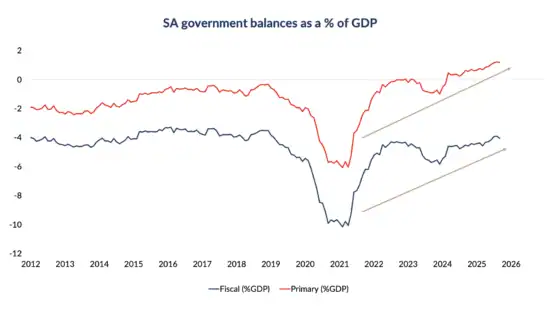

When it comes to the government’s primary balance – the income it receives less the money it spends on police, schools, et cetera– it has been negative “through almost the last decade or certainly the last decade or two …”

“Suddenly in the last few years, for the first time this primary balance has turned positive.”

“That means the government is receiving more in tax receipts than it is actually paying out as expenses in various avenues,” says Wapenaar.

“That is enabling the government to actually bring our debt under control, and it’s looking more and more like that debt level that people were talking about and the debt levels people were stressing about is actually going to come under control …”

“And this is a large part of why we saw our first rating upgrades late last year,” he adds.

“We think that there’s possibly further for this trend to run.

“Again, a positive development for South Africa.”

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.