Women, the youth and people in the lower income groups earn the least, while 6.9% of South Africans earn 60.4% of the cash flow.

South Africans’ total and cash flow income increased over the past five years, but not for everybody.

Inequality still rules across gender, income levels and demographic groups. Most South Africans are still earning incomes that they can barely survive on.

According to the latest Personal Income Estimates for South Africa (2020–2025) report issued by the Bureau of Market Research (BMR) at Unisa, there is some good news, with a projection of moderate but positive income growth for 2025.

The report shows that despite ongoing economic challenges, South Africa’s total personal income increased to R6.37 trillion in 2024, an increase of 5.4% from the previous year.

Cash flow income, the money available for spending and saving, increased to R5.68 trillion, marking a 5.2% year-on-year increase.

Jacolize Meiring, head of the personal finance division at the BMR, says this growth was largely driven by investment income, pensions and salaries, although the pace has slowed since the post-pandemic rebound in 2021.

The research also shows that structural inequality persists when it comes to gender and income, with the 2024 findings revealing that income inequality remains a defining feature of South Africa’s socio-economic landscape.

ALSO READ: Salaries slide in July, showing strain in job market

53% of women earn 41.8% of income, while men at 47% earn 58.2%

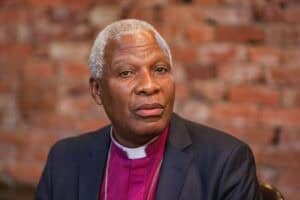

Gender disparities are particularly stark, Arthur Risenga, senior researcher, says.

“Although women make up 53% of the adult population (older than 15), they receive only 41.8% of cash flow income. Men, who represent 47% of the adult population, earn 58.2% of total income.”

The research also indicates that income group analysis reiterates the concentrated income structure, as 45.3% of adults fall into the very low-income category, earning less than R17 945 per year according to the cash flow definition, while an additional 28.8% are in the low-income bracket, earning between R17 946 and R81 763 per year.

This means that 74.1% of adults in South Africa receive only 10.3% of cash flow income. In contrast, only 6.8% of adults qualify as middle-high or high-income earners, earning over R413 541 per year, yet they generate a staggering 60.4% of national cash flow income.

“The reality is that most South Africans are still earning survival-level incomes. Meanwhile, a small proportion of households continue to capture the bulk of the nation’s wealth.”

ALSO READ: Pay gap: These CEOs earn on average 597 times what lowest paid workers earn

Older generations do better with income, while the youth are in crisis

Looking at income through a generational lens, the analysis shows that the youth are marginalised, while older groups benefit from owning assets. The generational analysis of 2024 data included in the report highlights significant divergence in economic participation and income generation across age groups:

- Generation Z (15 – 27 years): while making up 30.3% of the adult population, they earned only 7.4% of cash flow income in 2024. This generation faces high unemployment, with just 19.9% employed, while the majority (76.3%) falls in the very low-income bracket.

- Born-Free Millennials (28 – 43 years): they showed stronger labour market engagement, with 52.8% employed and responsible for 36.2% of cash flow income. However, internal inequality remains, with 40.4% of this group falling in the very low-income bracket.

- Generation X (44 – 59 years): this group represents 20.4% of the adult population and earns 35.6% of cash flow income. They are now in their peak earning years, are highly educated and have investment returns and assets that contribute to their financial strength.

- Older adults (60+ years): although they only make up 13.3% of the adult population, they generated 20.8% of cash flow income. Most of them rely on pensions and investments and are not highly educated. Income inequality is high in this group is high, as 1.9% of individuals generate 53.7% of the group’s income, mainly driven by investment income.

ALSO READ: Salary survey shows gap between increases and inflation narrowing

Looking to a better future for income?

Meiring points out that the outlook for 2025 is moderate growth with pockets of opportunity. Looking ahead, the BMR expects continued income growth in 2025:

- Total personal income is forecast to reach R6.76 trillion (+6.2%), while cash flow income is expected to grow to R6.04 trillion (+6.4%).

- Investment income will remain the key growth driver, projected to increase by 11.6% in total terms and 10.4% in cash flow terms.

- Net profits, pensions and grants are also expected to expand, with growth rates between 6% and 8%.

- Salaries and wages, although they are the largest income source, will see more modest growth of 5.1%, reflecting persistent labour market constraints.

Risenga says the 2025 forecast is encouraging, “but without structural reform and targeted interventions, these gains will continue to be unevenly distributed.”

ALSO READ: Can South Africa reform fast enough to beat unemployment?

Implications for policy and practice

These statistics also have implications for policy and practice, he says.

“These insights reinforce the urgent need for targeted interventions. Youth unemployment, gender disparities and income inequality must be tackled head-on. Expanding access to quality education and enabling more South Africans to earn and invest is central to building an inclusive economy.”

As South Africa navigates a complex economic recovery, the BMR urges decision-makers to focus on:

- Accelerating youth employment strategies, particularly for Gen Z and younger Millennials

- Investing in education and skills development to enable broader participation in formal income opportunities

- Enhancing financial inclusion, including mechanisms that support household saving and investment.

“The 2025 forecast offers reason for cautious optimism, but meaningful progress will depend on structural reform and inclusive economic strategies that bridge the generational, gender and geographic income divides,” Mering and Risenga say.