This created arbitrage with an estimated value of R780 million for exporters.

Policy interventions in the scrap metal market have created arbitrage between the price preference system (PPS) discount and the export duty on scrap metal products.

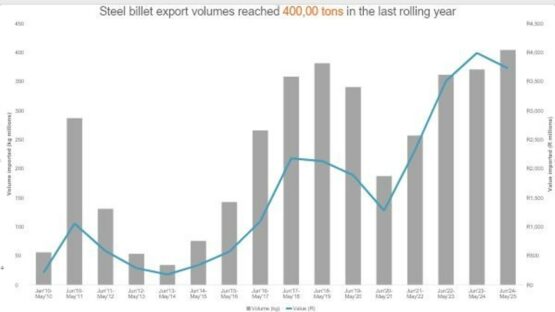

A recent study (XA’s Scrap Metal Report 2.1) by XA Global Trade Advisors (XAGTA) on the impact of these policy interventions on waste pickers showed that the export of 400 000 tons of steel billets (to circumvent the export duty) resulted in an arbitrage of R780 million.

Arbitrage refers to taking advantage of price differences in different markets to make a profit.

The first policy intervention was introduced in 2013 by way of the PPS. Scrap metal dealers can only obtain an export permit for their product once they have offered it at a 30% discount to local buyers such as the mini mills.

Only then are they allowed to export the scrap, but it comes with a 20% export duty. There has been a noticeable increase in the export of steel billets and a decline in raw scrap metal exports.

ALSO READ: US tariff an existential threat for a third of metals and engineering sector

Incentivising arbitrage

Donald MacKay, CEO of XAGTA, explains that mini mills get their raw material at a discount (PPS), melt it into steel billets (that are not a usable product such as rebar) and export the billet duty free.

Source: XAGTA

“We have ended up rewarding the companies that are involved in these exports with R779.9 million … I don’t think we should be incentivising scrap metal arbitrage,” says MacKay.

“The intention certainly was never to create the arbitrage, but the effect has been arbitrage. I don’t think it is a healthy situation.”

In theory it would be easy to correct the arbitrage created in the scrap metal industry, but in practice, this isn’t the case.

“The reason for the arbitrage, in my view, is that there is too much money entering the sector that has no natural demand.”

The easiest to prevent the arbitrage is for the Industrial Development Corporation to stop funding new mini mill operations, says MacKay.

“I am not saying they should pull their funding from existing operations, but you must stop putting more money into this space when there is no demand.”

ALSO READ: A brighter future for South African steel?

The trigger

XAGTA has been keeping a close eye on the sale of scrap metal globally and in South African for several years. A statement by Neva Makgetla, chief economist at Trade and Industrial Policy Strategies (Tips), triggered their recent study.

Makgetla is quoted as saying that the impact of the interventions on waste pickers is minimal, as they are not selling the kind of metal that the mini mills are consuming.

According to the International Alliance of Waste Pickers, the informal recycling sector in South Africa consists of between 60 000 to 90 000 waste pickers. Many are migrants who move from rural to urban and peri-urban areas to find employment opportunities.

According to a survey conducted by the University of Johannesburg, more than 70% of respondents earn less than R600 per week. The majority (39%) earn between R300 and R600 per week.

They are not officially employed by either government or the private sector, yet according to the Council for Scientific and Industrial Research, informal pickers saved municipalities between R309 million and R748 million in landfill airspace in 2014 alone by simply diverting recyclables from them.

MacKay says that, from its conversations with waste pickers, it is evident that the bulk of the volume they collect is paper, glass and plastic. However, the bulk of the value tends to come from metal.

ALSO READ: Government called to take the lead in restoring the steel industry

Policy matters

XAGTA asked recyclers what the biggest risk to their scrap yards was. Their answer: interventions by government in the form of policy changes that keep the price of scrap metal artificially low.

“That was quite surprising because one would have thought theft at their premises would be a larger risk,” says MacKay.

He adds that although the XAGTA advisors are not crime experts and there is a lack of sufficient data, they could not find a correlation between the imposition of PPS, export duties, or export bans on the theft statistics.

However, the policy interventions are not yielding good outcomes for the country, particularly not for the poor and most vulnerable people.

He would like to see them go but if they are not scrapped, he believes they should at least be lowered to something “less predatory”.

“If we get what was promised, which was to replace PPS with the export duty, it would lessen the amount of heat in this space,” says MacKay.

The International Trade Administration Commission is reviewing the PPS, and the findings are expected to be released later this year.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.