Depositors must first wait to be contacted by FNB before visiting the branches.

National Treasury has allocated R2.2 billion to refund Ithala depositors from 8 December 2025.

More than 250 000 customers of the state-owned bank have been struggling to access their money from January this year because the Prudential Authority (PA) is seeking to have the financier liquidated due to solvency issues and regulatory breaches.

“The National Treasury, following consultations with the KwaZulu-Natal Provincial Government, will make up to R2.2 billion available to enable the repayment of depositors of Ithala SOC Limited (“Ithala”),” said Treasury.

ALSO READ: Prudential Authority to appeal ruling on Ithala Bank liquidation

Process of repayment to Ithala customers

The department said on Tuesday that payments will start on 8 December and depositors have until 2028 to claim their payout. There will be a verification process to ensure the money lands in the right hands.

“Depositors will first need to be verified to ensure payments go to the correct recipients. Once verified, payments will be processed within approximately two days.”

The payout process will be facilitated by FNB. Treasury said depositors are not required to bank with FNB and can transfer their funds to a bank of their choice. “This arrangement is intended to ensure that funds are paid out in an orderly and secure manner,” added the department.

No payouts to be made at Ithala branches

Treasury said there will be no payout made at Ithala branches. Depositors will be able to visit any FNB branch to claim their share of the R2.2 billion after being contacted by the bank.

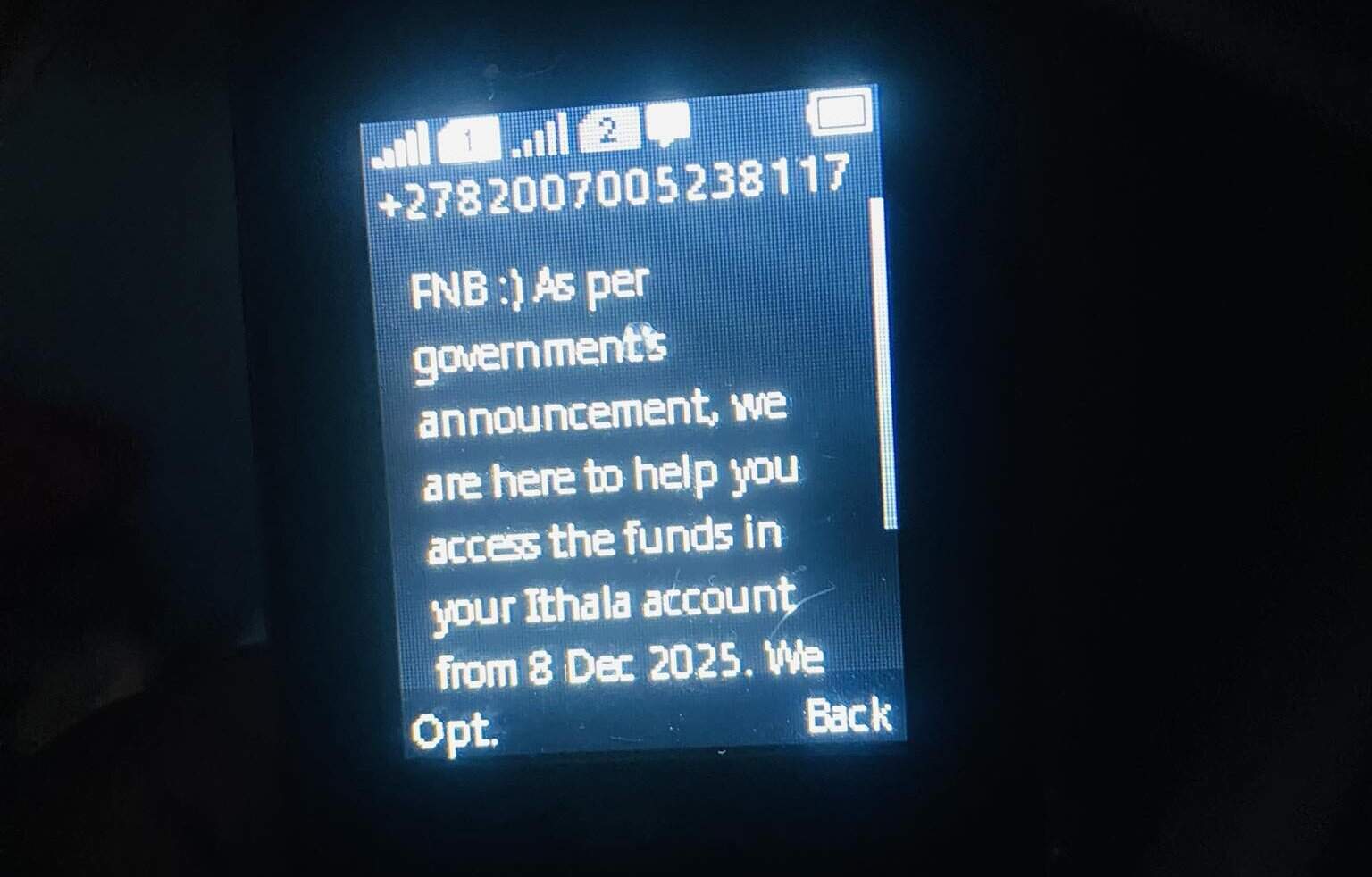

“Depositors will be contacted via SMS with details of the required documentation, which will include: an ID, proof of address, and proof of an alternate bank account where their money will be deposited.”

According to Facebook group “Ithala Bank Investment“, some depositors have received communication from FNB.

The department added that those with existing loans are still required to continue repaying them to Absa, as the appointed intermediary bank for Ithala.

Bailouts from 2018

Ithala has received over R450 million in bailouts since 2018, but operated under an exemption from the Banks Act until 2023.

The South African Reserve Bank (SARB) in January explained how Ithala’s abuse of the exemption status had placed it in a compromised situation.

“All exemptions expressly required Ithala to separate its deposit-taking activities from its other businesses, such as its business as a credit provider advancing loans to the public, which Ithala did not do,” the Sarb stated.

The entity explained that locking customers out of their accounts was intended to prevent a bank run, a process of mass withdrawals.

NOW READ: KZN Treasury unhappy with Godongwana’s R2bn guarantee to Ithala depositors

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.