Critics say it centralises power and even targets revenue from illegal interactive gambling.

The potential introduction of a 20% national tax on the gross gambling revenue of all forms of online gambling may very well violate the Constitution. Commentators are also of the view that it undermines democratic practice due to the lack of meaningful consultation with those who will be affected.

The Free Market Foundation calls the proposal “a naked revenue grab that threatens the very existence of the legal gambling market”.

Revenue from legal gambling is widely regarded as a far safer alternative than the technically illegal, unregulated activity of interactive gambling.

Ayanda Zulu, political studies graduate from the University of Pretoria and an intern at the Free Market Foundation, says in a published article the “bizarre proposal” should not see the light of day.

In terms of the National Gambling Act, gambling regulation is effectively a provincial competence. While the national government plays a role in oversight and coordination, the provinces retain primary authority over regulatory responsibilities.

“This means that a national tax is unconstitutional because its centralisation of fiscal responsibility ignores clear jurisdictional boundaries and the limits placed on the national government,” Zulu says in an article published by the foundation on Tuesday.

ALSO READ: There’s a national online gambling tax – but where is the online gambling law?

Gambling taxes

National Treasury published its discussion document at the end of last year, immediately provoking some harsh criticism from affected parties.

Currently gamblers who receive a once-off windfall from gambling are not taxed on their winnings while those who generate a frequent income from gambling are obliged to declare this as taxable income.

Government has made gambling tax proposals in the past, but none of them saw the light of day. Treasury proposed a 15% withholding tax on gambling winnings above R25 000 in 2011, including those from the National Lottery.

It was supposed to be implemented from 1 April 2012. However, after consultation it was discovered that there would be complexities with enforcement and compliance, Treasury says in its discussion document.

In the 2012 Budget, a national gambling tax based on gross gambling revenue was proposed for introduction in April 2013.

The tax was going to take the form of an additional 1% national levy on a uniform provincial gambling tax base, and a similar tax base was to be used to tax the national lottery. Again, it was not implemented.

Treasury is now back with a new option to address the negative “externalities” (social harm) caused by problem gambling.

It is also aiming to reduce the proliferation of online gambling activities.

ALSO READ: Thousands of illegal gambling operators are targeting South Africans

It wants a 20% national tax on online gambling that would be in addition to the current provincial taxes of between 6% and 9% on the gross gambling revenue of gambling operators (total turnover less winnings paid to players).

The rationale behind the higher tax rate on online gambling is because (at least) physical casinos generate employment and investment in infrastructure and higher expenditure on accommodation. “Few, if any, similar benefits are associated with online gambling,” Treasury argues.

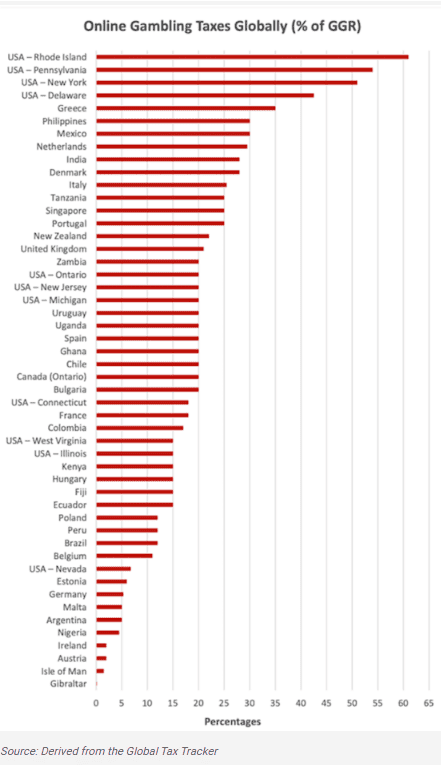

This practice of higher online gambling taxes is already prevalent in other jurisdictions.

National Gambling Board data for the 2024/25 financial year indicates that about R1.5 trillion was wagered in the South African gambling industry.

“At the current levels of gross gambling revenue, the 20% tax on gambling would translate into over R10 billion in additional revenue for national government. However, the main objective of the reform would not be to raise further revenue, but rather to discourage problem and pathological gambling and their ill effects,” says Treasury.

This tax is a separate and additional independent national tax that would share the same tax base as the provincial gambling tax on gross gambling revenue but “would also include any revenue from interactive gambling”.

ALSO READ: Will taxing the spoils of illegal online gambling put a stop to it?

Moral crusade

Zulu says the proposal comes against the backdrop of a moral crusade against interactive gambling in South Africa.

Online betting with licensed bookmakers is allowed, but most other forms of interactive gambling (like online casinos) is technically illegal. The Gambling Amendment Act of 2008 was never promulgated.

“Therefore, the proposal of a national tax on it [interactive gambling] constitutes an inversion of the basic rule of law logic,” says Zulu.

“Instead of first attending to the question of whether a regulated interactive market is desirable, Treasury is quietly opting to chase easy revenue.”

While interactive gambling is a vice and overindulgence has naturally placed it on the agenda, the conversation surrounding its regulation should be a robust one that considers all angles and resists moralising uniformity.

He adds that meaningful consultation is a core component of democratic practice that ensures legitimacy, accountability, and genuine participation by all stakeholders.

The bypassing of preliminary engagement with some stakeholders “strongly suggests” that National Treasury is not committed to democratic practices, but rather ticking boxes aimed at paving the way for its own agenda.

This article was republished from Moneyweb. Read the original here.