With over 470 outlets and rapid expansion, Pep Home has surpassed competitors.

At the end of September 2024, Pepkor had 426 Pep Home stores in South Africa. It hasn’t yet disclosed the split between Pep, Pep Cell and Pep Home for this year, but it has reported the addition of 45 Pep Home outlets in the last 12 months. This takes the total to around 470, barring the impact of any closures.

At current growth rates of between 50 and 100 stores being added each year, this unit should overtake the number of Pep Cell outlets (534 in March 2025) during 2026, given the relative concentration of the latter category in the market.

Across its Pep business in South Africa, these 45 openings accounted for nearly half of the total new stores (95) in 2025, while in 2024, the 38 Pep Home stores were two-thirds of the total.

Sure, this is a fast-growing segment for the core unit of Pepkor, but with nearly 1 700 Pep stores across SA, there is simply not that much white space left to add further ‘core’ Pep outlets.

This is not the case for Pep Home, which has seen the group expand into areas and neighbourhoods (like Leaping Frog and Kyalami Corner in the north of Joburg, Kloof in Durban), where it would probably never open a ‘normal’ Pep store.

ALSO READ: Pepkor to buy Legit, Swagga, Style and Boardmans

Sales mix, segment comparison

Pepkor doesn’t split out the sales mix within its Pep business in South Africa, which makes it impossible to see just how big the Pep Home unit is. Clothing and general merchandise, at R67 billion in the last year, accounts for 70% of group revenue and 74% of profits.

One proxy is Mr Price, where Mr Price Home and Sheet Street together account for around 16% of group revenue.

On that basis, it isn’t a stretch to imagine that Pep Home is around 10% of revenue. Pepkor says that it has continued to see market share gains in the homeware category (general merchandise), not to be confused with its furniture, appliances and tech unit (practically, the old JD Group).

ALSO READ: Where do you shop for jeans? Survey reveals Mr Price is SA’s most loved store

Historical context

It is strange to think that Mr Price, which basically created this segment – affordable homeware – with its acquisition of Sheet Street in 1996 and the opening of the first Mr Price Home store in 1998, created this gap for Pep.

They had a 10-year head start before Pep opened its first Pep Home store in 2007. Early growth was steady as it took nearly 15 years to reach more than 200 stores. That number has doubled in the last five as the business reached scale.

Contrast this with Mr Price Home, which has 235 stores (as of the end of September); while Sheet Street has 334. In the last six months, the group has added four and two new outlets, respectively.

Sheet Street is lot more comparable to Pep Home than to Mr Price Home, given its smaller stores, limited selection, and inclusion of décor items – it has long ceased to be a bedding and curtaining retailer (Pep Home stores are generally small enough to fit in a single department of a typical Mr Price Home).

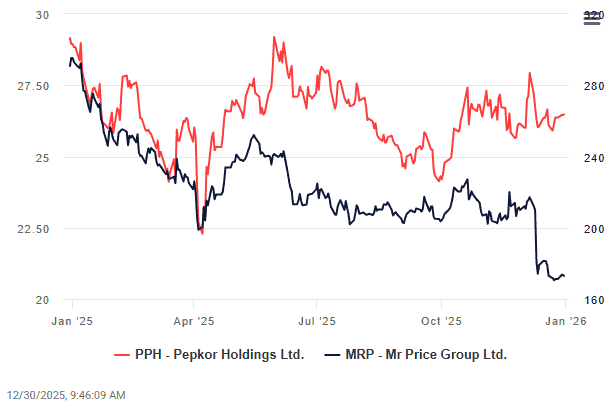

However, Pep Home already has a larger footprint and is adding new stores at a far quicker rate. Sales in Mr Price’s homeware segment (which also includes Yuppiechef, targeted at the more affluent market) were up 5% in the first half to September.

Not only has Pep found a sweet spot – trendy and affordable décor – it is managing to consistently source products that resonate incredibly well with shoppers.

Pep has cleverly leveraged the immensely popular and influential TikTok and Instagram social media platforms, with the #PepHomeFinds tag attracting more than a quarter of a billion views.

This is mostly user-generated content, which means that customers are doing their marketing for them.This also creates a coolness factor that is impossible to buy (could you even imagine a #SheetStreetFinds tag?).

On TikTok, Pep Home has more than double the number of followers as Sheet Street, while on Instagram, the difference is more than four times.

Pep, which one might think would be the last retailer to play in the e-commerce space, given its market positioning, has rolled out an online shop for selected Pep Home products on its main site. Think softs (throws and cushions) and smaller décor items, not table lamps.

ALSO READ: Did Old Mutual pick the exact wrong time to launch a bank?

E-commerce expansion

Starting with homeware basics means it doesn’t have to deal with the headache and complexity of clothing returns (items like stainless steel mugs and bathmats are far less likely to be returned than a dress that is the wrong size).

It offers free delivery for orders over R500, while orders below this amount are R25 for collection at over 2 700 Pep stores, or R50 for home delivery.

Between its launch and the release of its annual results (about a month), it has processed more than 5 500 online orders. This number is tiny compared to Pepkor’s scale (it processes 60 transactions per second across the group’s more than 6 000 stores), but it is a start.

Importantly, it broadens the addressable market for Pep Home, much like it has by opening stores in areas where it historically would never trade.

This article was republished from Moneyweb. Read the original here.