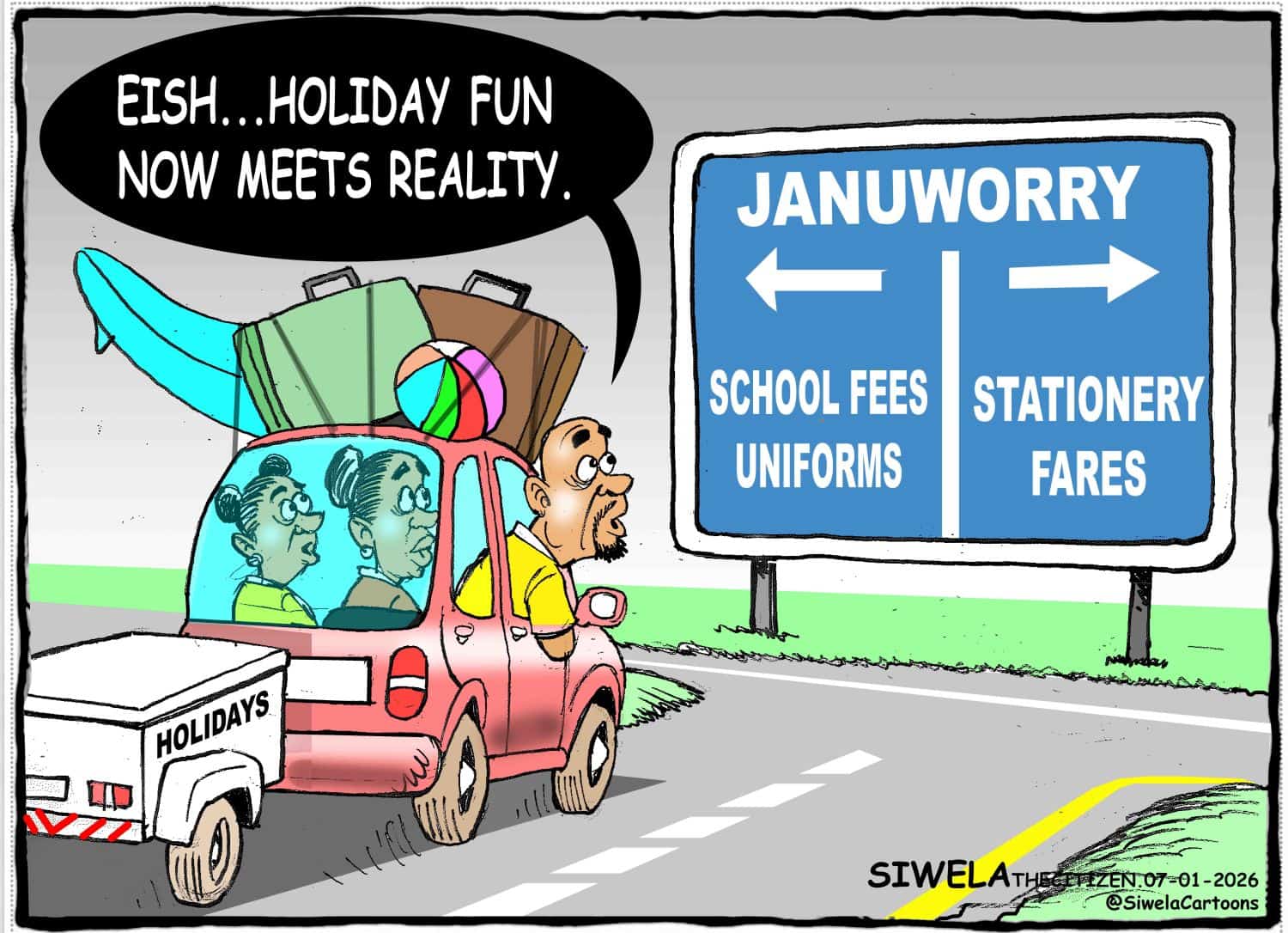

The new year comes with extra expenses for most South African families.

After enjoying the festive season in December, many South Africans have to return to their normal lives – and the costs that come with a new year.

Often referred to as Januworry, the first month of the year comes with extra expenses such as the costs of starting a new school year. Many resort to borrowing to cover these expenses.

The Credit Association of South Africa (CASA) has urged South Africans to make careful credit decisions and only borrow from credit providers that are registered with the National Credit Regulator.

“This time of year typically places additional strain on household budgets. Factors such as gifting, travel, social events, January back-to-school costs and family commitments can tempt consumers to take on debt they cannot afford,” Leonie van Pletzen, CEO of CASA, says.

Van Pletzen warned that poor decisions can lead to severe financial pressure early in the new year.

READ NEXT: Credit association urges consumers to borrow wisely as Januworry kicks in