A small retail chain beat the big precious metals players to record the steepest price increase, while a look at the Top 20 and Bottom 20 shows enormous contrasts.

It would be fairly safe to assume that very few investors – if any – expected that Botswana retailer Choppies Enterprises would be the best-performing share on the Johannesburg Stock Exchange (JSE) in 2025.

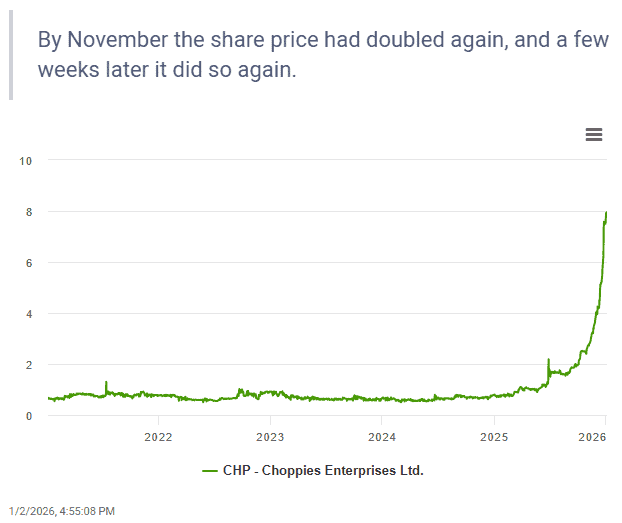

An increase of nearly 900% in the share price from 80 cents in January to almost R8 on the last trading day of the year was unbeatable.

The share had doubled from 80 cents in January to R1.60 by June, then started to run hard after the publication of the group’s results for the year to June 2025 in the last week of September.

The annual results alone do not explain the share’s sharp rise.

Things seem to be running relatively smooth at the chain of 287 stores operating in Botswana, Zambia and Namibia, but the group posted a 23% drop in profit in its financial year to June 2025.

The statistics suggest that Choppies is unlikely to be on the list of the best shares at the end of 2026. The increase in the share price places it on a price-to-earnings ratio of 62 times and the share currently trades at a price-to-net-asset-value of 31 times. The relatively small retail chain is valued at R14.5 billion.

ALSO READ: JSE breaches 107 000 for first time as gold stocks shine

Precious metals

The increase in precious metal prices and the run in mining shares was easier to predict at the beginning of 2025.

Gold started its strong rally during 2024 and the momentum was obvious at the beginning of 2025 – it went on to increase another 65% to consecutive new record highs and ended the year at $4 320 per ounce.

It was only a matter of time before platinum group metals followed gold with a rally, starting in the middle of the year. The platinum price increased 130% from $914 per ounce in January to $2 060 at year end, palladium ran 84% to $1 633 and rhodium doubled to $9 175 per ounce.

The strong prices led to a surge in the share prices of Eastern Platinum and Sibanye-Stillwater of more than 300%, while those of Northam Platinum, Implats (Impala Platinum), Southern Palladium and Valterra Platinum increased sharply too.

The continued increase in the gold price pushed AngloGold Ashanti another 240% higher and the share prices of DRDGold and Gold Fields ended around 200% higher.

ALSO READ: JSE hits new record above 105 000

Fintech

Apart from mining shares, another big winner was Vodacom’s black economic empowerment vehicle, YeboYethu. The share price increased as Vodacom itself surged nearly 47% on the back of strong results and upbeat commentary by management, especially about the group’s growing fintech interests.

Optimism about fintech also put Weaver Fintech among the best shares, with an increase of 116% since January 2025. Previously Homechoice, the retailer changed its name to Weaver Fintech in July to “ better reflect” the company’s strategic change.

Management reported that fintech products evolved into the primary source of income and future growth, with profit before tax increasing 48% in the six months to end June 2025.

Fintech also helped two more shares onto the list of the best shares of 2025, namely stockbroker Purple Group and communications and fintech giant MTN Group.

In the financial sector, Finbond surprised with its share price increasing 92%, and made proponents of penny stocks happy. The share surged from 65 cents to R1.25 after Finbond announced that its earnings had increased by nearly 600% in the six months to end August 2025.

No fewer than 30 shares on the JSE increased by more than 50% during 2025.

There were eight that declined by more than 50% since the 3 January 2025 opening bell.

| JSE winners & losers in 2025 | |||

| Best and worst-performing shares | |||

| Top 20 | Up | Bottom 20 | Down |

| Choppies Enterprises | 891% | Cashbuild | -36% |

| Eastern Platinum | 313% | Italtile | -36% |

| Sibanye-Stillwater | 304% | Super Group | -36% |

| Northam Platinum | 246% | Southern Ocean Holdings | -37% |

| AngloGold Ashanti | 240% | KAP Industrial Holdings | -38% |

| Pan African Resources | 229% | eMedia Holdings | -40% |

| DRDGold | 217% | Mr Price | -41% |

| Southern Palladium | 200% | Afrimat | -42% |

| Impala Platinum | 200% | Grand Parade Investments | -43% |

| Gold Fields | 194% | Truworths International | -45% |

| Valterra Platinum | 148% | Cilo Cybin Holdings | -45% |

| Harmony Gold Mining | 124% | Aveng | -48% |

| YeboYethu | 123% | Sappi | -50% |

| Weaver Fintech | 116% | The Foschini Group | -50% |

| Purple Group | 107% | Metair Investments | -54% |

| Delta Property Fund | 105% | Nutun | -57% |

| Nictus | 97% | Trematon Capital Investments | -59% |

| Stadio Holdings | 93% | Montauk Renewables | -65% |

| Finbond Group | 92% | Copper 360 | -70% |

| MTN Group | 84% | MTN Zakhele Futhi | -98% |

| * Compiled using ProfileData share prices | |||

ALSO READ: JSE All Share Index hit 100k points

At the bottom of the list …

The figure of a 98% crash in the price of MTN’s black economic empowerment scheme, MTN Zakhele Futhi, does however hide the true story.

MTN actually handed its black shareholders a win when it offered to buy the shares in the unsuccessful empowerment structure to save them from losses.

MTN Zakhele Futhi increased sharply from R7.70 to R21 after the initial announcement in May 2025, then fell sharply in August after it paid the proceeds of the share sale to shareholders by way of a special dividend.

The share price of Copper 360 was hammered as a result of a rights issue.

Montauk Renewables also took quite a knock following the announcement of a substantial loss for the six months to June 2025.

Trematon Capital Investments also declined as a result of corporate actions that impacted the overall size of its investment portfolio, namely the sale of its property interests.

The share prices of most of the rest of those lagging on the JSE fell due to simple economic and business realities.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.