Top priorities for the government are boosting local steel demand and sharply curbing high import levels to support the domestic industry, says company.

JSE-listed ArcelorMittal South Africa (Amsa) has reported a narrower headline loss per share for the six months ended 30 June 2025.

In a Sens announcement on Thursday, the embattled steel producer said it continued to face significant challenges in the first half of the year, with no improvement in market conditions compared to the prior period.

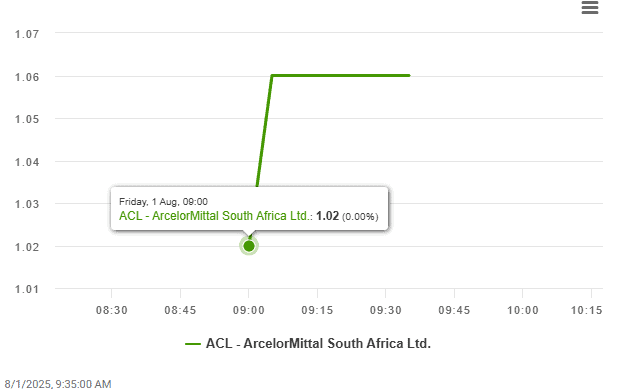

Amsa’s share price dropped over 4%% on Thursday morning, trading at R1.03 following the filing of its interim results.

In the period under review, the headline loss per share decreased from 100 cents to 91 cents, but revenue fell 16.5% to R17.1 billion (2024: R20.5 billion), weighed down by a prolonged global steel downturn.

Sales volumes declined 11% to 1.05 million tonnes. Realised steel prices dropped 7%, while the raw material basket price decreased 12%, with international prices down 22%.

ALSO READ: ArcelorMittal warns it might close without urgent solution to challenges

Amsa’s net borrowings for the period stood at R4.6 billion (2024: R5.1 billion). This includes capitalised interest and group charges of R421 million and deferred income of R842 million linked to Industrial Development Corporation (IDC) funding allocated to continue operating its long steel business in the third quarter.

“IDC funding has been applied in a responsible, transparent, and considered manner,” the company said, adding that it is still awaiting the outcome of the IDC’s due diligence process.

Amsa reiterated that it plans to wind down the long steel business by 30 September 2025 unless a viable solution is found.

The group previously raised concerns about the lack of progress in addressing “structural impediments” threatening the division’s sustainability.

It said engagements continue with the government and stakeholders in the South African steel and engineering value chain to support structural reform and agree on interventions to reverse the sector’s decline.

ALSO READ: IDC saves ArcelorMittal days before furnaces switched off

However, despite initiatives such as the review of steel tariffs, the export tax on scrap, and the preferential pricing system (PPS), Amsa said progress has been limited in implementing interventions that adequately tackle the constraints.

“South Africa can maintain and grow a thriving steel industry; however, commitments must translate into real and immediate supportive action.”

Amsa added that its two most pressing priorities are to ensure “a vibrant level” of steel demand accessible to local producers and to “dramatically” reduce high import levels.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.