Intellidex flash note.

Staying ahead of the technology curve is imperative

With vehicle theft rife in South Africa, Cartrack’s offerings will be in demand. South African Police Service crime statistics show overall carjacking rose 14% from April 2014 to March 2015 and it is more pronounced for trucks at 29%.

Cartrack listed on the JSE in December 2014, joining competitors Mix Telematics (Mix) and DigiCore. Subsequently, DigiCore delisted after it was acquired by Nasdaq-listed Novatel Wireless. Cartrack’s IPO was through a private placement where all proceeds were used to purchase a 20% stake owned by the founder. As such no funds were retained by the company. The pre-listing documents pointed out that the aim was not to raise capital at that point but to enhance the company profile and brand name, given its international expansion drive.

A recognised brand will become important as the vehicle telematics industry develops. Car manufactures are moving towards developing advanced built-in automobile telematics and service providers such as Cartrack will need to forge relationships with manufacturers.

The company metrics look good but the industry outlook presents mixed prospects. A definite positive is the low penetration level globally. An EY report, The quest for Telematics 4.0, projects that about 104 million new cars will be connected by 2025, with the EU, Japan and Bric nations presenting huge potential due to pending regulations.

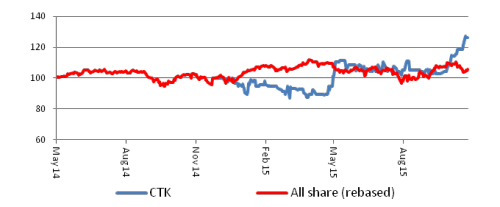

Cartrack share price performance (rebased)

Countering that are two important factors. First, is the high level of competition in the industry. Continued product development is standardising the product, which is fast reducing barriers to entry. So staying ahead of the technology curve is imperative to protect market share, and this does not come cheaply.

Second, is the fact that two important stakeholders in the telematics ecosystem, vehicle manufacturers and telecoms companies, have the ability to squeeze margins of service providers. We are concerned about the long-term sustainability of the business model given that it is a logical business opportunity for car manufacturers and telecoms operators. Next year Ford is rolling out a built-in cellular-connected telematics system, SYNC Connect, that uses the AT&T network. But this also presents a potential buyout opportunity provided its intellectual property proves invaluable

Revenue growth was supported by a 20% increase in the subscriber base to 463 000. Annuity-type revenue constitutes 84% of group revenue. Revenue growth was recorded in all operating regions and its gross profit margin remained high at 82%. However, the Asia-Middle East operation turned red at operating profit level due to start-up costs. Therefore, the operating margin deteriorated, but is expected to improve once operations have bedded down. Management reckons it might take three years before the operations turn into profit. To regain margins, significant top line growth is needed.

Furthermore, subscription revenue, which has higher margins, helped increase profit contributions from operations outside South Africa. This helped to maintain the gross profit margin despite price pressures in some regions. In addition, bulk purchasing of components and procurement cost management prevented the recent weakening of the rand from having an immediate impact on costs. Headline earnings rose 16% to 37.2c/share and an interim dividend of 20c/share (1H15: 16c/share) was declared.

The company has done well financially. As such its price:earnings multiple of 17 seems justified when compared with Mix (10), its industry average (9) and the all share index (19). This is supported by a superior gross margin of 82% (Mix: 69%) and its operating margin, which has deteriorated to 34% (Mix: 9%) due to start-up costs in Asia. It has a net profit margin of 23% (Mix: 16%) and has managed an average return on equity of 58% (Mix: 12%) over the past three years. Its revenue has generated a compounded annual gross return of 23% (Mix: 11%) in three years.

In addition, Cartrack has a significant annuity income base, low customer concentration and it promises to pay out at least 70% (1H16: 54%) of earnings. However, Mix is more cushioned by revenue diversification, generating 48% outside South Africa compared with Cartrack’s 24%. Also, its scrip is illiquid with less than 10% available to retail investors.

Cartrack was listed at R8.50/share and has since gained more than 40%. We believe this price advancement justifies its potential earnings power and the share is trading within its intrinsic value.

Bull Factors

– Geographical diversification will expand forex earnings and hedge against rand weakness

– Potential for significant growth in Asia and Middle East

– The group has built a customer behaviour database which is a springboard to offer additional customised products

Bear Factors

-Threat from other players in the telematics ecosystem such as car manufacturers and telecoms companies

-Weakening rand and poor economic outlook

-Highly competitive industry and the cost to stay ahead of the technology curve can be prohibitive

Nature of business: Cartrack provides fleet management, stolen vehicle recovery and insurance telematics services. The business incorporates global asset tracking, monitoring and recovery services with the provision of fleet management information systems from a platform of telematics technologies. While its principal operations are in South Africa, Cartrack is expanding into the rest of Africa, Europe and Asia. Telematics is the technology of sending, receiving and storing information relating to remote objects such as vehicles via telecommunication devices.

Disclosures: The analyst has no financial exposure to the instrument discussed. The opinion represents his true view.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.