Returns of more than and close to 200% from the top performers did much to prop up the Alsi.

The tremendous outperformance of gold and platinum shares so far this year – boosted by Prosus/Naspers – has pushed the JSE All Share Index to record highs of over 110 000 points.

Had you invested in the Satrix Resi ETF at the start of the year, you’d have more than doubled your money (returns are over 122% year to date).

Of the 10 best-performing shares on the JSE between January and September, only one – Blu Label Unlimited – is not a mining company. All 10 have shown share price appreciation of more than 100%.

Shares of the top performer so far, Sibanye-Stillwater, are up 229% over that period with pure gold producers Gold Fields and DRDGold not much further back (at 195% and 191% respectively).

And of the top 20 performers over the first three quarters of the year, only two shares, Blu Label and Telkom, could be considered ‘SA Inc’ stocks.

Blu Label has outperformed as it gets ready to separately list Cell C, which should unlock a tremendous amount of value in the process.

The rest are companies with varying amounts of exposure to South Africa: MTN Group, Ninety One, BAT, Vodacom and Sasol.

ALSO READ: JSE breaches 107 000 for first time as gold stocks shine

Now for those that didn’t sparkle …

The opposite side of the performance chart shows just how poorly companies whose earnings are directly linked to the South African economy have done.

These so-called ‘SA Inc’ shares span all sectors, including retail, manufacturing and financial services.

Of the 10 worst performers between January and September, seven could be considered ‘SA Inc’ stocks:

- Nutun (-59%)

- Truworths International (-47%)

- Afrimat (-46%)

- KAP (-46%)

- Tsogo Sun (-36%)

- WBHO (-36%), and

- TFG (-35%).

In every single one of these instances, you’d have lost at least a third of your money had you invested in early January.

Nutun, primarily a collections business, is effectively the remaining asset from Transaction Capital. SA Taxi (renamed Mobalyz) was sold and WeBuyCars was listed separately on the JSE. Today, the business’s market cap is less than R750 million as it continues its turnaround after a torrid three years.

Afrimat, technically a miner, along with Thungela Resources (-35%) are the lone resources counters on the list of 20, mainly due to the double whammy of a relatively stable iron ore price and underperforming Transnet.

Retailers dominate the bottom 20, with a full six on the list (seven if one includes Famous Brands, down 23%):

- Truworths (-35%)

- TFG (-35%)

- Italtile (-35%)

- Cashbuild (-34%),

- Spar Group (-33%), and

- Mr Price Group (-31%).

There are a further five more traditional industrial shares on the list: KAP, WBHO, Reunert (-28%), Oceana Group (-27%) and HCI (-25%).

Nedbank is the lone financial services counter (-24%). Of the traditional big four, it has the most exposure to the South African economy.

FirstRand has its UK business (and not insignificant operations across the SADC region) and Absa and Standard Bank have a far more diversified earnings base across the rest of Africa.

ALSO READ: JSE hits new record above 105 000

Some are adding exposure to local stocks

The thing is that many fund managers and market commentators have called for increased exposure to ‘SA Inc’ shares across the last 12 months.

Most have been careful to stress that this needs to be very selective.

At the mid-year point, Ninety One’s Value Fund manager John Biccard said he had “used the weakness in ‘SA Inc’ stocks” over the previous five months “to add to our positions, and we are once again overweight this sector”.

He says the investment house ascribes this “to ongoing nervousness about politics, weakness in the economy, and poor GDP growth”.

“We believe these concerns are more than in the price of domestic stocks.”

He cites Absa as an example. It trades at book value, has a price-earnings (P/E) ratio of six, and a dividend yield of 9%. Ninety One says the dividend is “now approaching the cost of 10-year money”.

The Absa share price “clearly shows no expectation of real growth ahead in the SA economy, a risk we are now being well compensated for”.

This thinking “prompted” Ninety One to “add Old Mutual to the portfolio (for the first time), which is trading at a 7x P/E, 7% dividend yield, and at book value, as well as Raubex, which is trading at 3x EV/Ebitda [enterprise value to earnings before interest, tax, depreciation and amortisation], and with strong growth prospects ahead”.

Substantially all of the growth in the All Share Index has come from resource counters as well as Prosus/Naspers in the first nine months of the year.

Holding one or two of the others would’ve maybe yielded 6% or 8% or 10%, but this is nothing like the returns being seen from resources. So-called ‘SA Inc shares’ have dragged the Alsi backwards.

ALSO READ: Gold and platinum shares steal the show as JSE cracks new high

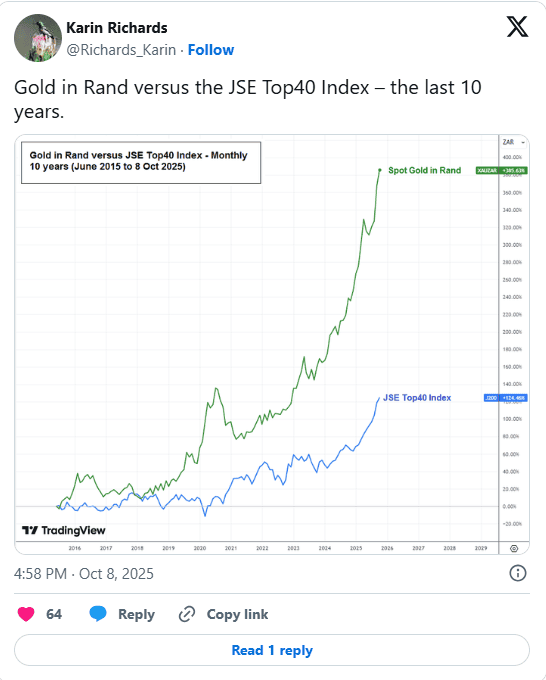

The context of a decade

Resource bulls will point to the fact that the Satrix Resi has outperformed all other ETFs and ETPs (exchange-traded funds and exchange-traded products) for the past decade, with an average total return of 18.04% per annum, led by the Sygnia Itrix MSCI USA ETF (at 16.7%) and physical gold (1nvest Gold or Absa NewGold, at 15%).

Investing in the SA market would have generated a total return of around 11.5% to 11.8% per annum over that period.

And financials and midcaps underperformed over the same time period (7.5% and 8%, respectively).

Listed property would’ve returned an average of 2.5% per annum.

A story for another day.

This article was republished from Moneyweb. Read the original here.