It is holding on to its recent gains, but economists warns against volatility and downside risks.

It might look like the rand has strengthened remarkably since the beginning of 2025, but the truth is that it didn’t really. The impression of a stronger currency is created by our focus on the rand/dollar exchange rate and the fact is that the dollar weakened significantly rather than the rand strengthening.

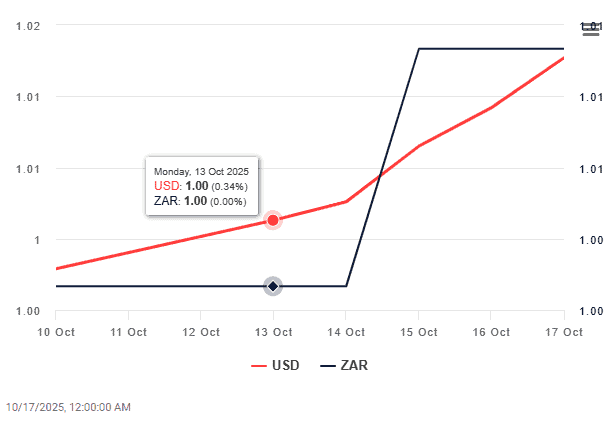

The net effect is that the exchange rate improved from R18.70 per dollar at the beginning of the year to the current R17.34, after reaching a best level of R17.15 on 8 October.

However, the rand still weakened against the euro, from R17.93 at the beginning of the year to the current R20.23 per euro.

It fared slightly better against the British pound, because – like the US – the UK economy is facing challenges.

Siphamandla Mkhwanazi, senior economist at FNB, says the rand has staged a notable recovery since May – when it hit a low of R19.75 to the dollar in response to US President Donald Trump announcing high import tariffs on SA goods. This followed the earlier announcement that US government agencies would stop all financial aid to SA.

Mkhwanazi says several global factors have contributed to the rebound of the rand, with expectations around US monetary policy an important factor.

“Growing market anticipation of a US Federal Reserve (US Fed) rate cut has weakened the dollar and supported emerging market currencies like the rand,” he says.

“The US inflation data for September came in slightly above expectations, but Fed officials have signalled comfort with the inflation trajectory – reinforcing expectations for a modest 25 basis points rate cut.

“This has buoyed risk appetite and encouraged inflows into high-beta currencies such as the rand.”

ALSO READ: Gold and platinum shares steal the show as JSE cracks new high

Gold

In addition, commodity prices have strengthened.

“Rising gold prices, driven by safe-haven demand amid geopolitical tensions, have also supported the rand, given SA’s status as a major gold producer. This has helped the rand to outperform many of its emerging market peers,” says Mkhwanazi, adding that domestic factors also supported the rand.

“There has been an improvement in output, like the better-than-expected mining production data in recent months. Particularly the increase in the value of copper and platinum group metals [PGMs] produced appears to have bolstered investor sentiment.

That the South African Reserve Bank (Sarb) decided to hold its benchmark rate at 7.5% at the last meeting in September “has also been interpreted as a sign of policy confidence, further reinforcing the rand’s upward trajectory”.

“Overall, we expect the rand to remain range-bound in the near term, with a bias toward strength if global risk sentiment holds and domestic fundamentals continue to improve,” says Mkhwanazi.

“However, volatility is likely to persist, and the currency’s resilience will depend on both external developments and the pace of local reforms.”

ALSO READ: Policy uncertainty index falls further into negative territory

US rates

Commenting on the outlook for the rand, Nedbank chief economist Nicky Weimar says the dollar might have found its trough, but the recent (small) recovery “still lacks conviction”.

“The US dollar regained some lost ground in volatile trade over the past three months. On a trade-weighted basis, it appreciated by 1.1% in the third quarter after plunging 7% in the second quarter.

“The pullback came as the Fed’s rate cut fuelled expectations of more to come, leading to a surge in risk-taking and a renewed rally in US equities,” she says.

“Usually, the dollar and other safe-haven assets weaken as interest rate differentials narrow and risk sentiment strengthens. This anomaly can be explained by renewed foreign capital inflows into US bonds and equities and the unwinding of earlier hedging activity.

“The dollar also benefitted from political turmoil and fiscal worries in other advanced countries, leading to significant gains against the Japanese yen and the British pound.”

Emerging market currencies benefitted from the resurgence in risk-on sentiment and expectations of a relatively steep decline in US interest rates over the next year.

The drag on currencies from tariffs also faded into the background as many countries concluded trade deals with the US, securing somewhat lower tariffs than those proposed in April.

As far as the rand goes, the dollar’s trajectory will set the course. “The unfolding US government shutdown and unsettled interest rate expectations will weigh on the dollar in the near term,” says Weimar.

“If the market’s expectations of aggressive monetary policy easing materialise, the dollar will probably remain on the back foot in 2026.

ALSO READ: What the strong rand means for inflation and monetary policy in 2025

“Any hint that the Fed’s independence has been compromised will also hurt the dollar,” she adds.

“In our view, the markets are probably discounting too many rate cuts by the Fed and we do not see significant further downside for the dollar.”

The Nedbank economics team expects the dollar to tread water over the next 12 months.

“By implication, most other currencies should hold up relatively [well], consolidating the gains of the past year,” says Weimar, warning that the team still sees the balance of risks for emerging markets currencies to the downside.

“US trade policy could still trigger a deeper slowdown in the world economy than anticipated.”

ALSO READ: Strong rand not reflection of SA’s economic health

SA concerns

Weimar notes a few headwinds that could affect the rand, despite forecasting an improvement in the SA economy.

“While the economy faces significant global headwinds, we still expect domestic demand to sustain the recovery in the quarters ahead.

“Consumer spending will remain the key driver as the stimulus from the interest rate cuts take effect through meaningfully lower debt service costs and increased borrowing,” she says.

However, the rand is vulnerable as SA is a net importer.

“Domestic demand will keep imports elevated, while exports will decline as the grip from higher US trade barriers, a weaker world economy and a relatively steady rand tightens,” says Weimar.

Nedbank forecasts that the current account deficit will increase from R48 billion in 2024 to R80 billion in 2025 and R168 billion in 2026, mostly because of a decline in exports.

ALSO READ: Tumbling rand has a lot to do with SA’s ‘weak growth story’

“Since June, the rand has strengthened by a meaningful 3.3% against the trade-weighted basket of currencies,” says Weimar.

“While the rand appreciated most against the US dollar, it also gained ground against other major currencies such as the euro and the pound.

“The currency’s resilience reflects a weaker dollar, firmer commodity prices and improved investor sentiment towards the domestic economy following the finalisation of the National Budget in May and an improved outlook for Eskom.

“That said, the rand remains volatile and sensitive to global shifts in risk appetite.

“Its stability will ultimately depend on US monetary policy, domestic reforms and SA’s ability to manage electricity and logistics constraints,” she adds.

“Looking ahead, while we expect the rand to remain broadly stable against a softer dollar, risks remain tilted to the downside, particularly if geopolitical tensions escalate, the government of national unity fractures or infrastructure setbacks worsen.”

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.