Bidvest Group has an annual revenue of about R127 billion.

Bidvest Group said it will recover money spent on the Paris Olympics trip by its chairman and two non-executive directors after the reimbursement of their expenses was rejected by shareholders.

The decision was taken on Monday at the group’s annual general meeting. According to the company’s SENS announcement, 59.7% of shareholders rejected the resolution to approve the payments.

Board members typically receive benefits such as travel reimbursement for official duties; however, in this case, shareholders saw no reason to approve the trip claimed by the three directors.

Payments to Paris trip excessive

“Bidvest will recover the expenses paid from the relevant non-executive directors,” said Bidvest.

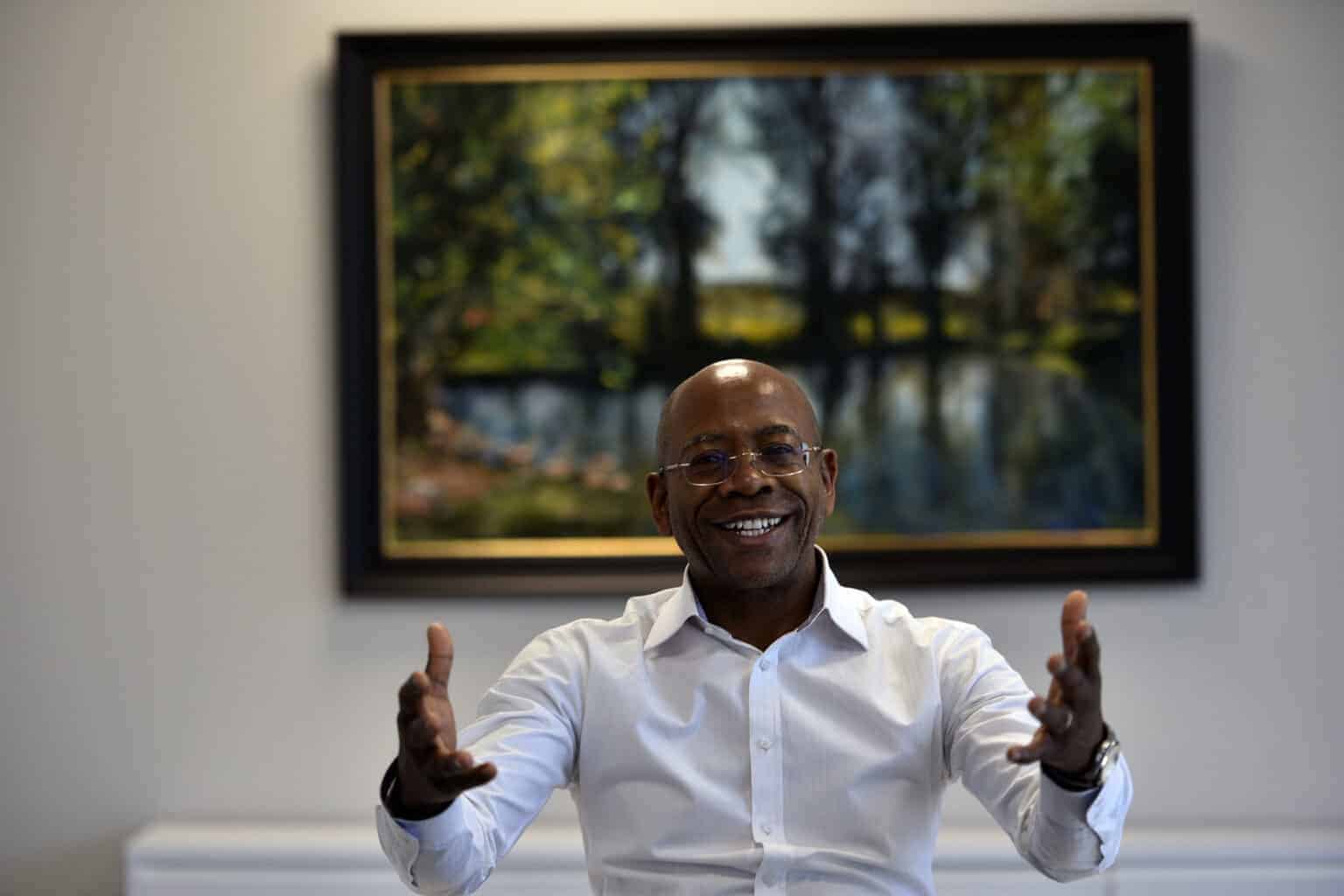

The three directors are understood to be Chairman Bonang Mohale, Lead Director Renosi Mokate

and Non-Executive Director Sindi Mabaso-Koyana. The payments for the trip cost around R1 million.

This comes after Institutional Shareholder Services (ISS), the world’s biggest proxy advisory firm, had recommended stockholders vote against the payments, saying they were excessive and may

compromise the independence of the directors.

ALSO READ: Directorship should be a regulated profession – Institute of directors

Reason behind Paris payments

Bloomberg reported last week that Bidvest justified its request for approval by arguing that it is a sponsor of the South African Sports Confederation and Olympic Committee. The group makes an annual revenue of about R127 billion.

“Support for this resolution … is not recommended given the relatively excessive amount,” ISS said in its note to clients, which it sent to Bloomberg after a request.

Some of the money managers also questioned the independence of the Bidvest board, saying it has too many executives.

Directors invited to the trip

It is understood that Bidvest invited all of its non-executive directors to join the executive team and 80 junior employees on a trip to Paris; however, only the three made themselves available.

The rejection highlights growing institutional investor activism in South Africa, focusing on adherence to the King IV Report on Corporate Governance.

Investors are increasingly demanding clear lines between executive and non-executive duties, ensuring that directors, especially those labelled as independent, maintain a critical distance from management that could be compromised by non-standard financial benefits.

This also highlights the institutional investors holding boards accountable for discretionary spending, even when the amounts, as in this case, are relatively small compared to the company’s market capitalisation. Bidvest had a market cap of R78.50 billion at midday on Wednesday.

NOW READ: Why it is important to verify directors’ qualifications upfront