SA metros in financial trouble

Tshwane is at its weakest level since 2011.

The country’s eight metropolitan councils play a crucial role in the economy, but the financial stability of half of them, including Johannesburg and Tshwane, is weak, ratings agency Ratings Afrika found.

While the situation has shown some improvement since 2011, some of the gains have been lost in the previous financial year, according to Ratings Afrika. Tshwane is at its weakest level since 2011 and Joburg which have shown improvement since 2011, has been moving in reverse gear for the last two financial years, Ratings Afrika found. The weak performance of these two cities comes in spite of the fact that they have the highest average income per household, being 170% higher than the national average.

Ratings Afrika has been analyzing the finances of South Africa’s 100 most prominent municipalities since 2011 and annually publishes its Municipal Financial Stability Index (MFSI). The MFSI is a scoring model that evaluates the operating performance (income v expenses), debt management, budget practices and cash position of a municipality and scores these components out of 100.

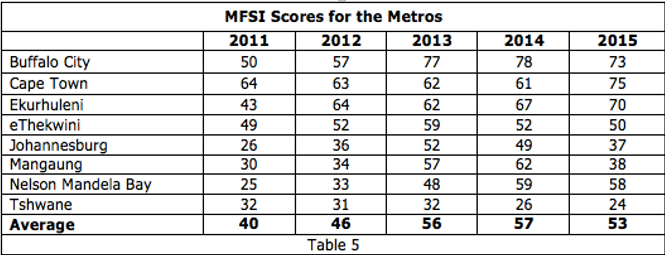

The average MFSI score of the eight metros for 2014/15 was 53, up from 40 in 2010/11, but down from 57 in 2013/14. Cape Town (75) had the highest score in 2014/15 and Tshwane (24) the lowest. Joburg (37), Mangaung (38) and eThekwini (50) were all unable to score more than 50, illustrating weak financial stability, according to Ratings Afrika. This could impact on service delivery due to a lack of funding.

Buffalo City, Ekurhuleni and Nelson Mandela Bay have improved substantially since 2010/11.

3 Metropolitan municipalities

The eight metros contribute about 60% of the country’s GDP and are home to about 40% of the country’s total population. This means they plays a crucial role in the economic growth and development of the country, Ratings Afrika said.

The devastating effect of Tshwane’s controversial prepaid smart-metering contract is clear from the way its net electricity margin has been destroyed. In 2010/11 the City sold electricity at a net margin of almost 22%. In 2012/13 it was down to 9%, but after the implementation of the contract it contracted further to 1.3% in 2013/14 and 2.7% in 2014/15. Ratings Afrika says the cost of the contract exceeds the benefits, as the city’s revenue collection rate dropped from 95.5% to 94.4% in 2014/15.

Ratings Afrika says Tshwane is in “deep financial trouble” due to inadequate budgeting and a lack of financial discipline. It has a huge shortage of cash, the second highest debt burden of all metros and its operating expenses, including staff costs, are too high for its income.

The city is performing well on infrastructure development, but has to rely on borrowings to fund it. This might be unsustainable. The city further under-budgets for repairs and maintenance, which might affect the quality of its infrastructure and service delivery in future.

Joburg’s financial stability improved from 2010/11 to 2012/13, but has deteriorated since, Ratings Afrika found. The city increased its infrastructure spending in the previous financial year, but had to borrow more to fund it, which has increased the city’s debt to high levels. Its cash reserves are low partly as a result of a low revenue collection rate.

The city’s expenses are growing faster that its income and it is spending a dismal 1.8% of its operating revenue on repairs and maintenance. This can impact the quality of infrastructure in future, which may lead to a deterioration in service delivery. The city’s staff costs are high, according to Ratings Afrika.

Tariffs in both Joburg and Tshwane are affordable in the light of the above average income of households living in these cities, but the high debt levels in both cities might lead to higher tariffs in future, Ratings Afrika warned.

Cape Town’s best performing score is based on it having a R4.4 billion operating surplus in 2014/15 and the fact that it has a revenue collection rate of 96%. The city had enough cash reserves in spite of the fact that it has increased its infrastructure expenditure. The city’s debt burden is moderate and it might even be able to increase borrowings to expand infrastructure investment, Ratings Afrika said.

Ekurhuleni’s expenses are catching up with its income, but the city’s financial profile is still very good, Ratings Afrika says. The city’s overall financial stability has improved since the previous financial year. It was able to fund its R3.3 billion capital expenditure its own sources. Ratings Afrika however says the city is not spending enough on infrastructure, which might impact on its sustainability. Ekurhuleni’s staff costs are high and it is spending less and less on repairs and maintenance. It’s debt levels have increased, but are still manageable. It manages its cash well, but can improve its revenue collection, Ratings Afrika found.

Mangaung’s financial stability has crashed over the last year, deteriorating from a credible 62 to 38. This largely due to lower cash reserves and spending outstripping income, Ratings Afrika found. While the city increased infrastructure investment, which might have caused some of the pressure on its finances, its lack of financial stability is concerning, according to Ratings Afrika. It has increased its expenditure on repairs and maintenance, but it is still low. Its debt levels are low and there is in fact room for further borrowings. Its financial pressure might affect the municipality’s ability to maintain current levels of infrastructure investment and lead to higher tariffs.

Nelson Mandela Bay’s MFSI score has improved from 25 to 58 since 2010/11 and Ratings Afrika considers its sustainability “adequate” at this stage. Its available cash has improved and debt decreased. The city’s infrastructure investment is at a good level and it can afford to borrow more to accelerate it. Ratings Afrika however warns that municipal rates and tariffs are high in relation to what residents can afford, which is evident from the low rate of 90% at which revenue is collected.

Buffalo City has a good MFSI score with enough cash available and low borrowings, but Ratings Afrika wants that its operating expenses are rising faster than its revenue. Municipal rates and taxes are becoming unaffordable with the result that the collection rate has dropped from 94% in 2013/14 to 91% in 2014/15. The city has improved its infrastructure investment and has room to borrow more to further accelerate it.

eThekwini has seen a drop in its MFSI score of almost 10 points over the last two financial years. Ratings Afrika says eThekwini is seeing expenditure growing faster than income. While its debt levels are still high, it borrowed less in 2015, which brought some relief. The cost of its municipal services is becoming less affordable while infrastructure development is adequate given the size of its population.