Volatile third quarter pushes global indices into negative territory

JSE Alsi a relative outperformer against emerging and developed market peers. SABMiller sees strong gains.

Picture Thinkstock

The quarter ending September 2015 was one investors might prefer to forget, as global equity markets came under severe pressure amid three primary catalysts, namely; the Greek debt crisis, slowing global growth (Chinese economic growth the primary concern) and the anticipation of monetary tightening out of the US.

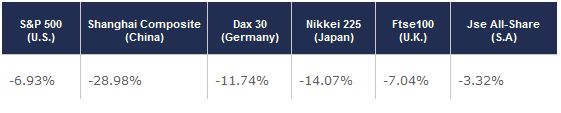

Index Q3 2015 performance

Surprisingly, the JSE All-Share index was a relative outperformer against both its emerging market and developed market peers, declining half as much as the Standard and Poor’s Top 500 index and around a tenth of the declines realised on the Shanghai Composite index.

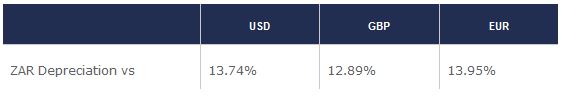

ZAR Q3 2015 performance

The rand’s double-digit depreciation against the majors would have helped buffer the decline on our local bourse, although the bulk of the index’s outperformance was largely attributable to a more than 20% single day gain on heavy weight industrial counter SABMiller.

Top gainers

Gains in SABMiller followed news of a possible merger/buyout from its US-listed, slightly larger competitor, Annheuser-Busch Inbev (AB Inbev). No formal bid has been communicated to the market as of yet, although speculation is for an offer of between $100 billion and $106 billion.

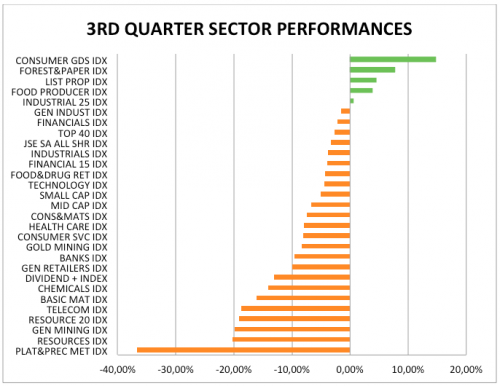

SABMiller is also included in the Consumer Goods (best performing sector Q3 2015) and Industrial 25 indices and is largely attributable to their respective outperformances of the broader domestic equity market.

In second place, on the Q3 sector gainers list, is the Forestry & Paper index. The index is largely a reflection of The Mondi Group, who’s Ltd and Plc listings are accompanied only by Sappi in terms of the index’s weighting. The Mondi Group released another strong set of interim results (within the quarter) in which operating profit was highlighted as having increased by 30% against the comparative period.

Top decliners

The last three months saw markets continue to digest the reality of a slowing Chinese economy waning on demand for resources especially as the supply thereof (for the most part) remains in abundance. The anticipation of US monetary tightening has maintained dollar strength keeping commodity prices under pressure. Crude oil fell to retest multi-year lows amid record production being realised from Saudi Arabia and Iraq, while the threat of even further supply entering the market from Iran (as US lifts its trade embargo against the country) has weakened the outlook for the commodity further.

The result of these market themes bode poorly for equity markets in general, but more specifically for resource counters, which were firmly entrenched in the third quarter’s poor performance list.

Platinum counters were hardest hit as losses in the underlying price of the metal were compounded by news of the VW emissions scandal. The prospect of lower diesel vehicle production from one of the globes biggest car manufacturers would equate to less demand for platinum (used in catalytic converters to reduce emissions).

Looking ahead

While “success” was finally realised in arduous Greek negotiations with its creditors (securing an additional EUR86 billion in aid), evidence of a slowing Chinese economy (through a series of weak trade balance and manufacturing PMI data) persists and US Federal Reserve policy makers remain vocal in tightening lending rates before year end. A positive start to the new quarter perhaps pays tribute to the notion that short-term declines maybe overdone (for now). However markets are likely to remain in a state of elevated volatility as the aforementioned concerns remain prevalent themes going forward.

– Brought to you by Moneyweb