But no improvement at SAA, PetroSA or Denel – and questions around Prasa.

The ninth year of collating the profits and losses of state-owned enterprises (SOEs) delivered a welcome surprise in that the aggregate results showed a profit. Unfortunately, there are significant caveats about the positive results – and serious questions about a few of the major companies.

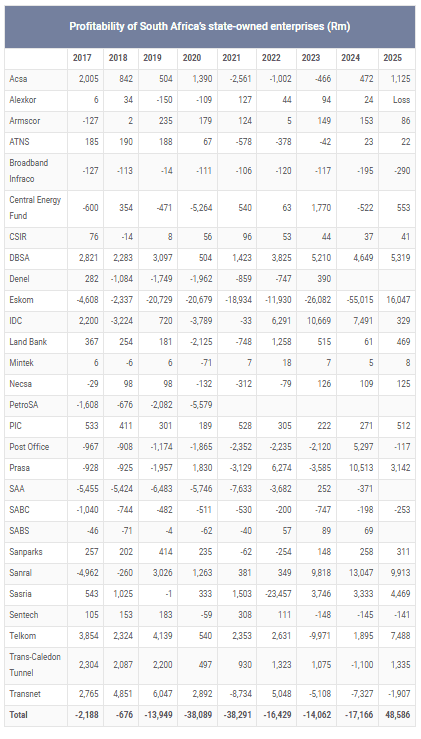

That the SOEs collectively posted a profit of R58 billion for the year to March 2025 is a welcome change. In the previous year, the total loss exceeded R16 billion – and in both 2020 and 2021 it peaked at more than R38 billion.

However, most of the improvement came from just a few of the big state companies posting improved results compared to the previous year.

The bulk of the recovery in the overall figure came from the turnarounds at Eskom and Transnet, even if Transnet is still running at a huge loss.

Eskom posted a profit of a shade more than R16 billion in the year to end March 2025 compared to a massive loss of R55 billion in the previous financial year. Interventions at Transnet cut the loss there from R7.3 billion to less than R2 billion.

Profit at Telkom surged from R1.9 billion to nearly R7.5 billion, while the Trans-Caledon Tunnel Authority recovered from a loss of R1.1 billion to post a profit of nearly R1.4 `11`billion.

Sasria grew its profit by R1 billion, while Airports Company South Africa (Acsa) and Development Bank of Southern Africa (DBSA) also improved.

But serious problems remain. The worst SOEs are still South African Airways (SAA), Denel and PetroSA – none of which have published audited financial statements for years.

ALSO READ: SAA slips back into loss as fuel and plane leasing costs spiral

SAA

SAA published four years’ worth of delayed financial statements when it exited business rescue in 2021 and management disclosed figures for the year to end March 2024, but audited financial statements are not publicly available for scrutiny.

The airline reported that it made a small profit in the year to end March 2023. This proved to be inaccurate and it was apparently revised to a loss of R354 million, according media reports quoting management.

Whatever figures SAA’s financial department presents have been found to the unreliable by the Auditor-General South Africa [AGSA), who questions every line of the income statement and balance sheet, commenting that the accounting system is in disarray and that there is no alternative method to substantiate the accuracy of the figures.

According to public statements by management, SAA has increased its headcount, leased more aircraft, and is expanding its routes – hopefully not running up huge losses in the process.

ALSO READ: Here’s what some of South Africa’s SOE bosses earn

PetroSA

PetroSA has not published an annual report since that for the year to March 2020 when it reported a loss of nearly R5.6 billion. It racked up nearly R10 billion in losses from 2017 to 2020.

PetroSA was merged with the Central Energy Fund’s (CEF) iGas and the Strategic Fuel Fund (SFF) to form a new state petroleum company – and the outstanding financial statements might not be published at all.

The CEF says in its annual report that earlier plans to return PetroSA’s gas-to-liquid (GTL) plant to production have been delayed, but a new plan is being considered.

The group’s subsidiaries include the South African Agency for Promotion of Petroleum Exploration and Exploitation – also known as Petroleum Agency SA (Pasa) – as well as the African Exploration Mining and Finance Corporation (AEMFC), iGas, PetroSA and the SFF.

The CEF annual report states that PetroSA “is facing significant financial constraints, primarily due to the non-operational GTL refinery in Mossel Bay, which has been inactive since 2020, leading to high fixed costs”.

“To address its challenges, a structured approach was followed, to develop a stabilization and turnaround strategy for PetroSA that is focused on building on existing capabilities to strategically position PetroSA on a path to a successful turnaround through the development of our domestic gas and investigating the reinstatement of a condensate refinery,” it says.

Notes to the financial statements disclose that PetroSA suffered a loss of R1.9 billion during the last financial year.

“Operating costs remained pretty much stable year on year, but revenue reduced by circa 40% as fewer product purchases were made,” according to the CEF.

“The overall cash flow levels have been low and very much constrained for the year. The company continues to be faced with significant cost pressures due to high fixed costs for the maintenance of the GTL Refinery not operating.”

ALSO READ: Denel presents its turnaround strategy to parliament, blames Covid-19 for poor performance

Denel

The state arms manufacturer has not published audited financial statements since the annual report for the year to end March 2020. It reported a loss of nearly R2 billion then, following a loss of R1.8 billion in the 2019 year and R1 billion in 2018.

Media reports and discussions in various parliamentary meetings stated that Denel suffered a loss of R859 million in 2021 and a loss of R747 million in 2022.

It apparently posted profit of R390 million in 2023.

It recently published a press statement that said it is well on its way to recovery after a “challenging period” in its history.

“It is currently undertaking a critical turnaround to optimise operations, bolster delivery capacity and rebuild trust among industry partners, employees, organised labour, suppliers and end-users within the defence sector,” it said.

“In this we are receiving significant support from our new shareholder, the Department of Defence, which enables Denel to integrate more fully into the broader defence community and benefit from stronger backing to capture a growing share of the international defence market and grow our footprint.”

Denel referred to its 2025 annual report, but the report is not available.

“We are establishing the foundation for sustainable growth and operational excellence. We are stabilising our core business strengths and repositioning Denel as a trusted provider of vital defence capabilities,” it said.

However, the press statement does not disclose any financial information.

It admits to shortcomings in its accounting function.

“In recent years, the Auditor-General has expressed significant disclaimers about the company’s internal controls.

“We are actively working together with the AGSA to implement comprehensive remedial actions, including the re-establishment of a strong internal audit capability. Denel also introduced a wide-ranging fraud and corruption prevention strategy which meets international standards, including lifestyle audits for senior management and executives,” it says.

Prasa

It is worthwhile noting the concerns at the Passenger Rail Agency of SA (Prasa), despite the reported profit of nearly R3.2 billion in the financial year to end March 2025.

The first concern is that the profit was more than R7 billion lower than the R10.5 billion in the previous financial year. The reason is that Prasa started spending its huge cash reserve and thus received way less interest income than it did in prior years.

It started to spend the money – as intended – to rebuild its capacity to run passengers trains.

One can only hope that it is employing real engineers this time around, and that the tender procedures involved in spending billions will withstand corruption attempts.

And then there is the SA Post Office, where profit fell from R5.3 billion in 2024 to a small loss of R117 million.

Hopefully the Post Office is not returning to its previous patterns – it posted billion-rand losses every year since 2017, save for that one profitable year.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.