But Eskom warns other consumers will pay for it.

The energy regulator Nersa, at its meeting on Thursday 28 August, approved an application from ArcelorMittal South Africa (Amsa) for relief regarding the price it pays Eskom for electricity at its Newcastle and Vanderbijlpark plants.

Eskom had earlier rejected Amsa’s application, saying the steelmaker does not qualify for discounted tariffs in terms of the existing framework.

This comes as Amsa’s competitors, which accuse it of predatory pricing, have asked the Competition Tribunal to interdict it from charging below market prices in order to kill competition, after Amsa received a R1.7 billion bailout from the state-owned Industrial Development Corporation (IDC).

Eskom warned the relief would set a precedent and open the door for at least 130 other large power users that do not meet the criteria to apply for such a discount. This could result in a 25% tariff increase for all other electricity users, according to Eskom.

The application however carried the approval of the Department of Trade, Industry and Competition, according to a discussion document Nersa previously published on the matter.

ALSO READ: ArcelorMittal narrows loss, warns of persistent headwinds

Following Eskom’s rejection, Amsa petitioned Nersa to reconsider its application. Nersa embarked on a consultation process, culminating in the energy regulator’s meeting on Thursday, where a final decision was made.

Nomfundo Maseti, Nersa’s full-time regulator member for piped gas, who doubles as chair of the electricity sub-committee in the absence of a full-time regulator member for this function, told Moneyweb on Friday that the regulator concluded Amsa complies with the criteria “on a balance of scale.” She confirmed that this refers to substantial compliance, saying it is in line with previous Nersa decisions.

The regulator referred the matter back to Eskom and Amsa to negotiate the details of the deal.

This type of discount deal with energy-intensive users has come under the spotlight, after Eskom in its tariff application last year, disclosed that five percentage points of the 32% increase it wanted was to compensate for the loss of revenue due to these negotiated pricing agreements (NPAs), as they are known.

ALSO READ: ArcelorMittal warns it might close without urgent solution to challenges

The criteria to qualify for an NPA in terms of the long-term (LT) framework Amsa applied for, are according to Nersa as follows:

- “The applicant’s operation/sector would be unsustainable in the long term on the applicable standard tariff, and a long-term NPA is required.

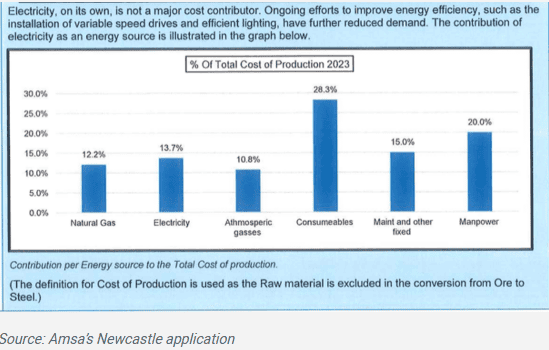

- Electricity must be a significant driver of the applicant’s operating costs (i.e. typically within the top three highest cost elements).

- Alignment with SA’s priority and strategic industries will be taken into account.

- An applicant must consume, or the forecasted annual consumption must be a minimum of 80 GWh and/or the load factor must be greater than 70% to qualify.

- Applicants already under business rescue or closed may apply.”

Amsa says in its applications for the respective plants that, while electricity represents a limited portion of its inputs, the company consumes about 1% of Eskom’s total generation.

It wants a discount in each case for a period of 72 months. However, the percentage discount it asks for is redacted in the version of the applications published on the Nersa website.

ALSO READ: ArcelorMittal hauls Transnet to Competition Tribunal for market abuse

Amsa acknowledges in its applications that discounted electricity tariffs alone will not be enough to guarantee the sustainability of the plants.

Eskom sets out the reasons for its rejection as follows:

- Neither plant meets the 70% load factor requirement, with load factors of ~63%.

- Electricity comprises a very small percentage (less than 10%) of the total operational cost base.

- Electricity intensity per ton of steel produced is less than 1 MWh/t.

- Fairness, consistency, and competition concerns for all players in the steel sector in South Africa.

- Applicants consume more than 80 GWh/annum; however, substantial deviations from the other criteria as contained in the LT NPA Framework would set a precedent for all large consumers of electricity.

- NPAs resulting in substantial price distortions to other customers.

- An electricity tariff rebate will not resolve the viability issues faced by Amsa and the SA steel sector.

Nellis Bester, chairperson of the Ferro-Alloy Producers’ Association (Fapa), which represents smelters – some of which have benefitted from NPAs with Eskom – says any deviation from the NPA criteria requires a change in the framework first.

“Then the whole NPA process needs to change.” He says it would be chaotic if the process were opened to all large power users.

ALSO READ: 17% of SA’s electricity consumed by a few giant consumers – at huge discounts

“It is necessary to save Amsa, for ferro-alloy producers and for South Africa,” Bester says. However, he maintains that import tariffs, rather than electricity prices, are the appropriate instrument for doing so.

Gerhard Papenfus, CEO of the National Employers’ Association of South Africa (Neasa), says Amsa’s plants are very old and inefficient in terms of electricity consumption, but ArcelorMittal International fails to invest in its local operations.

He says it is unacceptable to expect other electricity users to subsidise Amsa. The company is relying on import duties and the IDC bail-out to survive, but “someone is paying that money.”

He says protecting Amsa is killing the downstream steel industry. While the aim is to save 3 500 jobs at Amsa, it has already cost the country 200 000 job opportunities downstream.

This article was republished from Moneyweb. Read the original here.

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.