The past five years showed South African consumers that an emergency can happen at any time and that it could happen to each one of us.

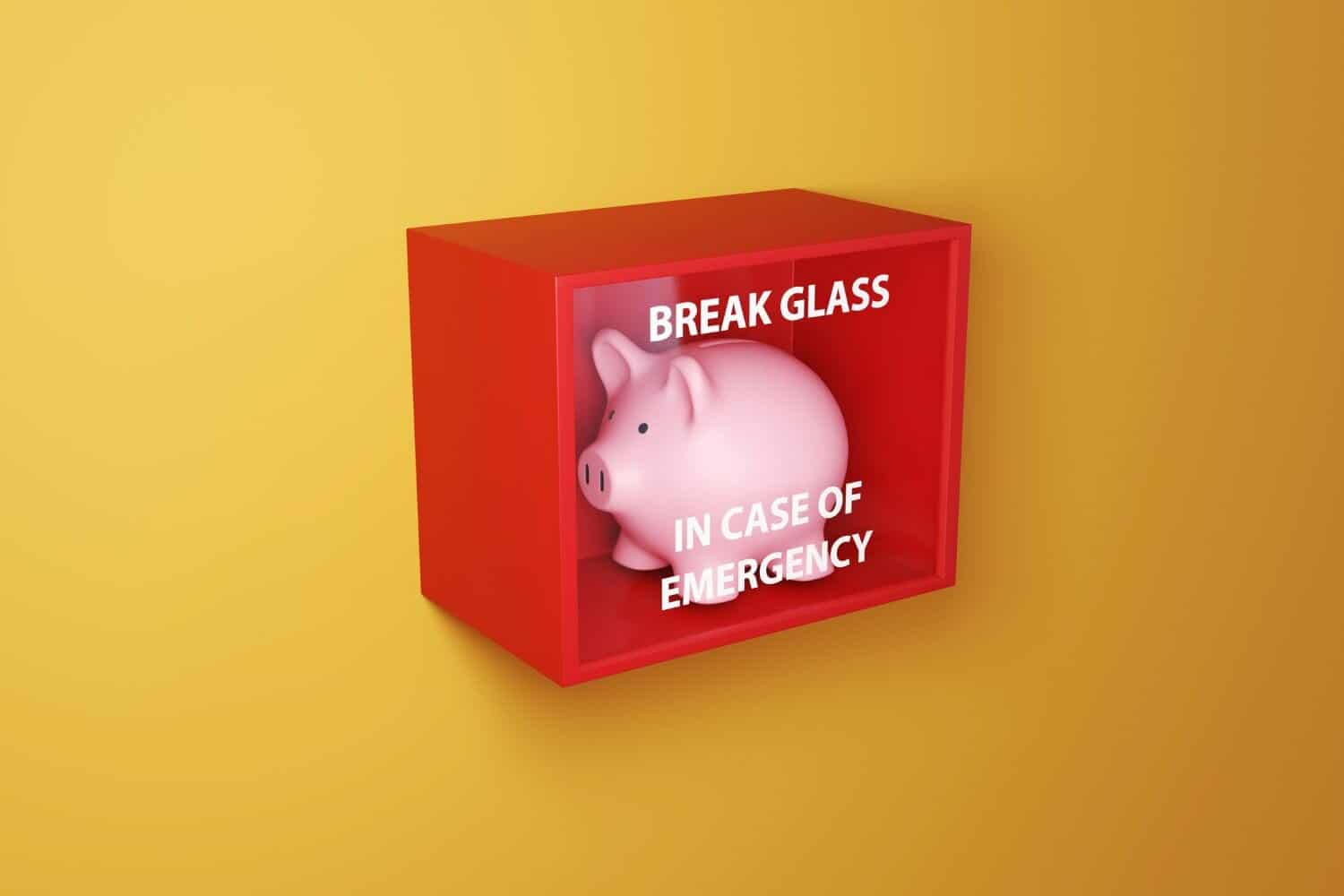

Emergency funds are top of mind for many consumers since the implementation of the two-pot retirement system in September last year, as the system was designed to give consumers a little access to their retirement savings in the case of emergencies.

Christiaan Coetzee, CEO of FinFix, says South Africans are under growing financial pressure, with households increasingly running out of money before month-end.

“Savings remain low, with consumers saying they would not be able to cover an emergency expense of R10 000 without borrowing or selling something.

“These sobering realities highlight one key financial truth: without an emergency fund, many consumers are one crisis away from economic freefall. Whether it is a medical emergency, job loss, or an unexpected car repair, financial disruptions are inevitable. The real question is: How prepared are you if a problem arises today?

“With South Africa’s official unemployment rate at 32.9% and inflation eating into disposable incomes, even a minor financial disruption can trigger a downward spiral of debt, defaults, or worse, total financial collapse.”

Coetzee points out that emergency funds serve as a financial shock absorber, providing peace of mind and preventing the need to turn to high-interest debt or predatory lenders in times of crisis.

ALSO READ: Here’s why you need an emergency fund – and it’s not to buy new golf clubs

How much should you save for an emergency?

Coetzee says a common rule of thumb suggests that to be financially safe you should aim to set aside 3 to 6 months’ worth of living expenses for emergency needs. These funds are intended to cover unexpected expenses or income disruptions.

He says there are two primary reasons to dip into your emergency fund: spending shocks and income shocks.

“Spending shocks refer to relatively common, unanticipated expenses that might include costs such as unforeseen healthcare needs, home repairs, or other urgent, unplanned expenditures. To prepare for potential spending shocks, experts recommend saving at least half a month’s worth of living expenses as a starting point.

“Income shocks occur less frequently but tend to have a more significant impact. These include situations such as sudden job loss or a substantial decline in income. To safeguard against income shocks, many financial experts advise maintaining enough money in your emergency fund to cover 3 to 6 months’ worth of living expenses.”

When should you use your emergency fund? Coetzee says deciding whether to use your emergency fund can be tricky.

“While it exists to provide financial relief during challenging times, it is crucial to use it wisely.

ALSO READ: How to build your emergency financial safety net

What constitutes a real emergency?

To determine if a situation qualifies as a true emergency, he says you must ask yourself these questions:

- Is the expense unexpected?

- Is it necessary?

- Is it urgent?

“If the answer to all three questions is “yes,” it may be appropriate to use a portion of your emergency fund. However, avoid dipping into your savings for non-essential or discretionary expenses, as this could undermine the purpose of the fund.”

ALSO READ: Two-pot retirement system: rather set up a separate emergency fund

How to start an emergency fund

Coetzee says even if you live pay cheque to pay cheque, starting an emergency fund is still possible by:

- Setting up an automatic transfer on payday into a separate savings account. Even R100 per month builds momentum.

- Identifying small, recurring expenses you can eliminate, such as unused subscriptions, takeaways, or impulse buys.

- Considering starting with a micro-goal. Aim for your first R1 000, then grow from there. Note that bonuses, tax refunds or birthday money can give your fund a healthy boost.

- Consider using high-interest savings tools such as a tax-free savings account (TFSA) or a notice deposit account to keep your emergency fund separate and growing.