Key drivers are performance-based incentives and global benchmarking.

The competition for global executive talent has resulted in a notable uptick in remuneration packages for top leadership roles in South Africa.

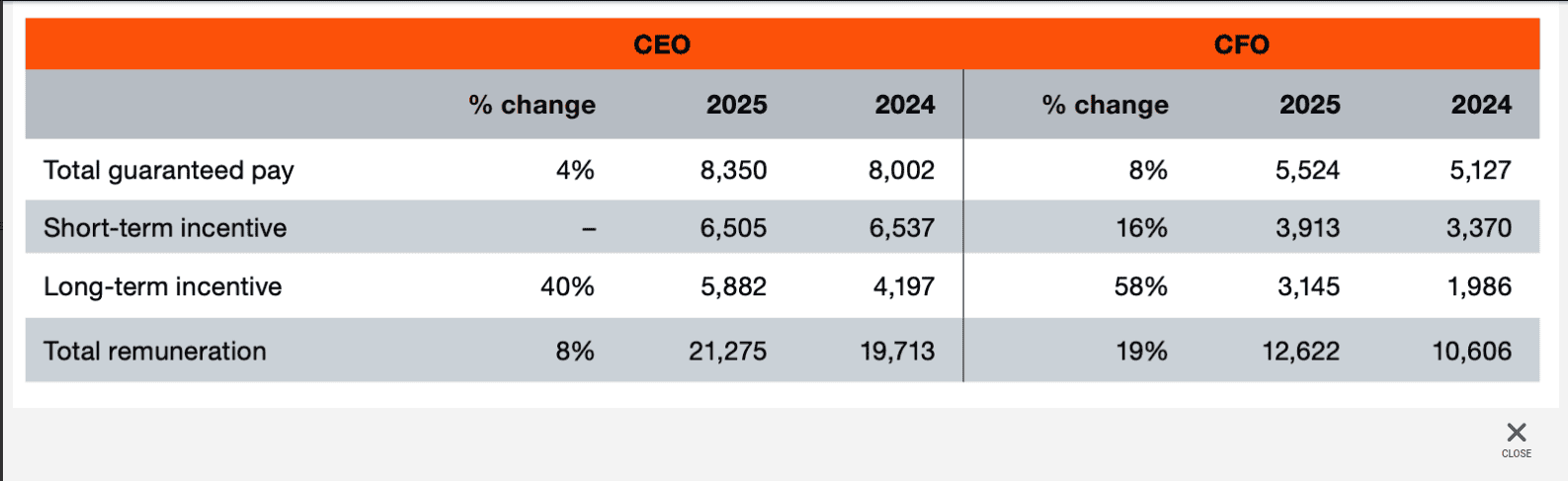

Executive directors saw significant increases in total remuneration – with chief executives receiving an 8% boost and chief financial officers (CFOs) experiencing a 19% rise.

These increases were driven by higher guaranteed pay and improved incentives.

CFO pay was particularly influenced by stronger short-term and long-term incentives, suggesting a shift in the pay mix towards performance-based rewards.

Summary overview by role

The 18th PwC Directors Remuneration and Trends Report, based on data from the top JSE 200 companies, shows that hybrid incentive designs, blending performance share plans and restricted share plans are becoming more common as companies compete for global talent.

The PwC rewards team – Makhosazana Mabaso, Leila Ebrahimi and Izelle Groenewald – looked at recent trends in the UK and US where boards increased the overall level of pay to align with international peer groups and restructured incentives.

“This shift caps a 15-year evolution from a regulatory emphasis on transparency and fairness to a clear focus on competitiveness,” the report notes.

ALSO READ: Here’s what some of South Africa’s SOE bosses earn

FTSE 100 companies are going big

Over the past two years, a rising number of FTSE 100 companies have lifted total incentive opportunities materially, with six doing so by 100% of salary or more in 2024, and a further 16 doing so this year.

“These developments provide a useful reference point for South African companies considering calibrated adjustments to executive reward positioning in line with global market dynamics and shareholder expectations,” according to the report.

Total remuneration consists of total guaranteed pay and short-term and long-term incentives for which the performance period concluded within the reporting period.

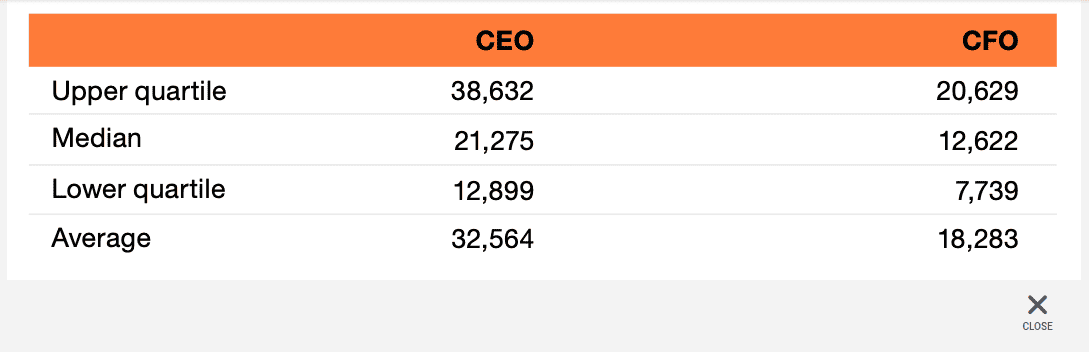

In SA, the median for total remuneration amounted to R21.3 million for CEOs and R12.6 million for CFOs in 2025.

Total remuneration by role

Non-executive director pay trends have also seen an uptick over the past year. Fees for board members increased by 12% on a median basis, while board chair fees increased by 6%.

The median fees are R1.6 million for chairs, R1.3 million for deputy chairs, and R1.186 million for lead independent directors.

The median fee for board members is R481 000.

Despite the higher than inflationary increases for board members, companies enjoyed high levels of support from shareholders (98.11%). This was consistent with the prior year.

ALSO READ: Watt a salary spike: Eskom CEO takes home R11.7 million

Alarm bells

Shareholders did raise specific concerns with remuneration committees. However, very few of these concerns appear to have made it to the annual general meeting (AGM) remuneration votes.

Alarm bells were raised over the emergence of “super-stretch” long-term incentive (LTI) awards – additional performance-based grants layered on top of regular LTIs.

These were often introduced without clear rationale.

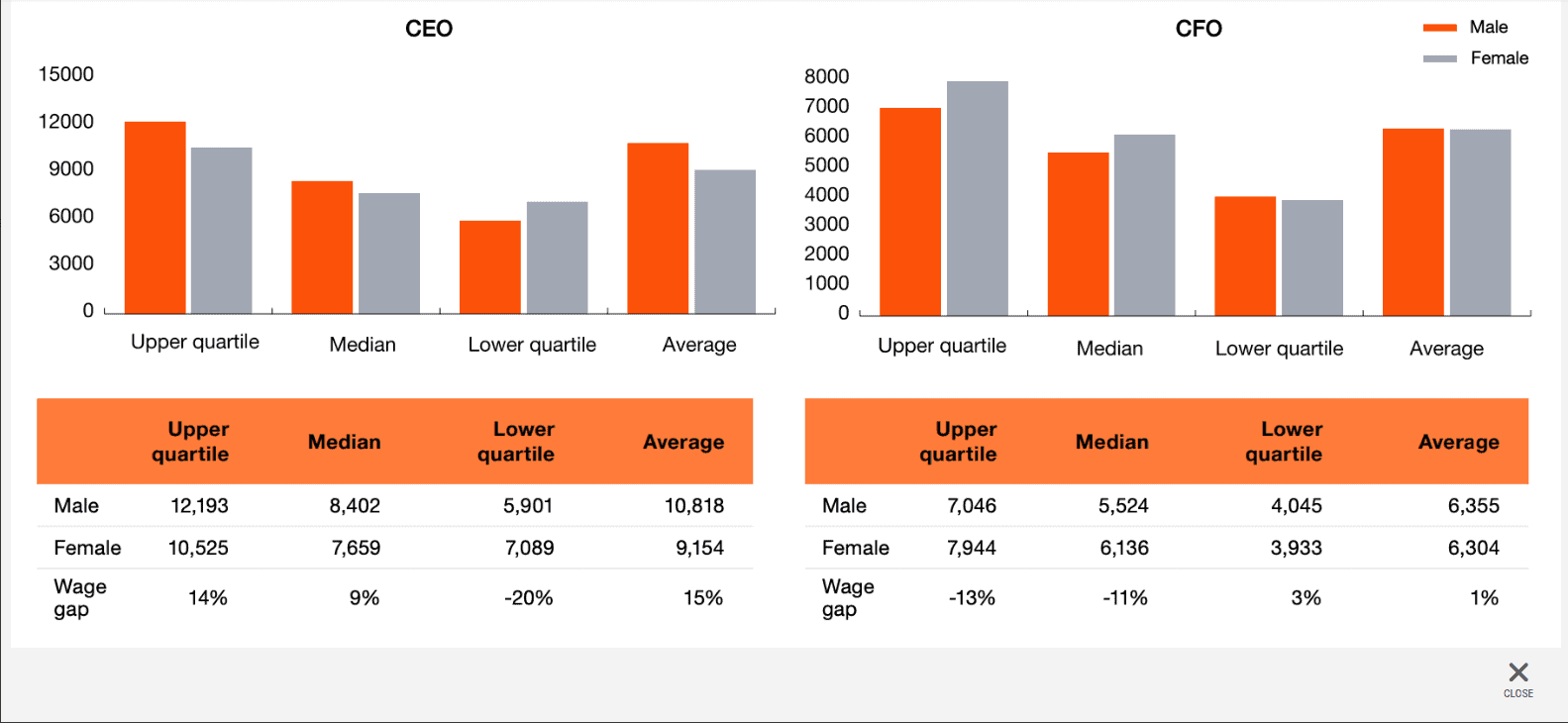

“We expect pay transparency to remain a focal area – particularly with the introduction of the Fair Pay Bill alongside the wage gap disclosure requirements of the Companies Act,” Mabaso and fellow team members note in their report.

“This emphasises the need for solid pay architecture to be in place, and we expect that companies will put more effort into ensuring that organisational design is optimised, and robust job grades and pay scales are in place to form the foundation for fair pay.”

Fair pay

The Fair Pay Bill was proposed by the political party Build One SA (Bosa) in June this year.

The aim of the bill is to promote remuneration transparency to help address the pay gap, gender pay, and the issues linked to South Africa’s Gini coefficient status.

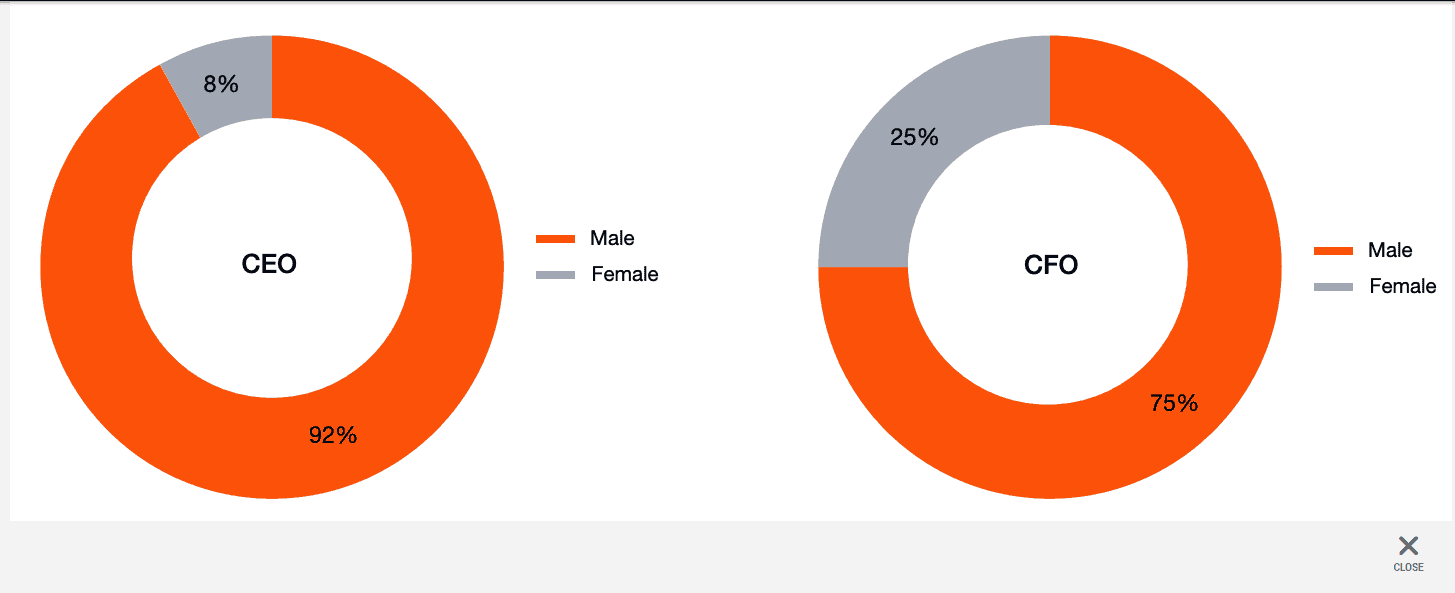

The PwC report shows that female representation at CEO level remains low, but is consistent with trends last year. However, there was some improvement in the level of representation at CFO level, up from 18% last year.

ALSO READ: Nedbank CEO laughs all the way to the bank: Here’s how much he earned last year

Gender representation by role

Race representation for African, coloured and Asian executives at CEO and CFO levels remains low. At CEO level, the combined representation is 20% and at CFO level it is slightly better at 28%.

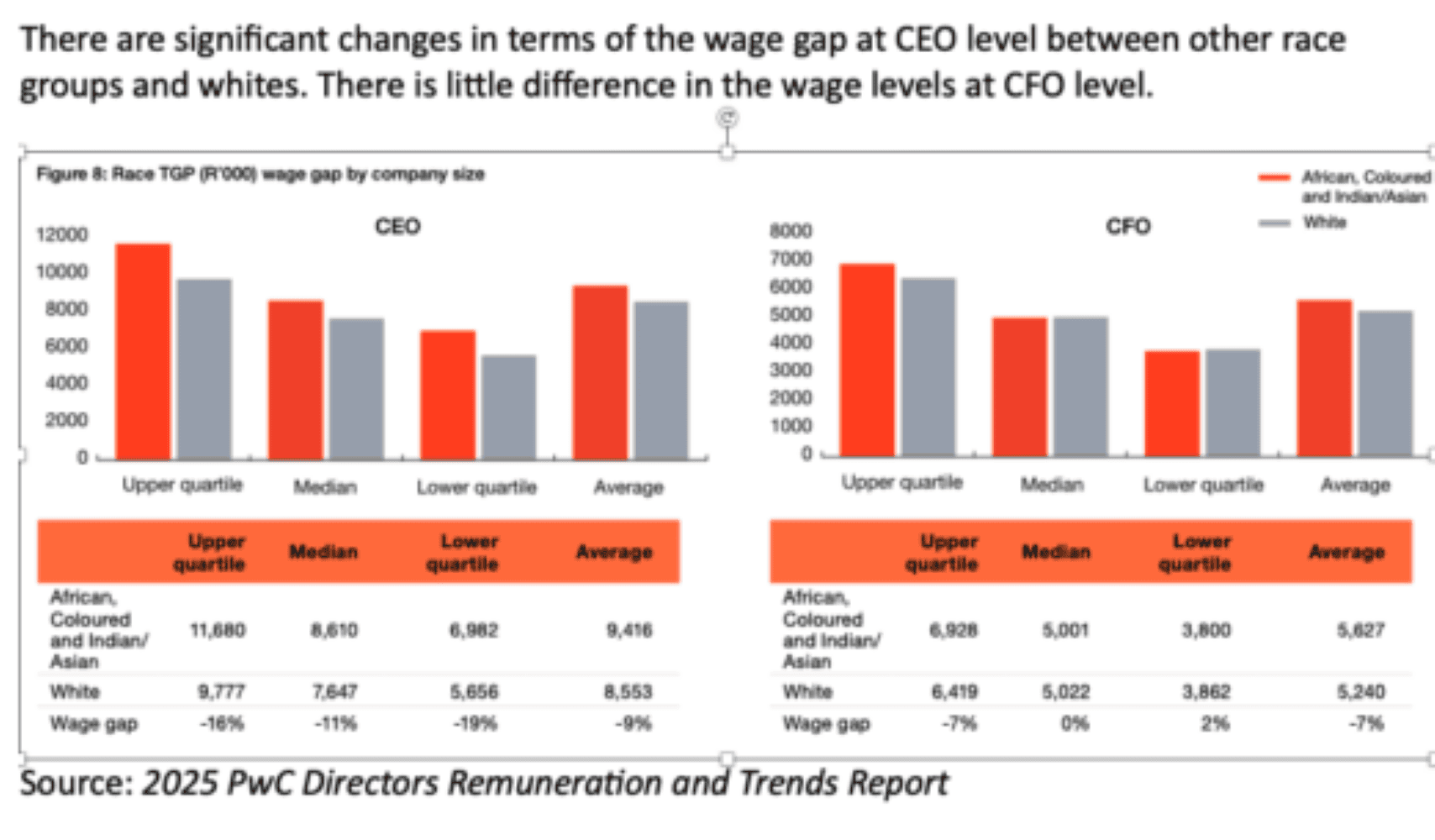

There are significant changes in terms of the wage gap at CEO level between other race groups and whites. There is little difference in the wage levels at CFO level.

ALSO READ: Big payday at TFG: Here is how much the CEO and staff received

Total guaranteed pay gender wage gap by company size

PwC expects the Companies Act amendments to be approved within the next few months. In terms of the amendments, the remuneration policy will be subjected to an ordinary shareholder vote every three years, unless there are interim material changes, which will also trigger shareholder approval.

The implementation report will be subject to an annual ordinary shareholder vote. In addition, mandatory wage gap disclosures are proposed. Some companies have already begun to disclose this information voluntarily.

In this year’s report, almost 92% of shareholders supported the JSE Top 200 companies’ remuneration policies compared to close to 91% last year.

This article was republished from Moneyweb. Read the original here.