Treasury publishes proposals to tighten tax laws.

National Treasury published several legislative amendments over the weekend that will give effect to tax announcements made in the 2025 Budget, which was eventually presented to Parliament for the third time in May.

One rather controversial amendment relates to taxpayers’ reliance on the scope of a “bona fide inadvertent error” to escape paying huge understatement penalties.

The amendments also pave the way for real-time reporting of value added tax (Vat) and an extension of the voluntary disclosure program to include defaults under the Customs and Excise Act.

Treasury says in a statement it also intends to reduce the threshold for the ring-fencing of assessed losses to prevent abuse and promote fairness. This is to ensure that losses from non-commercial trades cannot be used to evade paying taxes.

Other changes include the removal of the current tax-free limit on imported goods, which means that low-value imports will become subject to Vat.

ALSO READ: Sars makes changes to eFiling for easy use

It is also proposed that a senior official from the South African Revenue Service (Sars) may conduct unannounced inspections of business premises when a taxpayer applies for a tax registration.

Joon Chong, tax partner at Webber Wentzel, says in terms of the proposed amendment to understatement penalties, the remission of a penalty will only be available for substantial understatement, as it will now be “explicitly” linked with a substantial understatement.

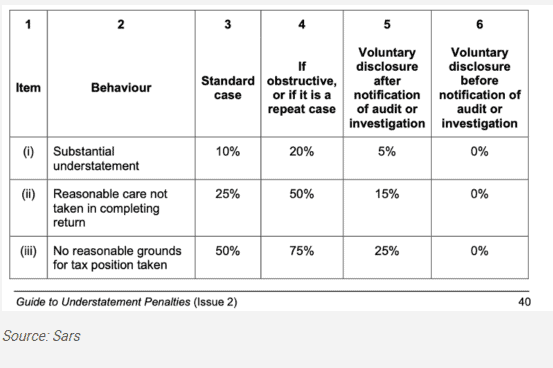

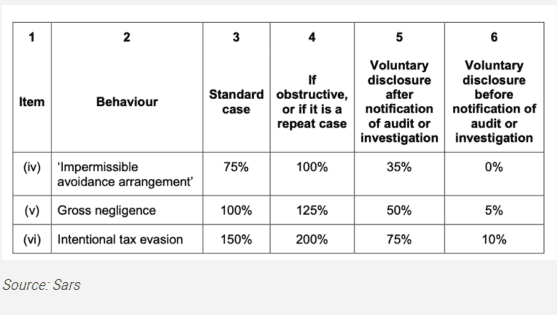

The triggers for understatement penalties include failing to submit a tax return, omissions from a return, an incorrect statement in the return, not paying the correct amount of tax, or being involved in an “impermissible avoidance arrangement”.

According to the Sars guide, the actions or inactions of these triggers must result in prejudice to Sars or the fiscus for an understatement to arise.

ALSO READ: Unjustified debt collection measures cause unnecessary taxpayer distress

The understatement table:

Chong says if the amendment is accepted as is, Sars will be a lot “tougher on taxpayers.”

“It will be necessary for taxpayers to get detailed and considered tax opinions for any risky tax positions they adopt.”

Nico Theron, founder of Unicus Tax Specialists, says as he reads the amendment, the intention is to remove “bona fide inadvertent error” as the “gatekeeper” and instead include it as a remittance ground, but only for penalties where there is a substantial understatement.

Theoretically, this limits taxpayers’ ability to rely on “bona fide inadvertent error,” he adds.

ALSO READ: Estimated assessments: Sars’s new ‘cash-cow-grabbing’ norm?

There have been concerns that taxpayers make themselves guilty of “opinion shopping”.

Currently, Sars must remit an understatement penalty if a taxpayer relied on the advice from a legal or tax expert. In some instances, the advice has been “questionable”.

“It is going to make disputes on understatement penalties more difficult to get them remitted. In terms of the proposed amendment, there will only be one understatement penalty that can be remitted and that is for a substantial understatement.”

All the other penalties are now exposed, regardless of whether it was a “bona fide inadvertent error” or not, says Theron.

ALSO READ: SA losing nearly R30bn to illicit cigarettes as Sars tools face delays, says Godongwana

New VDP rules

Chong adds that the introduction of rules for voluntary disclosure of defaults under the Customs and Excise Act must be welcomed. The Voluntary Disclosure Program (VDP) rules were introduced in terms of the Tax Administration Act that did not apply to the Customs Act. Now, it will be possible to apply for relief under the separate rules proposed under the Customs Act itself.

Successful applicants may receive relief from understatement penalties, administrative penalties, and even criminal prosecution – provided the disclosure is both valid and complete.

ALSO READ: Vat vendors: Be aware of the different types of tax assessments

Vat modernisation

Treasury has also published amendments to the Vat Act to support the Vat modernisation project.

“The project forms part of a broader effort to transform tax processes, improve customer service and engagement, reduce the Vat gap, and streamline tax administration for Vat traders, businesses, and Sars,” Treasury said in its statement over the weekend.

Chong says the modernisation project is aimed at greater transparency and to simplify compliance. “It is meant to reduce errors, improve administrative efficiency, and, I assume, to improve collections as well.”

The deadline for public comments on the range of proposed amendments in the Taxation Laws Amendment Bill as well as the Tax Administration Laws Amendment Bill is 12 September 2025.

This article was republished from Moneyweb. Read the original here.