These enhancements reflect Discovery Bank’s commitment to delivering a personalised, intelligent banking experience that goes beyond traditional financial services.

Discovery Bank is redefining digital banking in South Africa with a series of groundbreaking updates designed to enhance security, convenience, and lifestyle integration.

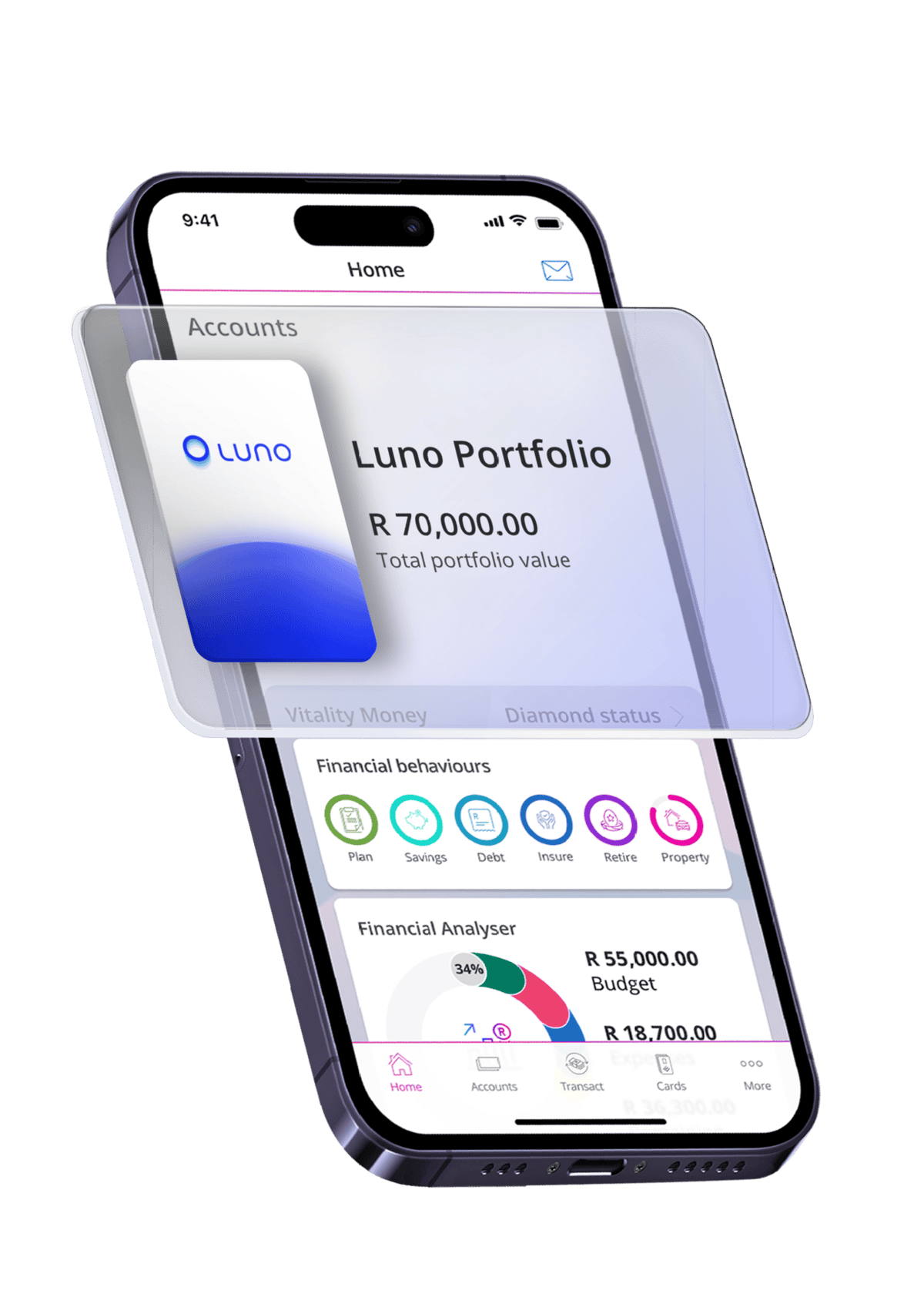

Building on its reputation as the country’s fastest-growing bank, Discovery Bank has announced the launch of crypto trading in partnership with Luno, advanced AI-driven security features, integrated motor insurance, and new lifestyle rewards with partners like MultiChoice.

These enhancements reflect Discovery Bank’s commitment to delivering a personalised, intelligent banking experience that goes beyond traditional financial services. The bank’s latest innovations include:

- Crypto Trading in the Discovery Bank App: A first-of-its-kind integration in Africa, enabling clients to buy, hold, and sell more than 50 crypto assets seamlessly through the Discovery Bank app.

- TRUST Alert System: Real-time, AI-powered transaction monitoring that provides clients with intelligent fraud protection and actionable alerts.

- Integrated Motor Insurance: Instant quotes and activation of Discovery Insure car insurance directly within the banking app.

- Expanded Rewards Network: Partnerships with MultiChoice and admyt, offering clients up to 50% back in Discovery Miles on streaming packages and lifestyle benefits.

Hylton Kallner, CEO of Discovery Bank, says: “The financial world is evolving fast, and our clients expect innovation that enhances both security and convenience. These updates position Discovery Bank at the forefront of digital banking, offering unmatched integration and rewards while ensuring robust protection against emerging risks.”

Discovery Bank’s shared-value model continues to incentivise healthy financial behaviour through Vitality Money, rewarding clients with better interest rates, discounts, and lifestyle benefits. With these latest advancements, Discovery Bank is not only shaping the future of banking but also creating a holistic ecosystem that connects finance, technology, and everyday living.