A pricing expert estimates the electricity tariff increase could rise as much as 25.24%.

All indications are that the energy regulator Nersa has once again entered a settlement with Eskom regarding its tariffs, which will cost consumers billions.

As it did in May, the regulator is again doing this in secret.

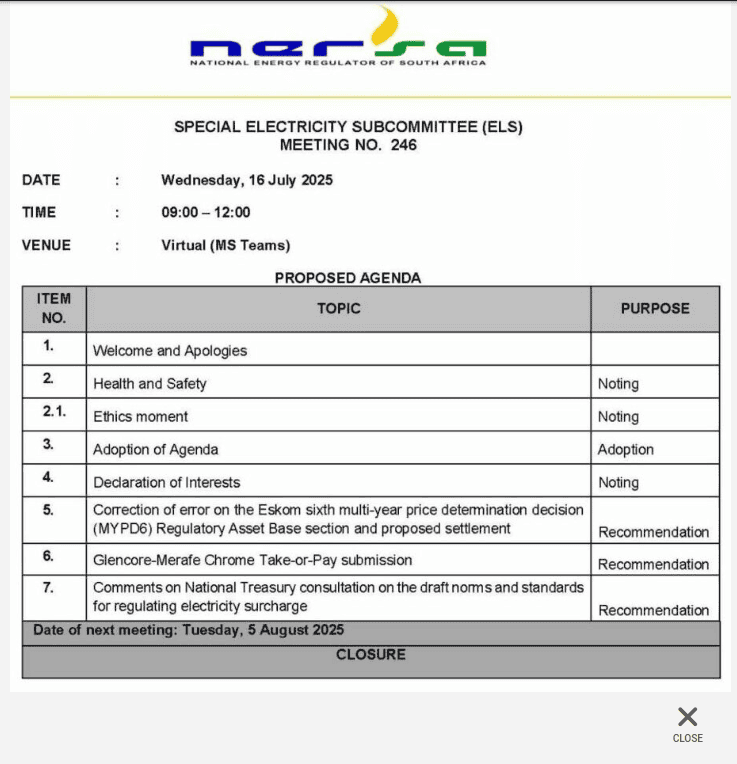

Moneyweb wrote in July that Nersa would, at a special meeting of its electricity sub-committee, make a recommendation to the regulator – its highest decision-making body – about a “correction of error” in its determination of Eskom’s revenue for the current and the next two years.

This was listed as an agenda point for the meeting scheduled for 16 July.

It pertained to the Regulatory Asset Base, which Nersa miscalculated, according to Eskom. Moneyweb learnt that Eskom had taken Nersa’s decision on review in the high court and, according to court documents, Eskom argued that Nersa’s mistake resulted in a revenue award that was R30 billion lower than it was entitled to.

By putting this on the publicly available agenda, the impression was created that Nersa accepted that it was at fault and was prepared to correct it.

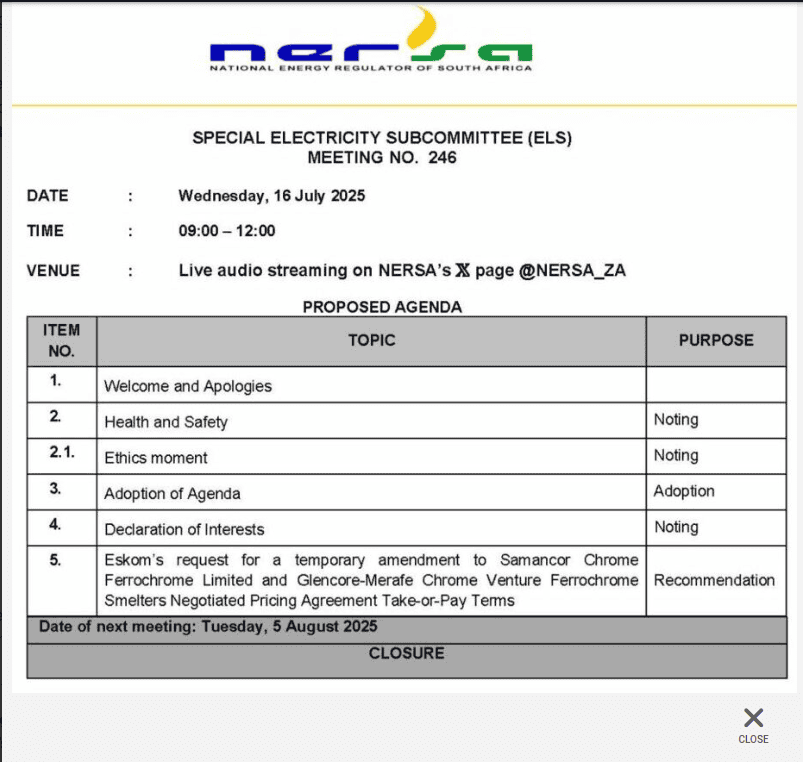

Moneyweb’s article was published on 14 July, ahead of the scheduled 16 July meeting. But lo and behold, before the meeting, Nersa published a new agenda in which that specific item was removed.

Moneyweb learnt that the matter was going to be discussed behind closed doors, and nothing more was heard of it.

Until now.

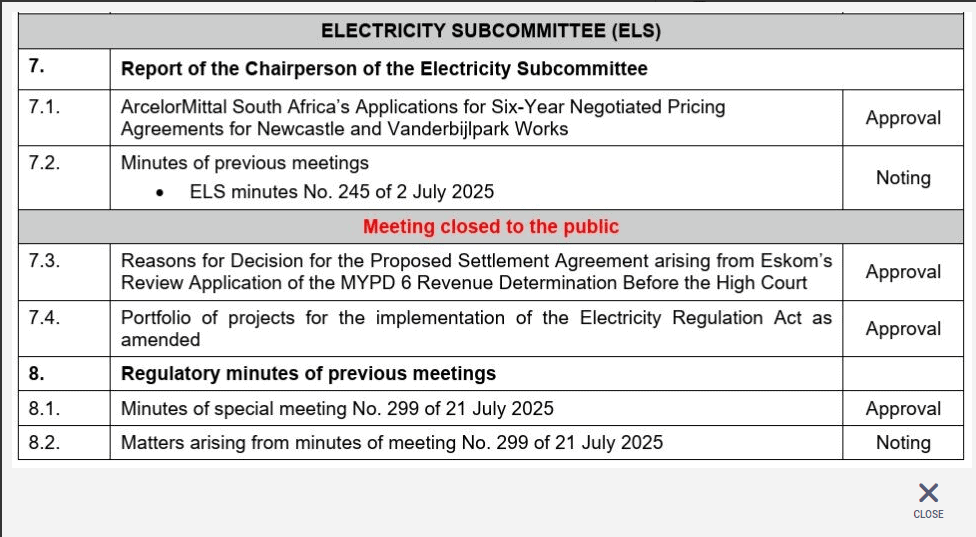

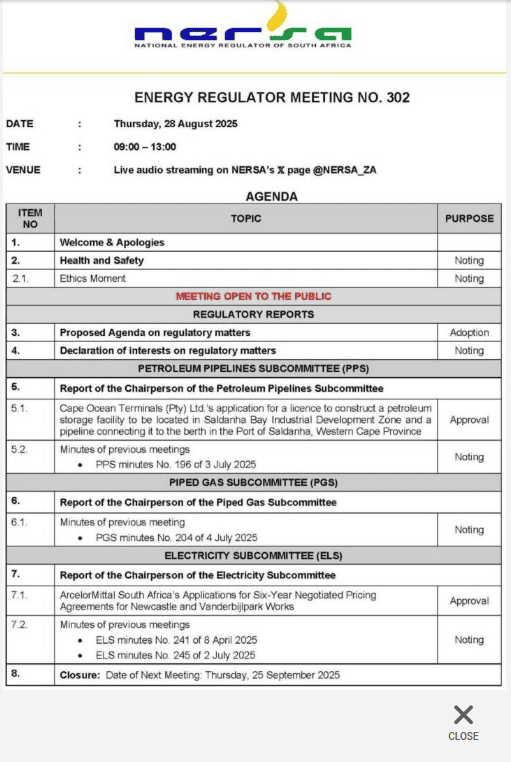

On 22 August, a reader forwarded a link to Moneyweb containing the agenda of the regulator’s meeting, scheduled for 28 August. On the agenda, under the section ‘Meeting closed to the public’, is a matter for approval: ‘Reasons for decision for the Proposed Settlement Agreement arising from Eskom’s Review Application of the MYPD6 Revenue Determination Before the High Court’.

The logical conclusion is that Nersa has indeed taken the decision to settle with Eskom without so much as a whisper to the public, who will ultimately be footing the bill for correcting its mistakes.

ALSO READ: Nersa’s mistakes will hit you hard

Calculated estimate

What the impact will be remains to be seen. To get an idea, Moneyweb asked Eskom’s former senior manager for electricity pricing Deon Conradie to make some calculations.

Conradie emphasises that the additional revenue Eskom is entitled to in terms of the settlement will almost certainly not be recovered in one go, but over several years – in other words, added to the tariffs the public must pay for electricity.

The earlier settlement, following Eskom’s court challenges to five different decisions Nersa took between 2015 and 2021 on amounts the utility was entitled to claw back from consumers at the end of a tariff year, amounted to R40 billion to be added to Eskom’s revenue.

Notably, Nersa has not yet announced this settlement to the paying public, nor has it published the decision or the reasons for it on its website, as it does with many other decisions.

To illustrate the scale of the additional Eskom revenue Nersa agreed to in the first settlement and its impact on consumers, Conradie calculated what the tariff increase would be if it were to be added to Eskom’s revenue next year (which it won’t be).

Nersa’s original decision granted Eskom a 5.36% increase on 1 April 2026.

If the R40 billion were added, the increase would jump to 16.72%.

We still don’t know the content of Nersa’s latest settlement with Eskom, but if we assume Eskom receives the R30 billion it claims Nersa’s mistake has cost it, and that it would also be added to Eskom’s revenue next year, the increase would be as much as 25.24%.

ALSO READ: Nersa slashes Eskom’s tariff hike – but consumers could pay the price in taxes

On the quiet

Interestingly, Nersa has since republished its agenda for Thursday’s meeting and, unsurprisingly, the whole section concerning the closed part of the meeting has been removed.

MC Botha Incorporated director MC Botha, an attorney who specialises in electricity matters, says Nersa is a public institution and its information should be accessible.

“It does not make sense that this is deemed confidential, except if there are good reasons to keep it from the public. We are not aware of such reasons,” he says.

He adds that, as a public body that took an administrative decision which affects the rights of the public in the form of higher tariffs as a result of the decision, Nersa is obliged to provide reasons for its decision.

Moneyweb has resolved to submit applications in terms of the Promotion of Access to Information Act (Paia) to get more information regarding Nersa’s decisions and the reasons behind them.

Moneyweb will also keep an eye on court proceedings, as we understand that the latest settlement will be made an order of the court. Documents and court proceedings in this regard will be open to the public.

This article was republished from Moneyweb. Read the original here.