There has been a steady increase in the number of women entering the South African property market over the past 10 years.

More women than men are becoming first-time homeowners, a clear indication that women are determined to achieve financial independence and build generational wealth, despite some of the income disparities that still exist today.

Female first-time homebuyers are now overtaking their male counterparts, Careen Mckinon, head of sales at ooba Home Loans, says.

“An increasing number of women view property ownership as a key marker of financial independence. Over the past decade, trends indicated not only a steady increase in demand from female first-time homebuyers, but also a shift toward younger women entering the market.”

Decade-long data from ooba Home Loans shows that while women made up 46.3% of first-time homebuyers buying on their own in 2015, this number has since steadily climbed to 53% in 2025. “Since 2018, the trend of women entering the property market without depending on a partner outpaced their male counterparts, a trend which is likely to continue.”

ALSO READ: Thinking of buying your first home, here are five key issues to consider

Provinces where women prefer to buy a house

There has also been strong regional performance. Mckinon points out that KwaZulu-Natal recorded the strongest increase in first-time female homebuyers, increasing from 47.7% in 2015 to 57.7% this year, a full 10 percentage point gain. The Eastern Cape was not far behind.

Mckinon says even in traditionally more expensive markets, such as the Western Cape which has the lowest percentage of female first-time homebuyers nationally women have made notable inroads. “The proportion rose by 6.6 percentage points over the decade to reach 50.7% in 2025. This milestone underscores the determination of women to overcome affordability barriers.”

When it comes time to spend, there is a higher concentration of solo female homebuyers in more affordable regions, such as the Free State and the south and east of Gauteng. “The data shows that lower-cost markets like these reduce the barrier to entry, making it easier to acquire property at more affordable prices.”

ALSO READ: How to finance your home loan if you do not have a regular income

Female homeowners are becoming younger

And there are not just more women buying homes for the first time – they are also getting younger. Mckinon says one of the most notable shifts over the past decade was the drop in the average age of female first-time homebuyers.

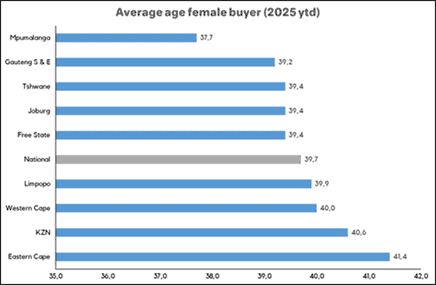

“In 2015, the average age was close to 47 years, but this has since fallen by more than seven years to 39.7 years in 2025.”

Year-to-date, Mpumalanga is home to the youngest average female first-time homebuyer group at 37.7 years, while the Eastern Cape is home to the oldest at 41.4 years.

The Western Cape saw the largest age drop of 8.5 years from 48.5 in 2015 to 40 in 2025. “This indicates that younger women are taking decisive action to secure their place in the property market earlier, whether through strategic savings, bigger salaries, smaller deposits or targeting more affordable properties.

“Overall, lower average ages suggest that women are recognising the long-term benefits of buying property sooner. The earlier you buy, the longer you have to enjoy capital growth.”

This graph shows the average age of women who buy homes for the first time:

ALSO READ: More women buying houses between R3 million and R5 million

Women now earning enough

Women are buying their own homes because they can afford to and they have more property choices, Mckinon says. “Over the past decade, female first-time homebuyers grew their purchasing power significantly.

“Since 2015, the average gross income of women applying to buy a home increased by 76.3%, reaching R59 549 in 2025. The increase in income outpaces the rise in consumer inflation between 2015 and 2025 (at 59.2%).

“Although it is marginally lower than the average income of male first-time homebuyers, this income increase reflects greater earning potential as well as the growing capacity for women to take on home loans independently. This strategic financial planning will work towards offsetting these income gaps over time.”

Regionally, the Western Cape tops the list with an average female homebuyer income of R73 079, followed by strong earnings growth in the Eastern Cape, up by 81.8% over the past decade. “This is likely prompted by the semigration of more affluent homeowners to the Garden Route which is renowned for its luxury coastal lifestyle.”

Mckinon notes that while recording the lowest average income at R43 009, the Free State still demonstrates that homeownership is well within reach for women in more affordable provinces.

ALSO READ: Townhouse or standalone house? Here is what and where 30-year-olds are buying

More property choices for first-time homeowners

When it comes to property choices, women are slowly shifting towards sectional title properties as these are often associated with lower maintenance, increased security and a ‘lock-up-and-go’ lifestyle, Mckinon says.

“In 2015, 37.1% of female homebuyers chose sectional title properties, compared to 39.4% in 2024 and 2025. Regionally, there is a stark contrast between Tshwane, as the sectional title province of choice (at 53.3% in 2025) and Eastern Cape with the lowest uptake of sectional title properties, at just 25.8% over the same period.”

However, some women also buy to let. Mckinon says single female first-time homebuyers currently account for 45% of buy-to-let applications. While this statistic remained constant over the past decade, the percentage of buy-to-let applications from this segment more than doubled since 2015.

“While single females may face income disparities compared to their male counterparts, they are increasingly taking on homeownership to generate additional income and build wealth.”

Regionally, the Western Cape leads with 21.6% of females entering the property market this year as investors, followed by the Eastern Cape at 9.3% and Tshwane at 8%.

ALSO READ: Johannesburg ranks as most affordable city to buy homes

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.