One fund manager questions Nhleko’s R68m pay and more loss of office payments to former CEO.

Nearly 40% of MTN shareholders voted against the advisory endorsement of the group’s remuneration policy at its AGM on Thursday. Only 62.64% of those who voted, did so in favour. This is significantly lower than the 67.81% who voted yes at the AGM in May last year (As recently as 2015, over 94% of shareholders voted in favour on this matter). This puts MTN in or near the bottom five of the Top 100 companies listed on the JSE when it comes to shareholder votes in favour of remuneration policies (see These 14 Top 100 companies are under scrutiny for exec pay)

Worse, only 78.9% of shareholders voted on the endorsement, versus 83% for other resolutions. Last year, a similar number voted on remuneration but 3.17% specifically abstained (this year, only 0.51% did so).

Chris Maroleng, MTN Group Executive for Corporate Affairs says “We have taken note of the outcome of the shareholders vote on MTN’s remuneration policy at the 22nd Annual General Meeting held on 25 May 2017. Notwithstanding the fact that the resolution was approved, we take note of the fact that some shareholders voted against it. We will be engaging with these shareholders on the matter.

“MTN’s pay structures are externally competitive, compliant with existing internal policies and governance structures such as the King Code principles, taking into account the availability of skills and the changing needs of our business.”

Given the large vote against the group’s remuneration policy, it is almost certain its largest shareholder, the Public Investment Corporation (PIC), voted no, as it did at the May 2016 AGM. The PIC, which manages assets on behalf of the Government Employees Pension Fund, held 14.92% of MTN as at 31 December 2016. Last year, it noted that it voted against the endorsement on remuneration as “whilst there is some additional policy disclosure as compared to the previous year, in terms of the company’s STI [short-term incentive] and LTI [long-term incentive] schemes, the KPIs [key performance indicators] remain financially skewed with no sustainability measures. This is regardless of the fact that the Group Executive Directors did not meet the performance bonus in 2015”.

In its remuneration report, MTN notes “executive directors’ bonuses were calculated in line with the approved bonus principles”. Only one executive director was paid a bonus: Phuthuma Nhleko who took over as executive chairman (from his previous non-executive role after the departure of Sifiso Dabengwa in late 2015). Via his professional services entity, Captrust Investments, Nhleko was paid a bonus of R38.191 million on top of a salary of R30 million (R2.5 million a month).

The group says the “board negotiated an appropriate monthly fee and performance-related cash bonus contract with him on the deliverables… in recognition of the unprecedented circumstances surrounding his appointment to the position of executive chairman, of the level of commitment involved and in consideration of the uniqueness of his experience for the role.” The report also notes that “Nhleko was required to commit 100% to the MTN task and step away for 16 months from all his considerable other various commercial interests”. Nhleko’s main mandate was to negotiate a reduction of the Nigeria fine, but he was measured on a number of other deliverables too.

Old Mutual’s Electus Boutique voted against the endorsement at Thursday’s AGM. It says such a vote is “warranted” for two reasons. First, “for the second consecutive year, significant (R19.6 million) loss of office payments have been made to the former CEO, who left the Company abruptly as a large fine was being negotiated with the Nigerian Government in settlement of events which occurred during his tenure as CEO”

According to MTN, Dabengwa was paid this amount as “compensation for loss of office, comprising notice pay and a restraint of trade payment”. In 2015, he was paid R23.664 million as compensation for loss of office.

The second reason, says Electus, is that “Chairman Phuthuma Nhleko was paid R30 million in salary and a bonus of R38.2 million for services provided as Interim Executive Chairman during FY2016. This is an exceptional level of remuneration in the South African market context”.

Coronation, the single largest asset manager holding MTN shares on behalf of clients, voted in favour of the endorsement on remuneration at last year’s AGM. It is not yet clear how Coronation voted on Thursday.

In terms of the group’s operations, only the following countries’ opcos declared bonuses in 2016 (for reaching targets): Ghana, Syria, Sudan, Yemen, Cyprus, Iran and Swaziland. Two of the group’s 10 prescribed officers in 2016 were paid bonuses: Ismail Jaroudi, Group vice-president for Middle East and North Africa (R6.353 million of R18.854 million in total pay) and Karl Toriola, Group vice-president for West and Central Africa (R1.969 million of R13.519 million in total pay).

Maroleng makes the point that “MTN faced an extraordinary set of challenges over the last 18 months. Appropriate steps were taken to stabilise the business in the wake of the MTN Nigeria fine, among them:

- Appointed Mr Phuthuma Nhleko as Executive Chairman after the sudden departure of the Group President and CEO;

- Introduced the Ignite transformation initiative to accelerate business performance as 2017 Q1 satisfactory results show, with group total revenue up 7%, MTN Nigeria’s up 11% and MTN SA service revenue increasing by 4%;

- Appointed new directors to the MTN Board – including Group President and CEO Rob Shuter, Group CFO Ralph Mupita and COO Jens Schulte-Bockum;

- Embedded the new regional structure headed by VPs for WECA, MENA and SEA. This has improved MTN Group’s oversight over Opcos and brought about much needed efficiencies; and

- The repatriation of MTN funds, comprising loans and dividends, from Iran.”

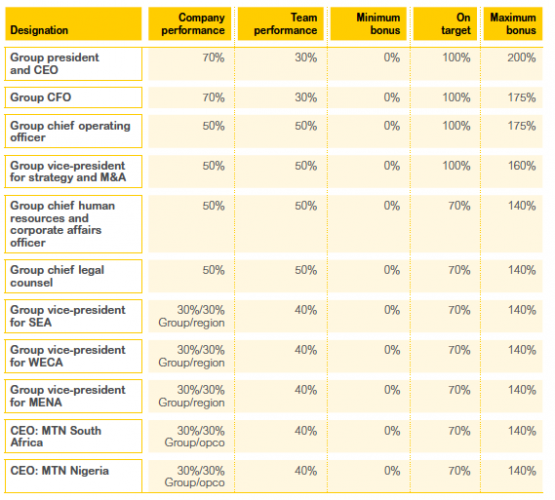

MTN Group says it has revised bonus parameters for its executive team for 2017, “given the recent significant changes”. This summary was included in the group’s 2016 integrated report, published at the end of March 2017.

* Hilton Tarrant works at immedia. He can still be contacted at [email protected].

Brought to you by Moneyweb

Support Local Journalism

Add The Citizen as a Preferred Source on Google and follow us on Google News to see more of our trusted reporting in Google News and Top Stories.